CBRE: Multifamily Assets Consolidate Real Estate Investment Growth

Real estate investor appetite for European multifamily properties has been thriving in the past decade. Resilient income-driven performance, sustained by strong occupier market fundamentals and long-term socio-demographic trends, should continue to fuel the rise of this asset class.

Real estate investor appetite for European multifamily properties has been thriving in the past decade. Resilient income-driven performance, sustained by strong occupier market fundamentals and long-term socio-demographic trends, should continue to fuel the rise of this asset class.

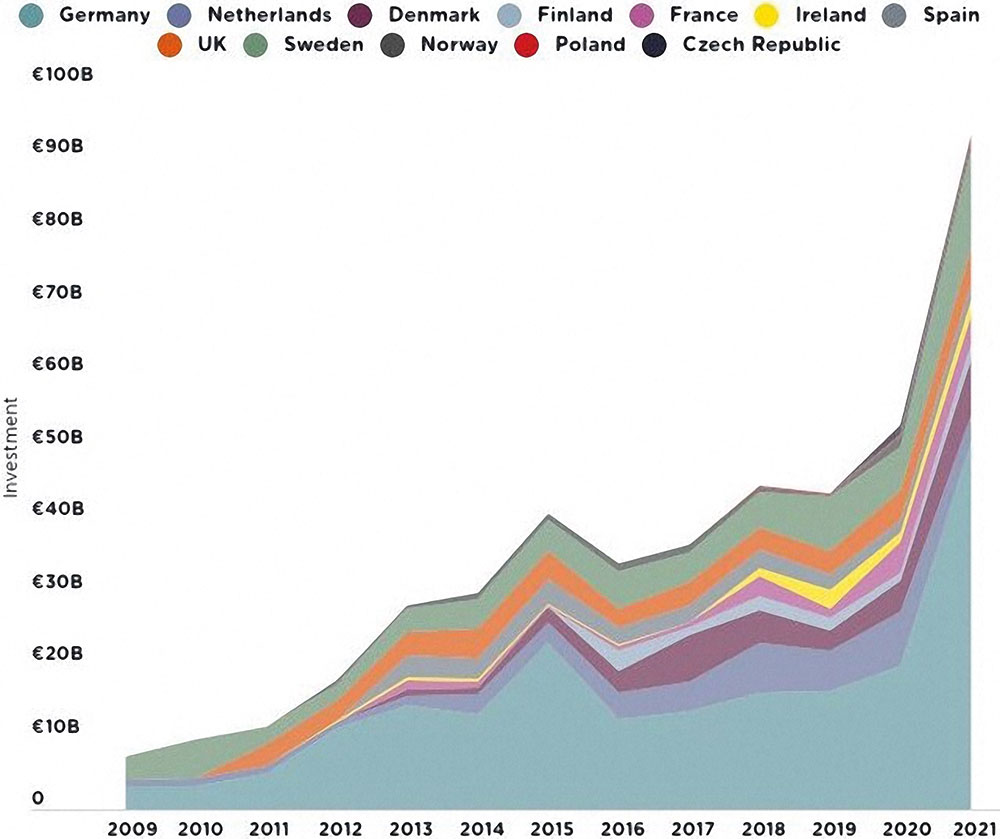

Last year ended by beating European multifamily records with nearly €100bn invested. With a compound annual growth rate of over 15 percent in total investment into the sector between 2012 and 2020 and a larger than 50 percent annual increase in 2021, multifamily has moved from the fringes of investors’ barometers to sit firmly in the sights of those looking to deploy capital. Mega-deals have taken the investment market to new highs, such as German-listed Vonovia’s takeover of rival Deutsche Wohnen for around €23.5bn (which included €1bn in nursing home assets, or AXA’s €2bn purchase of a portfolio developed by intermediate housing provider In’li in the Greater Paris region.

Robust factors underpin the performance of the multifamily sector. These include continued urbanisation and strong city demographics, changes to household formations, affordability challenges, and persistent supply-demand imbalances. These factors are typically de-linked from economic cycles and have allowed the sector to continue performing well during a period of wider economic instability through 2020 and 2021.

Strategic Partnerships

There is a general shortage of modern, efficient investment grade stock in mature multifamily markets, while the opportunity to buy fully stabilised assets is virtually a non-starter in nascent investment locations. With compressing yields, many investors are also looking up the value chain towards development opportunities and taking advantage of local partnerships or in-house development expertise.

Figure 1: European multifamily investment sharp increase in 2021. Source: Savills Research

With the ownership of a scaled platform the continued goal for many investors, some are looking even further up the value chain and taking stakes in developers as a way of securing pipeline, or working on a more strategic manner across a number of sites.

