Otaviano Canuto, IMF: What Happened to World Trade?

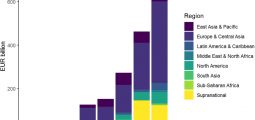

World trade suffered another disappointing year in 2015, experiencing a contraction in merchandise trade volumes during the first half and only a low recovery during the second half (Figure 1). While last year’s trade performance can be associated to the ongoing growth transition in China and its reflections on other non-advanced economies, the fact is that last year’s performance came after a period since the 2000s in which world trade volumes have lagged behind GDP growth, a trend accentuated since the onset of the global financial crisis and in sharp contrast to global trade increases at a higher pace than world GDP prior to the new millennium.

World trade suffered another disappointing year in 2015, experiencing a contraction in merchandise trade volumes during the first half and only a low recovery during the second half (Figure 1). While last year’s trade performance can be associated to the ongoing growth transition in China and its reflections on other non-advanced economies, the fact is that last year’s performance came after a period since the 2000s in which world trade volumes have lagged behind GDP growth, a trend accentuated since the onset of the global financial crisis and in sharp contrast to global trade increases at a higher pace than world GDP prior to the new millennium.

Economists have indicated some circumstantial factors to explain this post-GFC pattern. For instance, world GDP and trade figures would be reflecting the fact that the highly open-trade countries of the Eurozone have had a sub-par growth performance relative to the rest of the world. Furthermore, the weak recovery of fixed investments in advanced economies has suppressed an important source of trade volume, given the higher-than-average cross-border exchanges that characterise such goods.

“Since 2008, world trade has been rising slower than GDP at around 0.8:1, leading to a fall in the share of exports in global GDP.”

More disputed hypotheses have also been argued. More stringent capital requirements and financial regulations might be curbing the availability of trade finance. Additionally, rising “murky” trade-restrictive tax-cum-subsidy policy measures adopted in some key sectors by some countries may also have become more significant than usually perceived.

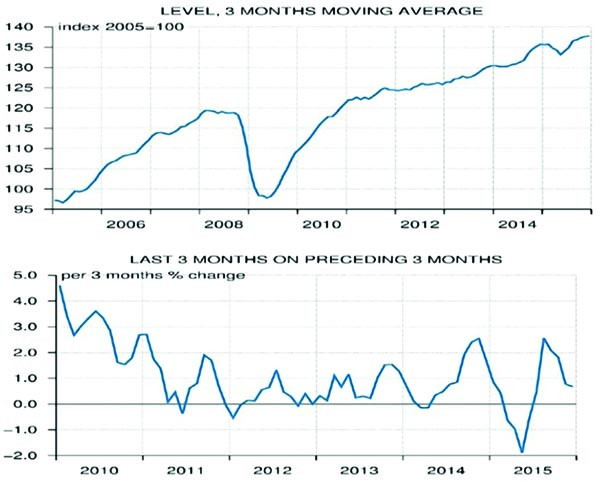

While those post-crisis factors have certainly played a role, some structural trends also seem to be at play. As suggested by Figure 2, after steadily increasing between the mid-1980s and the mid-2000s, the trade elasticity to GDP has lost steam – though it remained above one, thus implying that trade was still rising faster than GDP.

Figure 1: World Merchandise Trade Volume. Source: Netherlands Bureau of Economic Policy, World Trade Monitor, December 2015.

After jumping in previous decades, the world’s exports-to-GDP ratio seems to have started to approach some plateau (or a peak trade). Since 2008, world trade has been rising slower than GDP at around 0.8:1, leading to a fall in the share of exports in global GDP. However, even if post-GFC factors were partially reversed, the presence of a long-term trajectory of trade elasticity displaying a slowdown already prior to the recent pattern would suggest no automatic return to the heydays.

Relevant Processes

Hoekman (2015) brings a thorough examination of both cyclical (post-GFC) and structural hypotheses about the global trade slowdown. Regardless of the weight attributed to these factors in explaining recent developments, three processes stand out as relevant for the purpose of analysing what lies ahead in terms of the link between global trade and development. Two of them were transitional – in the sense that they were one shot – the unfolding of which underpinned the extraordinary ascent of the global export-GDP ratio. The third one has evolved more gradually and will likely carry a significant transformative role ahead.

Figure 2: Trade-income elasticity and Exports-GDP ratio – global economy. Source: Escaith and Miroudot, ch. 7 in Hoekman (2015).

