Tightening Financial Conditions Bring Impacts to Asset Values

In the first half of this year, US stock markets suffered a fall not seen in more than 50 years.

In the first half of this year, US stock markets suffered a fall not seen in more than 50 years.

The S&P 500 index on Thursday June 30 was more than 20 percent down compared to January, a drop not experienced since 1970. The S&P 1500 Index, built by Bloomberg and incorporating companies of various sizes, has seen more than $9 trillion in stock value disappear since January. All sectors except energy stocks have suffered value reductions. On Wednesday June 29, Citi announced that it expected the S&P 500 to fall by another 11 percent by the end of the year.

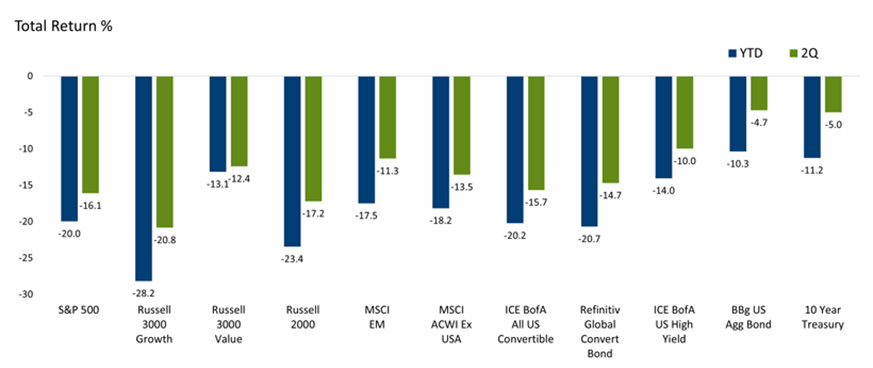

Stock market declines have also occurred in Europe and Asia. The European Stoxx 600 index is down about 17 percent since January, while the MSCI index for Asia-Pacific markets is down 18 percent in value in US dollar terms. The FTSE All World index, which brings together stocks from advanced and emerging economies, has shrunk by just over 20% so far this year. Figure 1 shows how generally bad the global asset class performance has been in the first half of the year.

The perception of recession risks in the US and Europe has been a major factor in this flight of investors from stock markets. Although the numbers in the US labour market in May showed a high degree of heating, household consumption spending decreased in the month, on top of the numbers in the previous months that have been revised downwards. Consumer confidence indices have plummeted.

Figure 1: Global Asset Class Performance – A Painful 1H22. Source: Calamos Investment Team Outlooks, July 2022.

In housing, the unprecedented rise in mortgage interest rates since 2010 has reinforced this. An Institute of Supply Management (ISM) report, released on July 1, showed signs of a sharp drop in the pace of manufacturing activity in June.

There was a deterioration in indicators of manufacturing activity and consumer confidence in the German economy. The European economy was expecting the impact of the supply and price shocks resulting from the war in Ukraine. In Asia, the impacts of China’s zero-Covid policy led to a downward revision in growth forecasts. The real change corresponds to earlier signs that the growth slowdown in the US economy has joined that of other advanced economies.

A major factor in the withdrawal of equity investors has been the perception that signs of a slowdown will not reverse the trajectory of rising interest rates on either side of the Atlantic — previewed for later this year in the Euro area — and tightening of financial conditions. At the annual conference of European central bankers in Portugal on June 30, US Federal Reserve governor Jerome Powell spoke of “some pain” as necessary to return inflation to closer to the target average of two percent.

