OECD: Blended Finance Institutional Role in Responding to COVD-19

COVID-19 has had a dramatic impact on developing countries and undone years of progress on sustainable development, pushing back into poverty large sections of the population. World Bank analysis projects growth in Sub-Saharan Africa to decline to -3.3% in 2020, giving the region the first recession in 25 years. In this respect, COVID-19 is and will have a negative influence on economies in many developing countries and further widen inequality, pushing back as many as 150 Million into extreme poverty by 2021.

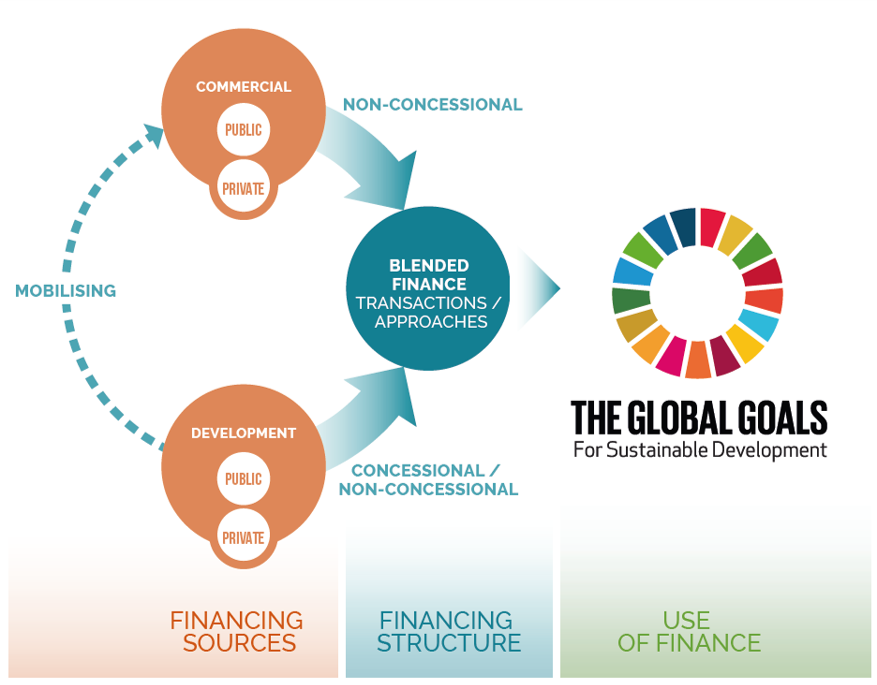

As developing countries are already facing considerable fiscal pressures and in some instances debt burdens, mobilising the private sector in support of the SDGs will become increasingly important. Blended Finance is recognised as one of the tools available to development actors that can be used to bring the much needed private sector support to address the SDG financing gap. The OECD Development Assistance Committee (DAC) defines blended finance as the strategic use of development finance (concessional and non-concessional) for the mobilisation of additional (commercial) finance towards sustainable development in developing countries.

Filling the financing gap and directing the private sector to key sectors that can stimulate economic recovery, or attracting commercial finance that would not have otherwise invested in development are the key roles of blended finance. Blended finance should not be seen as a substitute of Official Development Assistance (ODA). ODA will always be primordial, particular in social sectors and least developed countries (LDCs). Currently ODA is likely to remain flat, yet the SDG gap due to COVID-19 will grow even bigger.

Directing and de-risking projects and markets is also an important objective of blended finance, particularly in sectors such as climate. Development actors, due to the concessional and non-concessional nature of blended finance, are willing to take risks and expose themselves to greater financial, political, foreign exchange and technological risks. However, whenever blended finance is being used, the fundamental goal is to work alongside the private sector partner in a program or transaction.

Blended finance has gained considerable traction since the launch of the Addis Abba Action Agenda and the SDGs. That is not to say that the instruments that underpin blended finance have not been used before; e.g. guarantees are a stable instrument of development actors. The difference now is that blended finance has become more mainstream and role of the private sector more evident. On the demand side, the development gaps are significant, while on the supply side substantial amounts of capital are invested in low or negative returning assets, yet could be funding projects and portfolios that contribute to the SDGs.

For blended finance to be effective the institutional architecture of the development landscape needs to be fully mobilised, otherwise the necessary scale will be out of reach. The OECD DAC blended finance definition has a wide approach, which financially means concessional and non-concessional funds mobilising the private sector. The goal being to ensure that institutions act as mobilisers of the private sector while not only using blended concessional finance but also in certain instances non-concessional finance but always the institutional capacity. Institutions bring not only finance to a transaction but credibility and assurances, through the undertaking of due diligence and development skills. The private sector when going in to high-risk transactions focus on the precedent and DFIs and MDBs have a lot of the necessary experience. This approach is captured in the OECD DAC Blended Finance Principles, which were agreed by the High Level Meeting of the DAC in 2017. The Principles have subsequently been referenced by several G7 and G20 Presidencies thereby forming a part of the international development architecture [1].