The period from the mid-1980s to the mid-2000s was peculiar in several aspects. For one, these decades featured a process of economic reforms that aimed to remove barriers to trade, a multilateral trading system that reduced uncertainty for traders, and technological advances that reduced trade and communications costs. Combined, these trends ushered in years of sustained trade expansion. Average tariffs moved to well below ten percent, and in many countries a significant share of trade became duty-free.

Advances in transport (such as containerised shipping) and information and communications technologies greatly reduced the cost of shipping goods and of managing complex production networks. Together these developments led to two major changes in the structure of global trade: (a) the vertical and spatial cross-border fragmentation of manufacturing into highly integrated global production networks or global value chains (GVCs); and (b) to a lesser extent, the rise of services trade.

The full establishment of cross-border GVCs intrinsically raises trade measured as gross flows of exports and imports relative to GDP, a value-added measure, because of double counting of the former – although the ratio of trade to GDP still increases even when trade is measured on a value-added basis. Given the then-prevailing technological state of arts in production processes, the policy and enabling-technology breakthroughs above mentioned sparked a powerful cycle of fragmentation, especially in manufacturing, with a corresponding cross-border spread of GVCs.

Reshaped Economic Geography

The reshaping of the economic geography might have kept the pace with global trade impacts via further dislocation of fragments of GVCs, depending on the evolution of country locational attributes. Technological changes might also have altered optimal spatial configurations of the various manufacturing activities, as well as extended fragmentation to other sectors. This may well be the case ahead, as technologies and country policies keep evolving – some analysts point to a greater reliance on regional production networks, while others refer even to a potential reversal of GVCs because of 3D printing (additive manufacturing).

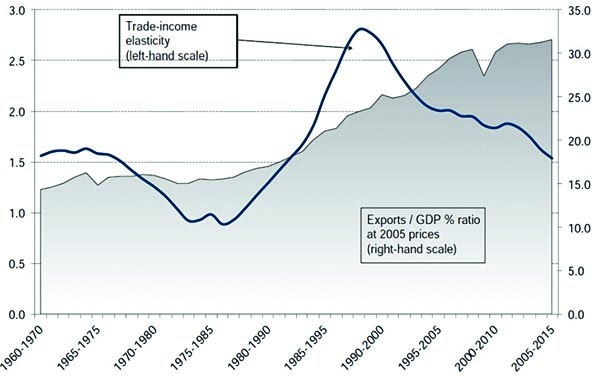

Figure 3: Ratio of Foreign Value Added to Domestic Value Added in World Gross Exports (%). Source: Constantinescu et al (2015).

However, the wave of cross-border manufacturing fragmentation of the mid-1980s through the mid-2000s was particularly intense and time-concentrated. Figure 3 shows that the ratio of foreign value added to domestic value added in world gross exports increased by 2.5 percentage points from 2005 to 2012, after having risen by 8.4 percentage points from 1995 to 2005.

The wave of fragmentation of manufacturing activity benefited from the incorporation of large swaths of lower-wage workers from Asia and Eastern Europe into the global market economy. Conversely, the former facilitated a process of growth-cum-structural-transformation with substantial total factor productivity increases in these countries via transfer of population from low-value, low-productivity activities to the production of modern tradable goods, for which foreign trade was instrumental – with China as a special case both in terms of speed and magnitude.

The transitional nature of such a lift of world trade relative to world real GDP, even as the latter grew substantially, stemmed from the inevitable tendency of both starting to rise more in line once the intense transformation approached completion. Its extraordinary intensity also reflected a peculiar – and transitory – combination of ultra-high investments-to-GDP and trade-surplus-to-GDP ratios in China with large current-account deficits of the US.