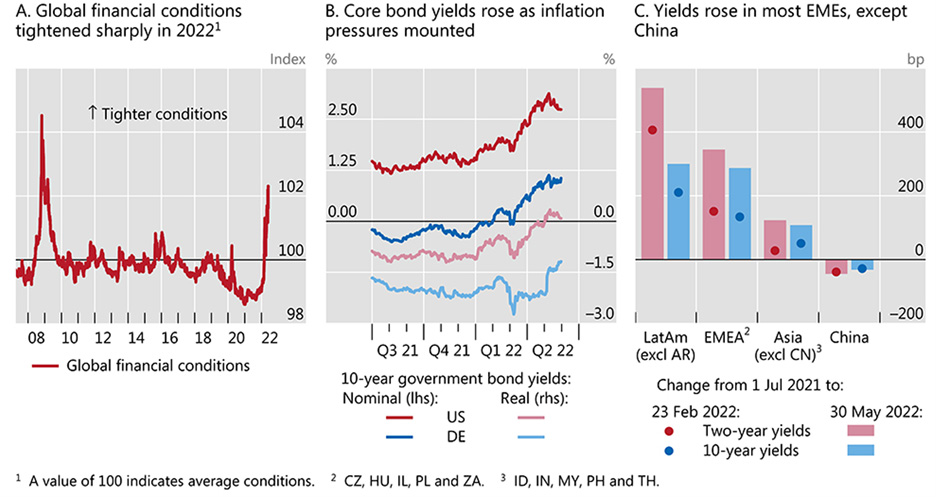

As Figure 2 shows, financial conditions have tightened as government bond yields have risen globally, including in most emerging-market economies except China. Such tightened conditions are expected to worsen as central banks keep moving along that path.

In this context, the stock devaluation fits in with other items of US monetary policy in the pursuit of lower inflation rates. In addition to the quantitative tightening — the gradual reduction of the Fed’s balance sheet, without a replenishment of the assets in the portfolio — the negative wealth effect of the fall in share values will help to contain aggregate demand, which corresponds to the Fed’s policy objective.

This is a significant difference from other moments in the recent history of the relationship between Fed policies and asset markets. In 1987, after an almost 30 percent drop in US stock prices, then-Fed president Alan Greenspan cut interest rates in what became known as a “Greenspan put”, a kind of insurance against losses similar to a put option purchased as protection against sudden losses in value. In this case, it was provided by the Fed, free-of-charge to asset holders.

In the years that followed, the expectation of bailouts via Fed monetary policies as a reaction to asset devaluations ended up being incorporated as a premium in asset values.

That was the case in 2018 — but not this time. The commitment to reduce inflation by containing aggregate demand seems the priority.

Figure 2: Financial Conditions Have Tightened as Government Bond Yields Have Risen. Source: BIS Annual Economic Report, June 2022.

The Fed can ignore falling stocks while keeping an eye on credit markets, because there is a direct relationship between credit and bank money creation, and therefore implications for aggregate demand and inflation. But the Fed cannot ignore risks that financial intermediaries will go insolvent.

And how are prices in the credit markets behaving? Risk spreads have widened both for high-risk bonds — rated CCC — and investment grade cases. Attention has now turned to the risks to credit and liquidity.

Judging by reports from credit-rating agencies, US non-financial corporations have taken advantage of the facility opened by the Fed in March in the wake of the pandemic to lengthen debt maturities on favourable terms. The apparent scope for rate hikes, with little concern for their impact on corporate equity structures, allows the Fed to continue raising rates. Rates are still low in real terms when discounted by anticipated inflation rates this year and next.

How far the Fed will go is an open question. It will depend on the signs of inflation as interest rates move up. A bad sign was the fact that the index that serves as the official reference — the Personal Consumption Expenditures (PCE) Price Index — rose in May and reached a level 6.3 percent higher than a year ago. In the euro area, inflation in June hit a record 8.6 percent.

Long-term inflation expectations expressed in 10-year inflation-protected US Treasury bonds are around 2.36 percent per annum, remaining in the range between 1.5 percent and 2.5 percent that has been a trademark for the past 20 years. If inflation shows clear signs of slowing in the months ahead, the Fed may not reach the 3.5 to 3.75 percent range currently expected for the middle of next year.

The problem is that — even knowing that there is a time lag between interest rate decisions and their effects — the Fed will not be able to ignore what happens to monthly inflation rates, even if that hampers a soft landing for the economy.

Significant negative surprises on the corporate finance side could also lead to some sort of “Powell put”. What seems more likely is a global economic slowdown and continued tightening of financial conditions. Equity markets in advanced economies will continue to exhibit downward slides until the monetary-financial grip eases.

First appeared at Policy Center for the New South

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a professorial lecturer of international affairs at the Elliott School of International Affairs – George Washington University, a nonresident senior fellow at Brookings Institution, a professor affiliate at UM6P, and principal at Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil.

You may have an interest in also reading…

BRIC Stocks Now Out of Favour … Later to Be an Incredible Investment Opportunity

With BRIC stock valuations currently low and yet with strong long term projected growth a great buying opportunity may materialize

Ross Jackson: Nero Politics Meet Limits to Growth

Nero – the last emperor of the Roman Empire – is best remembered as the man who fiddled while Rome

EDFI: Africa and Energy Access – Financing Impact

Energy is arguably one of the major challenges the world faces today. For those living in extreme poverty, the lack