Multilaterals

Back to homepageUNCDF: Tanga UWASA Issues a Historic Green Bond for Water Infrastructure

The bond represents an important capital market transaction for the city of Tanga — and the whole of Tanzania,. The Tanga Urban Water Supply and Sanitation Authority (Tanga UWASA) has issued a 10-year water infrastructure green revenue bond valued at

Read MoreWorld Bank: How to Accelerate Growth and Progress in Developing Economies

Amid a barrage of shocks during the past four years, the global economy has proved to be surprisingly resilient. Major economies are emerging mostly unscathed after the fastest rise in interest rates in 40 years—without the usual scars of steep

Read MoreAsian Development Bank: Three Actions Governments Can Take to Help to Tackle Climate Adaptation

Impacts of climate change are causing significant economic and social challenges, and there is an urgent need for good fiscal policy to prepare adaptation strategies. Climate-related disasters in Asia and the Pacific have affected 800 million people and caused $400bn

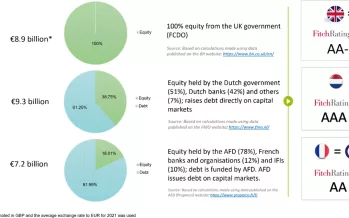

Read MoreOECD: The Funding Models of Development Finance Institutions

The drum beat of reform is increasing for the development system and particularly for the Multilateral Development Banks (MDBs). While the reform is looking to address a number of areas, there is a repeated call for the mobilisation of the

Read MoreWorld Bank: The Digitalisation of Capital Markets Can Boost Bond Market Efficiencies

Since its creation in 1944, the World Bank has issued bonds to raise funds from private investors that have mobilised close to $1tn for sustainable development projects and programmes in middle-income countries. But while both the World Bank and the

Read MoreUNCDF: Time to ‘Youth-Up’ – the Status Quo Simply Has to Be Adjusted

“It’s time to sustainably invest in youth affairs and future generations”, argues Edoardo Tancioni. As the world grapples with conflict, climate change and Covid, one thing is abundantly clear: the exigency to focus on youth. International forums increasingly feature the

Read MoreWorld Bank: Tackling Development Crisis Through Financial Innovation

The World Bank uncovers fresh avenues to increase financing capacity. Global development faces multiple crises: Growing debt burdens, inflation, and the rising cost of finance have made the economic path rockier. These challenges, together with the escalating climate emergency, have

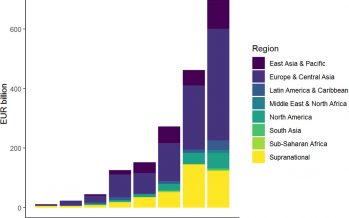

Read MoreOECD: Sustainable Development and Climate Change Require More than Just Money

Blended finance could hold the key to overcoming major world challenges. Financing the UN’s Sustainable Development Goals and climate objectives requires huge financial investment — in an increasingly urgent timeframe. Seven years remain to meet the 2030 Agenda. The pressure

Read MoreOECD: What Will It Take to Achieve UN’s Sustainable Development Goals?

Achieving the UN’s Sustainable Development Goals (SDGs) requires financial and non-financial investment to discover sustainable development pathways. One of the key elements is securing enough capital. Development finance providers are working to mobilise commercial finance. They are designing blended finance

Read MoreOECD: Only Scale and Development Impact Will Help Us Reach the SDG Mountain Summit

The development community is used to responding to crises but current events, not least COVID-19, have put the SDGs further out of reach. The private sector is recognised as a key contributor to delivering the SDGs by the development community

Read More