New Chinese Growth Pattern

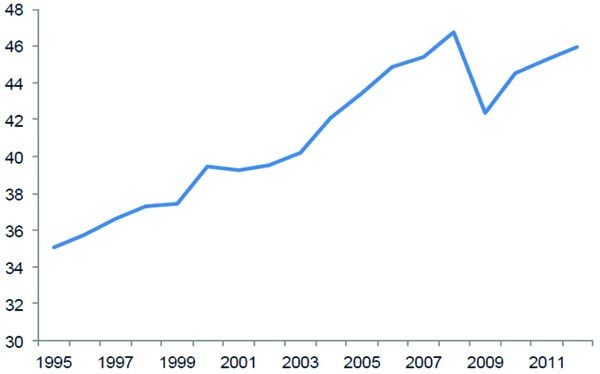

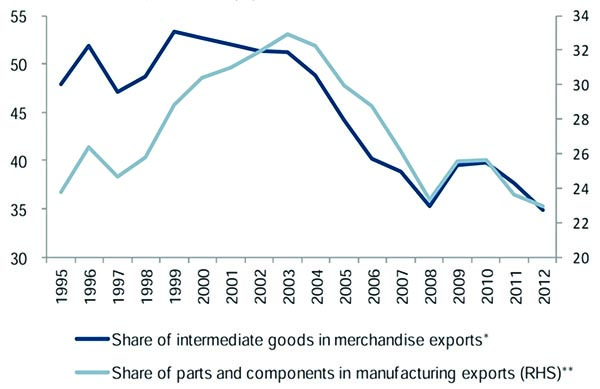

More recently, China has initiated a rebalancing toward a new growth pattern, one in which domestic consumption is to rise relative to investments and exports, while a drive toward consolidating local insertion in GVCs to move up the ladder of value added is also to take place. That rebalancing has been pointed out as one of the factors behind the recent global trade slowdown, given China’s weight in the world economy and a recent trend of import substitution as illustrated in Figure 4.

Figure 4: China’s Share of Imports of Parts and Components in Exports of Merchandise. Source: (Constantinescu et al, ch. 2 in Hoekman (2015).

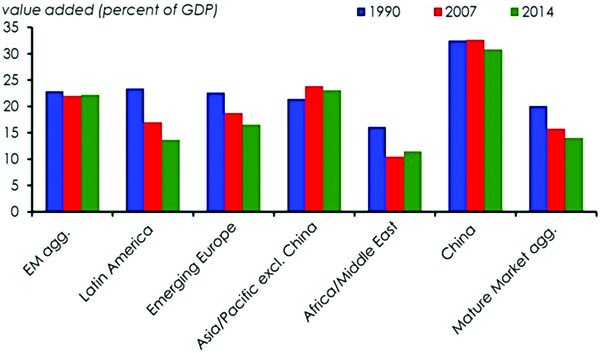

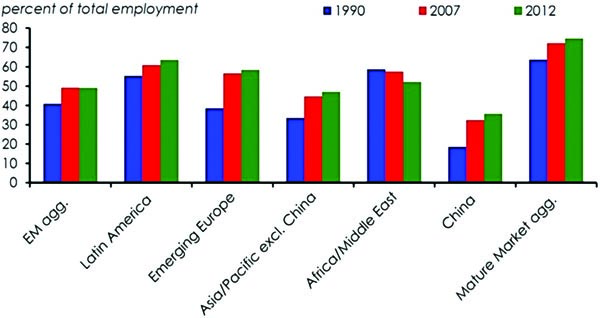

While both the GVCs’ rise and growth-cum-structural-transformation – especially in China – were taking place, with corresponding impacts on the landscape of foreign trade, advanced – or mature market – economies maintained a steady evolution toward becoming service economies – a trend maintained after the GFC. Lower GDP shares of the value added in manufacturing have accompanied rising shares of employment in services (Figures 5 and 6).

Both supply and demand factors explain such trends in advanced economies. On the supply side, beyond the higher pace of increases of productivity in manufacturing than in services (with correspondingly different rhythms of reduction in labour requisites), not only did the relative prices of manufactured goods fall, but a substantial part of local production was also off-shored as a result of GVCs and the incorporation of cheaper labour from areas previously out of the market economy world.

Figure 5: Global Manufacturing. Source: Institute of International Finance, “The rise of services – what it means for the global economy”, December 15, 2015.

On the demand side, one may point out both a higher income-elasticity of demand for services – reinforced by aging of the population – and to technology trends favouring software vis-à-vis hardware – or intangible relative to tangible assets – as leading to an increasing weight of services in GDP and employment.

Those evolutionary features of supply and demand would also be valid for emerging market and developing countries – even if, as suggested in the upper half of Figure 5, they were partially mitigated in China and other Asia/Pacific countries by sucking manufacturing activities from other emerging market and developing economies. In any case, given the state of current technological trajectories, rising shares of services throughout would imply an anti-trade bias, given a still higher trade-propensity of manufacturing.

