Paul Horrocks, OECD: Risk, Return, Impact – SDG Aims Need a Shift of Focus

Russia’s war on Ukraine and interruption of global food supplies has put greater pressure on the development system.

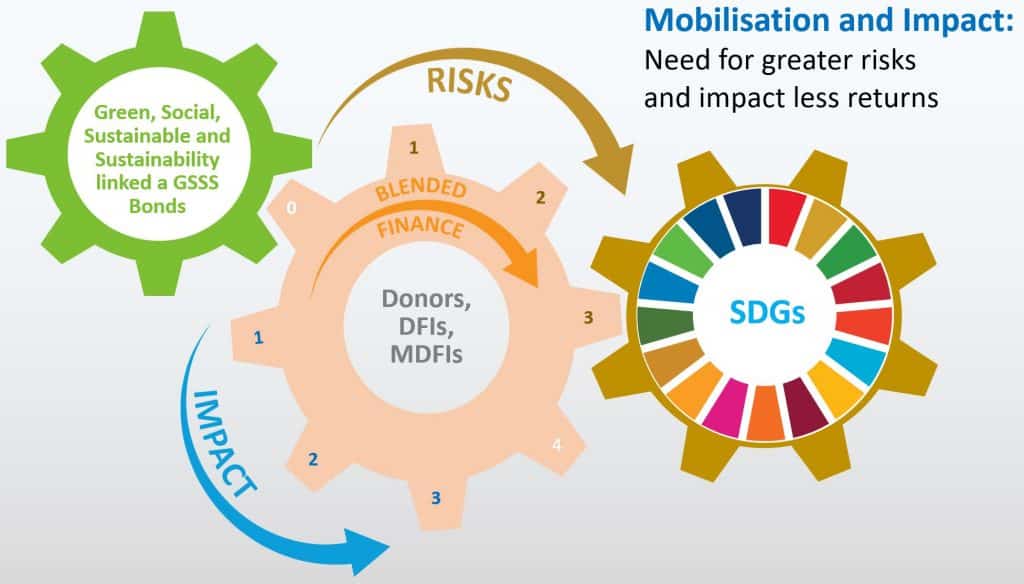

Development finance resources will need to increasingly mobilise the private sector. The private sector, meanwhile, is looking for more access to ESG investment opportunities and SDGs. Donors are the development architecture for this private sector mobilisation alongside the multilateral development finance institutions (MDFIs) and development finance institutions (DFIs). Blended finance is typically the structure used for mobilisation.

Despite the pressing need for private sector mobilisation, obstacles stand in the way. In contrast with the transparency and openness of Official Development Assistance (ODA), the risk-return and impact of blended finance transactions typically remain hidden behind commercial confidentiality clauses. This impedes the mobilisation of private finance.

A lack of credible information or transparency dissuades new market participants, as the risks and opportunities of investing in frontier markets remain unclear. Investing remains the preserve of a few who understand local market dynamics.

This compounds the challenge of private investment into the least-developed countries (LDCs) and social sectors. These economies and markets are in critical need, and the SDG gaps remain. Despite donor government commitments to “leave no one behind”, these geographies and sectors typically have a history of a limited number of transactions. They also lack and an evidence base.

The refrains of civil society organisations about the subsidisation of profits could be addressed by donors, MDFis and DFIs through data transparency on returns in these contexts and countries. Greater transparency is also needed on the measurement and management of impact.

There is a trade-off between risk, return and impact — so is the balance right? Ministries of foreign affairs and development finance providers have been tasked by the governments of wealthy countries to help low- and middle-income nations achieve the SDGs. But finance ministries, treasuries, and credit-rating agencies control the risk exposure and — crucially — the incentives of MDFIs and DFIs to deliver on their mandates. These institutions must often generate sustainable impact and a financial return, which are not always compatible. Returns are likely to take priority over impact, to the detriment of the sector or region.