The 32 percent of equity invested in the European multifamily sector during 2021 came from cross-border investors, roughly in line with the five-year average. Nearly three-quarters of cross-border capital invested throughout 2021 came from other European countries, significantly above the five-year average (52 percent). Asian and North American money accounted for around 10 percent of total cross-border investment, but are increasingly involved in assessing deal opportunities.

Urbanisation Trends

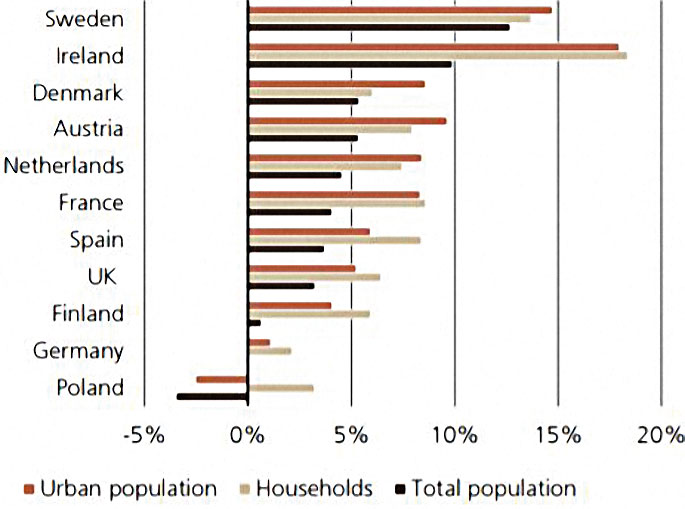

Demographics probably constitutes the most relevant factor when assessing residential property investments. As in most regions, population growth prospects are expected to be impacted by an increasingly ageing society and a subdued birth rate in the coming decades. Despite a muted top-down picture, some European countries are likely to experience a dynamic population development between 2020 and 2035 (see Figure 2). This is evident in countries such as Sweden (ca. 13 percent) and Ireland (ca. 10 percent).

Despite the increasing digitalisation of the job market, which enjoyed an additional boost from the pandemic, urban centres will remain the hotspots for the service sector, which makes up the largest stake of the job market. These locations are likely to remain attractive due to their cultural and entertainment offering. However, as home- and near-office activities are expected to gain traction, suburban municipalities and well-connected secondary cities — particularly locations with strong public transportation links — will probably become more attractive. This could also influence the geography of the European multifamily market on a micro-level.

Figure 2: Expected demographic growth 2020 – 2035. Source: Oxford Economics

The threat of regulatory changes constantly looms over the sector. Despite record levels of investment, there remain some headwinds, not least political interventions in the housing and investment markets that could restrict investment opportunities and deter potential new entrants.

Regulatory changes were felt in various locations over the past year and the outlook in many cases remains uncertain. The best-documented intervention was the rent freeze introduced by the Berlin government and its subsequent removal following a national court ruling. The new coalition government does not look likely to grant the state’s wishes to grant it the legal mechanisms to re-introduce the freeze, but popular and media perception will continue to influence investor behaviour.

Elsewhere, Spain’s Housing Law has progressed and includes provisions for rent control (already enacted by Barcelona) and taxation of empty flats. During last year, the Irish government tightened permitted rent increases in Rent Pressure Zones (RPZs) and introduced a transfer tax surcharge on bulk purchases of single-family rental homes.

At a broad level, most investors are generally not deterred so long as regulation is stable, well-signposted and proportionate, but local and national governments need to ensure private capital is not deterred from helping meet housing related challenges. These include facilitating newbuild delivery to ease supply constraints and renovating stock to improve quality and energy efficiency.

Europe’s multifamily market has grown from a small, geographically concentrated market to an investment opportunity with more depth and complexity. Despite some near-term concerns over rising interest rates, multifamily returns are still significant, and it continues to be one of the more favourable real estate sectors across the continent. Equally investors are turning to multifamily-adjacent sectors — particularly shared and single-family rental — to achieve higher returns and bring portfolio diversification benefits.

By David Casas Alarcón Property Management Accounting Lead at CBRE’s European Center of Excellence

You may have an interest in also reading…

SegurCaixa Adeslas Emphasises Value Creation as a Way to Endure Its Sustainable Growth Strategy

The Spanish insurance company stands out for the digitalization of its proceses that allows it to offer more accesible, personalised

AccountAbility: Building Better Boards

Building a strong and effective board of directors can be a daunting challenge in today’s world. High-profile board failures, the

CFI.co Meets Juan Pablo Córdoba Garcés

Mr Córdoba Garcés assumed his current position as CEO of the Colombian Securities Exchange in March 2005. Since then his