At the Blended Finance and Impact week, the release of the OECD DAC Blended Finance Guidance provided further insights on how to mobilise the private sector using all the institutional capacity possible, particularly MDBs and DFIs. Progress has been achieved, with Blended Finance increasing private sector mobilisation by 28% to USD 48.4 Billion in 2018. More still needs to be done and all the capacities of the development system should be mobilised. As highlighted in the Blended Finance Guidance, mobilisation is not only financial: the DFIs’ institutional role is critical given their understanding of the market, involvement in projects and due diligence capabilities. This institutional capacity is a key catalytic factor in mobilising private actors.

As new actors enter the blended finance space, the OECD DAC Blended Finance Guidance provides a tool for donor governments, development co-operation agencies, philanthropies and other stakeholders to design and implement effective and transparent blended finance programmes. The expectation is that as new DFIs are established or donors deepen their capabilities to work with the private sector, the Guidance will be the essential roadmap. Each of the five Principles and sub principles and their respective detailed guidance notes provide insights and knowledge that has been co-created over several years with development actors – from both developed and partner countries –, CSOs, the private sector and donors, amongst others.

Policy work on mobilising the private sector has been considerable and the mobilisation figures are starting to bear proof of this collective effort. However, blended finance is yet to show its full potential in terms of development impact. Work still remains to be done on assessing the outcomes of the institutions, instruments, and activities.

Development actors have a strong desire to show how they achieve development impact through blended finance. The OECD/UNDP Impact Standards for Financing Sustainable Development (IS-FSD), developed by the Community of Practice on Private Finance for Sustainable Development (CoP-PFSD), have this goal. Developed as a best practice guide and self-assessment tool, the Standards are designed to support all providers of development finance in the deployment of resources in a way that maximises the positive contribution towards the SDGs. The Standards were developed as part of a community of practice that counts over 300 members from government’s agencies, DFIs, private asset managers and CSOs. Following approval by the DAC, the Standards will be made freely available for subscription, with Detailed Guidance as a support to implementation.

A lot of work still needs to be done but the policy pieces are coming together thereby allowing development actors and the private sector to respond to the SGD challenges according to the direction given but COVID-19 means we now need to redouble our efforts.

[1] Specifically, under the Canadian Presidency, the G7 committed to “work to implement the OECD-DAC Blended Finance Principles including promoting greater transparency and accountability of blended finance operations”. Under the Japanese G20 Presidency, the G20 Osaka Declaration by Leaders recognised that blended finance “can play an important role in upscaling our collective efforts”. Under the G7 French Presidency in 2019, the G7 further highlighted their support “to mobilise additional resources for development and help increase the impact of existing resources” and “the implementation of the OECD DAC Blended Finance Principles for Unlocking Commercial Finance for the SDGs” (2019).

About the Author

Author: Paul Horrocks

Paul Horrocks is Head of the Private Finance for Sustainable Development Unit at the OECD Development Co-operation Directorate. Paul is working on a number of initiatives aiming at encouraging greater private sector investment into developing countries, in particular on policies and approaches that governments can adopt in order to ensure that activities are aligned and impact achieved.

Prior to this, Paul was a Senior Executive in Fiscal Group of the Australian Federal Treasury, working on the domestic infrastructure market but also providing policy advise during Australia’s G20 presidency on international policy challenges. Paul has over a decade of Senior leadership at the European Institutions in Brussels, having worked on initiatives such as the deepening of European capital markets in response to the 2008 financial crisis.

Paul has degrees from the University of Wales, and Masters from the University of Liverpool as well as an Executive MBA from Vlerick Business School in Belgium.Paul has degrees from the University of Wales, and Masters from the University of Liverpool as well as an Executive MBA from Vlerick Business School in Belgium.

You may have an interest in also reading…

Exploring Business Opportunities in Mexico: The Landscape of Potential

The country has long been recognised for its economic promise across sectors. With its strategic geographic position, diverse economy and

A New Generation of Banker

Brazilian Alessandra França, by no means fits the banking stereotype at only 26 she has already, established a bank for the

Godiva Chocolatier: What’s in a Name?

While love-struck Juliet in Shakespeare’s Romeo and Juliet proclaimed that a name is just a name, nothing so straight forward