Finance

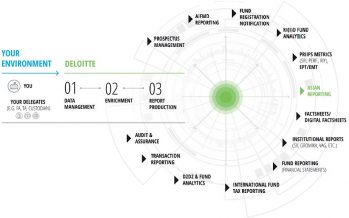

Back to homepageDeloitte: Changes on the Horizon for Europe’s Alternative Investment Fund Market

The European Commission’s ongoing efforts to establish the Capital Market Union have reached the alternative investment manager’s market in Europe. It has launched a legislative review cycle of the Alternative Investment Fund Managers Directive (AIFMD), giving the industry the first

Read MoreIBM Thought Leadership: Transparency Makes the Invisible Hand Visible Again, And Inclusive

Paolo Sironi is the global research leader in Banking and Financial Markets at IBM, Institute of Business Value. IBV is the thought leadership centre of IBM. Financial markets and economic systems are still exposed to periodic collapses, notwithstanding unprecedented institutional

Read MoreBuilding Bridges: Joining Impact Investing and Social Entrepreneurship

Finance is stepping up to a growing impetus from stakeholders to transform society for the better. Yet, there is a continuous disconnect between social entrepreneurs as vanguards of social value creation and the providers of financial services. A unique partnership

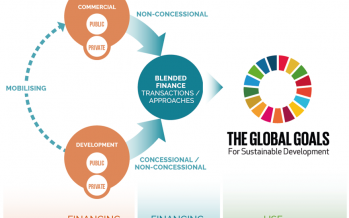

Read MoreOECD: Blended Finance Institutional Role in Responding to COVD-19

COVID-19 has had a dramatic impact on developing countries and undone years of progress on sustainable development, pushing back into poverty large sections of the population. World Bank analysis projects growth in Sub-Saharan Africa to decline to -3.3% in 2020,

Read MoreWorld Bank: Pandemic Recovery is an Opportunity to Step Up Climate Change Action in Europe and Central Asia

2021 needs to be the year that climate change urgency truly entered the collective consciousness and lasting action followed. In the same way the effects of climate damage are often described as irreversible, so too is the movement calling for

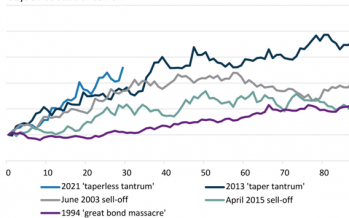

Read MoreA Possible Tug-of-war Between the Fed and the Markets

The projections for United States GDP released by the Federal Reserve on March 17, pointed to a growth rate of 6.5% in 2021, well above December’s 4.2% forecast. Congressional approval of the Biden administration’s $1.9 trillion fiscal package and the

Read MoreOtaviano Canuto: Middle-Income Countries Should Not Be Rushed to ‘Graduate’ Status

Many donor countries seem eager to see middle-income countries (MICs) graduate to non-client status in multilateral development institutions before achieving their full development potential. Such institutions can significantly contribute to the sustainable development of MICs, while seizing many benefits from

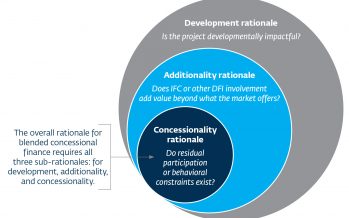

Read MoreIFC’s Blended Finance Department: Blending Public and Private Finance to Invest in Challenging Markets

What can be done to encourage more private investment in developing countries, especially the poorest and most fragile? This question lies at the heart of the development challenge today. Governments and development institutions alike recognise that the private sector is

Read MoreThe Size of Biden’s Fiscal Package

The monetary policy report submitted by the Board of Governors of the Federal Reserve System to the U.S. Congress on Friday Feb. 19 showed that the Fed’s members have improved economic growth expectations for 2021 and 2022, expect lower unemployment

Read MoreOtaviano Canuto: Central Banks and Inequality

While the economic recovery around the world remains uneven, fragile, and unbalanced across sectors, financial markets are generally doing very well, thanks! In the United States, only half of the unemployment caused by the pandemic last year has been reversed,

Read More