Declining Trade Elasticity

IIF (2015) goes as far as to argue that this has already brought consequences for the global business cycle, rendering it less influenced by swings in manufacturing output, with shock transmission from advanced economies increasingly taking place via trade of services among themselves and more weakly to manufacturing-dependent emerging market and developing economies. This would be one of the factors behind the abrupt decline of the world trade elasticity and of the recent decoupling of growth between recovering advanced and decelerating emerging economies.

World trade may well live through a new era of rise relative to GDP: ongoing technological trajectories may deepen the fragmentation and increase the tradability of services; new vintage trade agreements – including possible TPP and TTIP – are giving special attention to restrictions on trade of services. In fact, the content of services in current foreign trade transactions has already been higher than what gross trade figures display.

Figure 6: Employment in Services. Source: Institute of International Finance, “The rise of services – what it means for the global economy”, December 15, 2015.

Another question is what lies ahead in terms of growth opportunities for non-advanced economies through foreign trade given the evolution of the latter along the lines here described, one in which the factors that led to the peak trade seem to have exhausted, at least in the near future ahead. Trade has been a key driver of global growth, income convergence, and poverty reduction. Both developing countries and emerging market economies have benefited from opportunities to transfer technology from abroad and to undergo domestic structural transformation via trade integration in the last decades. One may thus understand why there has been some concern over whether the current pace and direction of world trade lead towards a lesser development-boosting potential.

The nature and height of domestic policy challenges have changed substantially in a three-fold way:

First, China is in a league of its own and its rebalancing-cum-upgrading will condition other emerging market and developing economies. If it lets low-skill labour-intensive manufacturing activities go, a new wave of further GVC dislocations may open opportunities for countries currently endowed with cheap and abundant labour. On the other hand, its densification of local parts of GVCs will represent a competitive challenge to medium-range manufactures produced in other middle-income countries. The net result will also depend on the leakages outward of its domestic demand as it rebalances toward a more consumption- and service-oriented economy.

Second, the directions taken by technological trajectories and aggregate demand in advanced economies seem to point toward a broad alteration of the balance of locational advantages for production fragments, decreasing the weight of labour costs and augmenting the relevance of local availability of other complementary intangible assets. A double whammy on production and exports of non-advanced economies may take place: a partial reversal of off-shoring and a slower growth of outlets for their typical exports.

Third, the bar, in terms of what it takes to countervail that double whammy – improvements of the local business environment and transaction costs, quality of economic governance and other conditions favourable to accumulation of intangible assets – has been raised. Nonetheless, provided that such bar is reached, the local provision of – embodied or disembodied – services complementary to those produced or used in advanced economies may flourish. This will be the case, e.g. of natural resource-rich countries that manage to develop related intangible assets in terms of applied-science capabilities.

The run-up to peak trade was one of primarily exploring complementarities within GVCs to substitute for existing producers. The post-peak trade era may well be one of building complementarities.

About the Author

Otaviano Canuto is the executive director at the board of the International Monetary Fund (IMF) for Brazil, Cabo Verde, Dominican Republic, Ecuador, Guyana, Haiti, Nicaragua, Panama, Suriname, Timor Leste, and Trinidad and Tobago. The views expressed here are his own and do not necessarily reflect those of the IMF or any of the governments he represents.

Otaviano Canuto is the executive director at the board of the International Monetary Fund (IMF) for Brazil, Cabo Verde, Dominican Republic, Ecuador, Guyana, Haiti, Nicaragua, Panama, Suriname, Timor Leste, and Trinidad and Tobago. The views expressed here are his own and do not necessarily reflect those of the IMF or any of the governments he represents.

Dr Canuto has previously served as vice president, executive director and senior adviser on BRICS economies at the World Bank, as well as vice president at the Inter-American Development Bank. He has also served at the government of Brazil where he was state secretary for international affairs at the ministry of finance. He has an extensive academic background, serving as professor of economics at the University of São Paulo and University of Campinas (UNICAMP) in Brazil.

You may have an interest in also reading…

IFC: Addressing Climate Change Can Unlock $23 Trillion-Dollar Investment Opportunities in Emerging Markets

By Christian Grossmann and Thomas Kerr The historic Paris climate change agreement entered into force in record speed last November,

World Bank on Social Protection in Africa: Burkina Faso Mobile Childcare Scheme Could Transform Public Works

Children put to sleep on the ground, exposed to sun, wind and rain near dangerous construction sites – while their

The European Conundrum

The European Union is an interesting project that – once logic is duly applied – must end up with the