Otaviano Canuto: Rising Use of Local Currencies for Cross-Border Payments

At the recent BRICS summit in Johannesburg, the leaders of Brazil, Russia, India, China and South Africa said they wanted to use more of their national currencies for cross-border payments.

Those payments are currently dominated by the US dollar and other global convertible currencies. Like China and the other BRICS members, several countries have sought to develop alternative external payment mechanisms. Pairs of countries have agreed to settle commercial and financial transactions with one another in local currencies, usually facilitated via bilateral agreements between central banks.

Currencies across national borders serve as units of account, a measure of value for trade invoices and financial asset pricing. They also comprise a medium of exchange, settling payments as part of cross-border commercial and financial transactions. They store value abroad, as public- and private-sector foreign reserves, in the form of financial or monetary assets.

From an individual-agent perspective, those functions may be interlinked; payment in a portion of transactions can be required to be made according to national public authority rules.

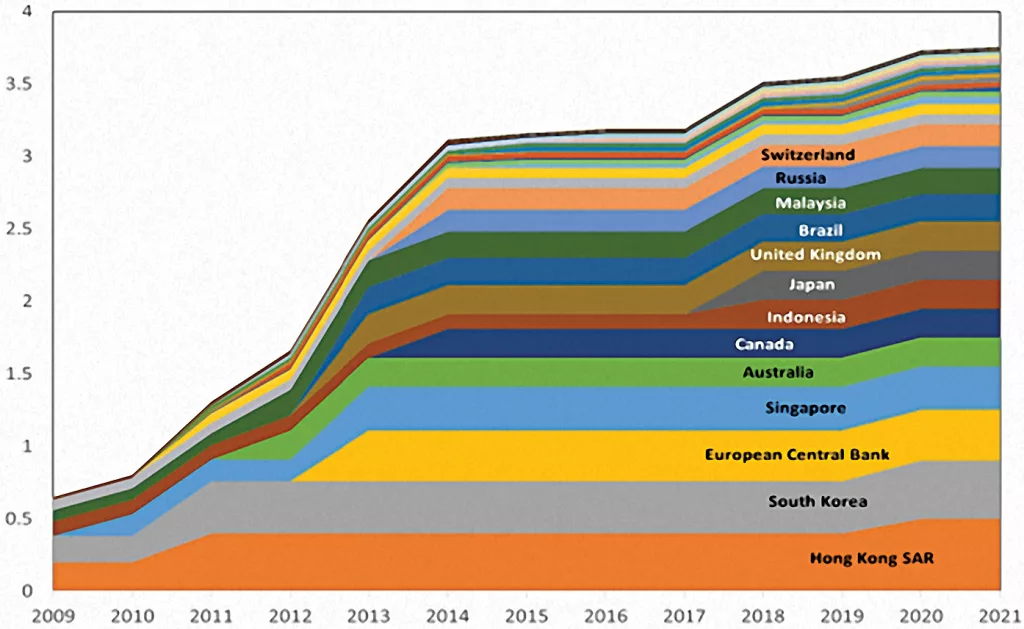

Figure 1: Evolution of PoBC Swap Lines (RMB trillions). Source: Perez-Saiz and Zhang (2023)

There is an obvious reason why governments might want to use local currencies for cross-border payments. A country subject to geopolitically motivated sanctions issuing the dominant international currencies may constitute destinations of external reserves. This is true for Russia, Iran, and Venezuela, but China and others want to reduce their vulnerability to sanctions.

One can point to an eventual gain in lower stocks of reserves in fully convertible currencies — dollar, euro, yen, sterling — necessary to ensure stability in central bank cross-border payments. A possible cost of bilateral cross-payment using local currencies: if a country has a systematic surplus, it tends to accumulate foreign reserves in the currency of the country on the deficit side, instead of doing so in a currency that is fully convertible and generally accepted.

It is enough for one side to impose the use of local currency in payments to ensure that private agents of the other accept it to make a transaction possible. Brazilian exporters no longer face mandatory convertibility of their foreign revenues into Brazilian currency, and can dispose of their revenues in dollars — or however they wish. But if the Chinese demand to pay in their currency, Brazilians will have no other option if they want to sell there.

The Chinese renminbi (RMB) has seen the greatest expansion in use through bilateral external payment agreements. By the end of March 2023, the People’s Bank of China (PoBC) had signed bilateral agreements for the creation of currency swaps with central banks of 41 countries, amounting to $480bn — with the balance of funds activated via such lines reaching $15.6bn (Figure 1). In addition to such credit swap lines, China has expanded offshore clearing banks.

