Columnists

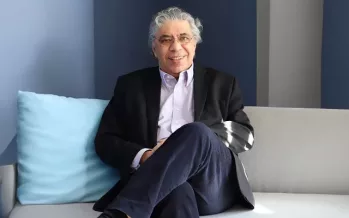

Back to homepageOtaviano Canuto: The Global War of Subsidies

US bids to limit tech imports and exports send a message of frustration and fear. Prior to her visit to China on April 4 — her second in nine months — Janet Yellen, US Secretary of the Treasury, sent a

Read MorePaolo Sironi, IBM: Regenerating Banking via Bots — AI Has Our Full Attention

Financial services specialists — like professionals in so many sectors — are embracing the radical technology, to great effect… Generative AI has seized the world’s attention like no technology before it. Executives are either dazzled by bright futures or dismayed

Read MoreHow Will Artificial Intelligence Affect the Economy?

Artificial intelligence (AI) is the name given to the broad spectrum of technologies by which machines can perceive, interpret, learn, and act by imitating human cognitive abilities. Automation was created to better fulfill repetitive tasks, increasing productivity. AI, with its

Read MoreWhither China’s Belt and Road Initiative?

The Belt and Road Initiative (BRI), launched by Xi Jinping, passed its tenth anniversary in 2023. It has entered a third phase. The initiative added a label to China’s financing and construction of infrastructure abroad, which had already totaled more

Read MoreOtaviano Canuto: Growth Implications from a Fractured Trading System

To understand the implications of a fractured trading system, let’s use the period known as hyper-globalisation, or globalisation 2.0, as a benchmark. In the 1980s and ‘90s, we saw the consequences of a tectonic shift deep beneath the global economy.

Read MoreOtaviano Canuto: Rising Use of Local Currencies for Cross-Border Payments

At the recent BRICS summit in Johannesburg, the leaders of Brazil, Russia, India, China and South Africa said they wanted to use more of their national currencies for cross-border payments. Those payments are currently dominated by the US dollar and

Read MoreTrade: Engine Room of the United Kingdom

‘While economic issues might not be centre stage by many, there is a real need for there to be a bridge-building exercise to build on trust with the European Union’, declares Lord Waverley. Pragmatism should dictate at least listening to

Read MoreOtaviano Canuto: The Dollar’s ‘Exorbitant Privilege’ Remains

Otaviano Canuto discusses the ongoing role of the greenback in international monetary systems… There has been talk of “de-dolarisation” of the global economy, with recent initiatives and policy moves by China and other countries to extend the reach of use

Read MoreTrusting AI in International Trade — the Road to Failure, or the Future?

Lord Waverley dons his techie hat and has a closer look at the potential applications of artificial intelligence… Generative AI is vital to national interest, regional prosperity, and tackling shared global challenges. It can help to grow economies, quickly and

Read MoreOtaviano Canuto: Macro-economic Policy Change – We’re Not in Kansas Any More

The possibility of multiple financial shocks lies ahead. Three significant changes to the macro-economic policy regime in advanced economies have unfolded in the past two years. Fears of a chronic insufficiency of aggregate demand as a growth deterrent — which

Read More