A Merger that Sparked a Revolution in India’s Modern Banking Universe

Despite its twists and turns, the harmonious merger between a fintech NBFC and an Infrastructure Bank turned into a massive success and an enduring example for future such mergers.

India’s IDFC FIRST Bank started out with a vision: to build a world-class financial institution guided by ethics, powered by technology, and for larger social good.

MD & CEO: V. Vaidyanathan

Ethical Banking is one of the key tenets of the Bank’s vision statement. But saying it one thing, living it is another. So, the Bank followed it up with concrete action. The bank’s survey revealed that most customers are unaware of the large amount of fees they pay in small bits and pieces, don’t understand the complicated descriptions, and the complicated calculations behind them. So, in one stroke, the bank simply waived off fees on savings accounts and made it simple.

Thus, IDFC FIRST Bank became the first and only bank to offer its customers Zero Fee Banking for savings accounts. “We won’t touch your bank account for this fees or that” says the Bank.

Similarly, IDFC FIRST Bank became the first bank to offer monthly credit on savings account. When the bank launched its credit cards business, it came with features such as rewards points that never expire and dynamic APR linked to credit scores, not the flat 36-42% APR charged by most banks to all customers.

This hinges on the conviction that income earned in unethical ways is “not worth earning”.

IDFC FIRST Bank has transformed from infrastructure to retail banking in the four years since its merger with Capital First in 2018. The current-to-savings or CASA ratio has risen most rapidly for any bank in India’s Banking history, from 8.6 percent to 46.4 (as on September 30, 2023).

After reporting losses for six quarters after merger due to infrastructure and corporate loans, the bank turned around in FY 21. The Bank recorded profit after tax of Rs 7.51 billion ($91m) in Q2-FY24, a growth of 35% YoY, with capital adequacy of 18.06 percent. It also boasts high asset quality, with the retail, rural, and SME book showing gross NPA (non-performing assets) of only 1.53 percent and net NPA of 0.52 percent as of September 30, 2023.

IDFC FIRST Bank has taken up ESG as a core endeavour and pressing hard on its goals. Its governance scores are high, the business lines support social goals, and there are ongoing efforts to achieve environmental goals. It financed over 2,00,000 toilets and sanitary fittings under its first-of-its kind WASH Loans with loans of less than $500 as part of this initiative, and more importantly, reported collection rates of 99.7%.

MD & CEO V. Vaidyanathan previously worked with Citibank and ICICI Group. Chasing an entrepreneurial opportunity, he acquired a small NBFC with a retail loan book of $14m, renamed it Capital First, built it to scale of $4b in loans, grew market cap 10X in eight years, and then to acquire a commercial Banking license, merged it with IDFC Bank in 2019. The retail loan book has since grown to $15b, growing at 25% per year. It has confounded analysts who were once sceptical of its ability to grow retail deposits in a fiercely competitive market dominated incrementally by private banks. It is one of the unique banks in India growing deposits consistently by over 40% for five years, in a banking system where deposits are growing by 12-13%.

You may have an interest in also reading…

What Really Spurred the Great Recession?

Based on the research of Ravi Jagannathan, Mudit Kapoor and Ernst Schaumburg Globalization and the U.S. dollar are as much

Tipa Nawawattanasub, CEO of YLG Group: Driving Group to Golden Greatness

Tipa Nawawattanasub is the chief executive of YLG Group, a family-owned company in Thailand. Thanks to its expertise and experience,

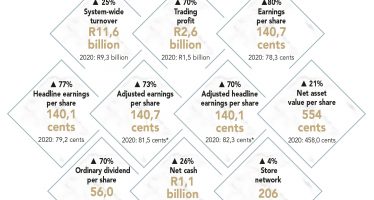

Italtile: Resilient South African Group Remains Strong, Optimistic and Locked-into its Ethical Stance

Founded in 1969, Italtile Ltd has always had a clear goal: to be the best manufacturer and retailer of tiles,