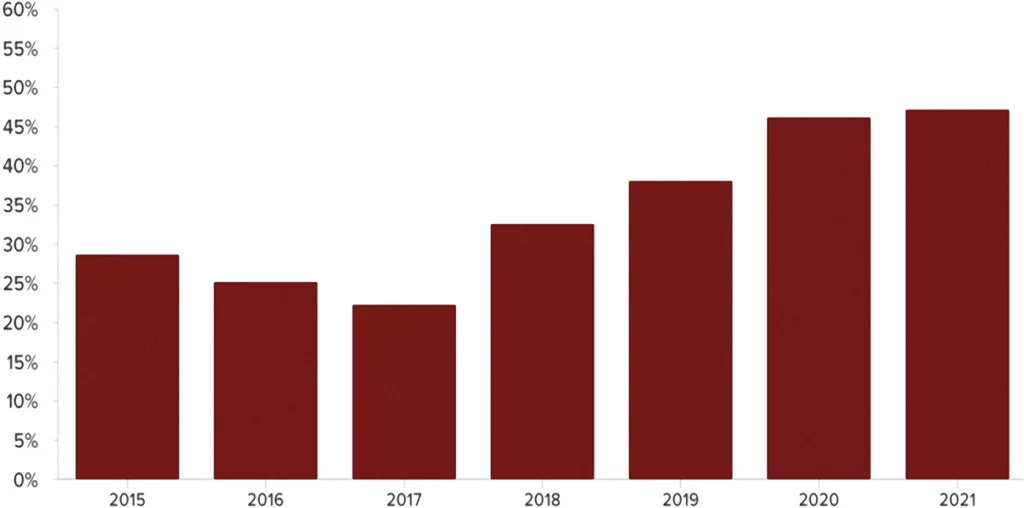

Figure 2: RMB Share of China’s Total Cross-Border Settlements. Source: Hung Tran (2023)

China has been able to use RMB to settle half its foreign trade and investment transactions (Figure 2). According to an International Monetary Fund working paper by Hector Perez-Saiz and Longmei Zhang (2023), the median use of the RMB went from zero in 2014 to 20 percent in 2021, based on a sample of external payments between China and 125 other countries.

RMB has occasionally been used in bilateral transactions between third parties. Some refineries in India used it to buy oil from Russia. Argentina resorted in August to its bilateral line with China to pay its debt service with the IMF.

An ongoing project to develop a digital multi-currency platform is being implemented by the central banks of China, Hong Kong, Thailand, and the United Arab Emirates, with support from the Bank for International Settlements (BIS). Digital currencies from China (and others) may become viable for external payments in a plurilateral framework.

Russia and India have also been looking to extend the use of their currencies. At a of the Association of South East Asian Nations (ASEAN) in May in Indonesia, members agreed to develop a framework for the settlement of external transactions in local currencies.

BRICS installed, in 2010, an interbank co-operation mechanism to facilitate payments in local currencies. In 2018, it launched BRICS Pay, a public-private partnership project for a digital payment platform in local currencies.

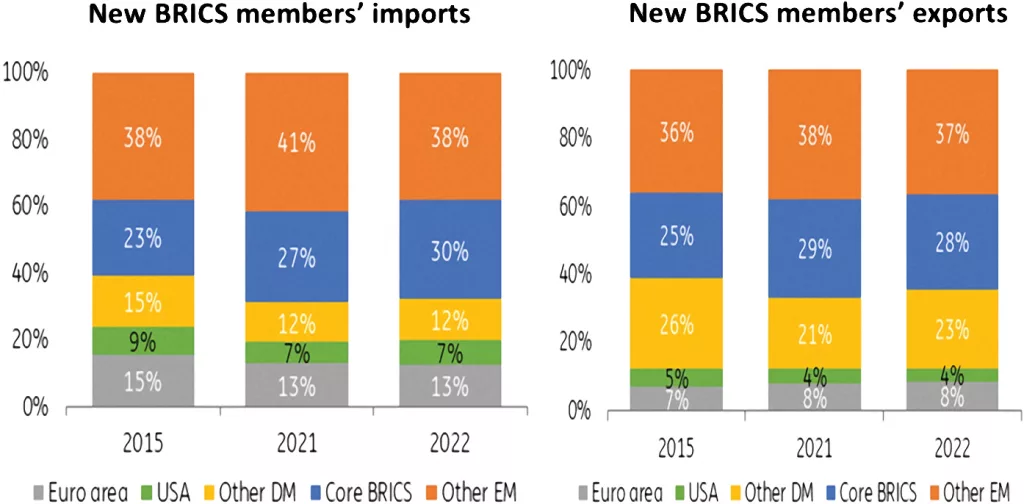

Figure 3: Core BRICS Countries Have Gained Weight in New Members’ Trade. Source: ING Economic and Financial Analysis 2023)

The BRICS summit in August included an invitation to six countries: Argentina, Ethiopia, Egypt, Iran, Saudi Arabia, and United Arab Emirates. Given that the original BRICS have increased their share of new members’ exports and imports (Figure 3), the use of local currencies will rise if they go down that path.

The growing use of local currencies in external payments will be part of a slow and bounded de-dollarisation. If a local currency is not fully convertible, remaining subject to regulations restricting liquidity and asset availability — as with the RMB — it will not fulfil the function of an external store of value for the bulk of agents in the global economy. Nonetheless, a partial fragmentation of the global payments system is under way.

A previous version was published by the Policy Center for the New South

About the Author

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, a visiting public policy fellow at ILAS-Columbia, and principal of the Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil. Otaviano has been a regular columnist for CFI.co for the past 11 years.

Follow him on Twitter: @ocanuto

You may have an interest in also reading…

Anthony Scaramucci: Mooching Towards Washington, With No Polyester Suits in Sight

Entrepreneur and author Anthony Scaramucci has seen plenty of ups and downs — and the US presidency may not be

Breaking Down Biden’s 2025 Capital Gains Tax Proposal: What’s Really in Store

In President Biden’s proposal for the Fiscal Year 2025 Budget of the United States Government, one of the most talked-about

UN Expects Subdued Asia-Pacific Growth in 2013

Growth in Asia-Pacific remains subdued due to the impact of persistent weaknesses and uncertainties in the developed economies, the United