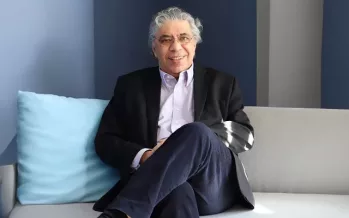

Author: Otaviano Canuto

Back to homepageOtaviano Canuto

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, a professor affiliate at UM6P, a professorial lecturer of international affairs at the Elliott School of International Affairs – George Washington University, and principal at Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil. Otaviano has been a regular columnist for CFI.co for the past 10 years.

Otaviano Canuto on Aging and the Immigration Conundrum: A Demographic Dilemma

Across the globe, populations are aging as declining fertility rates and increased longevity reshape demographic landscapes. While longer life expectancy is a testament to medical and public health advancements, the persistent decline in birth rates presents an economic challenge of

Read MoreOtaviano Canuto: The US Elections Will Have Global Economic Impact

On Tuesday, US voters will decide who will control the White House, the Senate, and the House of Representatives. Kamala Harris, Donald Trump, and their respective parties differ significantly on key economic policies that will affect not only the U.S.

Read MoreOtaviano Canuto: Politics and Climate Change Make Awkward Bedfellows in the Race to Tackle a Truly Fearsome Foe

The earth’s average surface temperature this May was higher than any other May on record… what can, and should, governments be doing? According to the European Union’s Copernicus Climate Change Service, May’s temperature was 1.52 degrees Celsius above the pre-industrial

Read MoreChina’s Economic Growth is On-Target Despite Challenges

The IMF World Economic Outlook recently released a projection of China’s economic growth of 4.6 percent and 4.1 percent for this year and next. In 2023, after the economic reopening with the end of the “Covid-zero” policy, the rate was

Read MoreOtaviano Canuto: The Global War of Subsidies

US bids to limit tech imports and exports send a message of frustration and fear. Prior to her visit to China on April 4 — her second in nine months — Janet Yellen, US Secretary of the Treasury, sent a

Read MoreHow Will Artificial Intelligence Affect the Economy?

Artificial intelligence (AI) is the name given to the broad spectrum of technologies by which machines can perceive, interpret, learn, and act by imitating human cognitive abilities. Automation was created to better fulfill repetitive tasks, increasing productivity. AI, with its

Read MoreWhither China’s Belt and Road Initiative?

The Belt and Road Initiative (BRI), launched by Xi Jinping, passed its tenth anniversary in 2023. It has entered a third phase. The initiative added a label to China’s financing and construction of infrastructure abroad, which had already totaled more

Read MoreOtaviano Canuto: Growth Implications from a Fractured Trading System

To understand the implications of a fractured trading system, let’s use the period known as hyper-globalisation, or globalisation 2.0, as a benchmark. In the 1980s and ‘90s, we saw the consequences of a tectonic shift deep beneath the global economy.

Read MoreOtaviano Canuto: Rising Use of Local Currencies for Cross-Border Payments

At the recent BRICS summit in Johannesburg, the leaders of Brazil, Russia, India, China and South Africa said they wanted to use more of their national currencies for cross-border payments. Those payments are currently dominated by the US dollar and

Read MoreOtaviano Canuto: The Dollar’s ‘Exorbitant Privilege’ Remains

Otaviano Canuto discusses the ongoing role of the greenback in international monetary systems… There has been talk of “de-dolarisation” of the global economy, with recent initiatives and policy moves by China and other countries to extend the reach of use

Read More