Financial regulators decide on whether a DFI can have a credit rating and issue debt, or have the capacity to use blended finance instruments such as guarantees. Donors can recapitalise MDFIs and DFIs, but ultimately balance sheets and capital risks are controlled by finance ministries and treasuries. Currently the risk dial is focused largely on financial returns.

The picture is complex as every DFI and MDFI has a different mandate and capability. The new US International Development Finance Corporation (DFC), whose funding is based on budget appropriations, may take more risks than a DFI and invest more readily in LDCs and social sectors.

A wider definition — encompassing concessional and non-concessional blending — could facilitate the mobilisation and the greater use of instruments such as guarantees.

The operational frameworks of MDFIs and DFIs must move from a focus on risk-return, to risk-return and development impact. Investing in developing countries is high risk and does not always equate to financial returns, — but is likely to have a significant development return.

For DFIs and MDFIs to work effectively in building SDG markets, they need a clear plan from equity to debt, from a DFI willing to take more risk compared to another, to refinancing, and ultimately exit and full handover to the private sector.

There are options available to donors, DFIs and MDFIs. In recent years, innovators on capital markets have developed thematic financial instruments to accelerate progress on the SDGs, which can be broadly defined as “sustainability-linked financial instruments”. Green, Social and Sustainability and Sustainability-linked (GSSS) bonds, fixed-income instruments, already in use by many DFIs and MDFIs, could be used more effectively for funding activities.

DFIs and MDFIs with a credit rating are typically based in financial markets eager to achieve the SDGs, and the sovereign supporting government are keen to develop SDG capital markets — particularly where a “greenium” exists. Currently investor demand provides a greenium of cheaper financing to the issuer or the DFI and/or MDFI, which could then be loaned-on into riskier projects in higher-returning developing markets.

Access to cheap financing should not come at the expense of local currency finance. The creation of local GSSS bond markets would provide new financial capacity to fund SDG-relevant projects. DFIs and MDFIs can, at the local level, use blended finance to increase the pipeline of projects that can be aggregated to issue as GSSS bonds. In regions such as Sub-Saharan Africa, where access to capital markets and impact reporting are limited, this would enable greater transparency and disclosure.

Greater co-operation amongst DFIs and MDFIs on bundling projects would help to develop the necessary aggregation for issuance and diversification of GSSS bonds so attractive for institutional portfolios. Co-operation, not competition, is needed to grow the market.

DFIs and MDFIs can also provide technical assistance to GSSS bond-issuers, supporting developing countries to set up frameworks to select and implement the GSSS bond. This is a key requirement to obtain a GSSS label. By sharing best-practices in setting-up eligibility criteria for the projects that underpin the bonds, as well as establishing allocation and impact reporting practices, DFIs and MDFIs can strengthen market discipline. This can help to shift investor focus to the region and encourage other GSSS bond issuers to follow suit.

More can also be done at balance-sheet level to transfer risks to the private sector or other donors. This could help bring in a range of new risk profiles, such as institutional and alternative asset managers. A notable example of a risk transferred through the securitisation of projects is the Room-to-Run transaction, the first- synthetic securitisation of an MDB’s private sector loans portfolio. It increased the balance sheet capacity of the African Development Bank.

The scale and ambition of the 2030 Agenda demands a new shareholder governance model that explicitly prioritises the mobilisation of private finance. Donors need to take a more active role in working with DFIs and MDFIs to grow the financial capacity of sustainable development finance. This requires exploring options, approaches and incentives to deliver scale and depth. MDFIs and DFIs need to see themselves as mobilisers of capital.

You may have an interest in also reading…

Türkiye in the Economic Spotlight: Globalturk Capital Keeps the Focus on the Country’s Growing Status

A growing body of international luminaries, government ministers and experts are taking note of Türkiye’s rise in international economic affairs.

European Environment Agency: Greening Our Economy

By Professor Jacqueline McGlade At first sight, the fate of threatened species might seem a world apart from the economy. Upon

Q&A with the Executive Secretary of the UNCDF: Judith Karl

How would you sum up in three single words what characterises your team at UNCDF? Innovative Nimble Trusted What are