Book Review: Squeezing Cash Out of Milliseconds

Time is money. To high-frequency traders, it means big money. HFTs make cash by being milliseconds faster than the other guy – or system. These are not mom-and-pop investors: high-frequency traders employ ultra-fast Internet connections and powerful computers to catch buy and sell orders just moments before they hit the trading floor and affect equity prices. By unleashing sophisticated algorithms on the captured data, HFTs can trade on marginal price differences. A position is often assumed and liquidated within a fraction of a second. In this curious segment of the market, there is no place for basic research, buy-and-hold, or any consideration other than raw computing power.

Time is money. To high-frequency traders, it means big money. HFTs make cash by being milliseconds faster than the other guy – or system. These are not mom-and-pop investors: high-frequency traders employ ultra-fast Internet connections and powerful computers to catch buy and sell orders just moments before they hit the trading floor and affect equity prices. By unleashing sophisticated algorithms on the captured data, HFTs can trade on marginal price differences. A position is often assumed and liquidated within a fraction of a second. In this curious segment of the market, there is no place for basic research, buy-and-hold, or any consideration other than raw computing power.

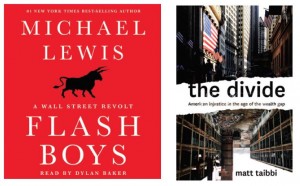

Whilst not illegal, high-frequency traders have been receiving plenty of attention from regulators, prosecutors, and from Michael Lewis – the American financial journalist who has been at the forefront of uncovering the many exotic ways in which the real wolves make their billions. A graduate from the London School of Economics and trained by Salomon Brothers as a bond salesman, Michael Lewis exited the trading floor to write Liar’s Poker, an exposé of life on 1980s Wall Street.

“Time is money. To high-frequency traders, it means big money.”

Now considered mandatory reading for future traders – alongside Tom Wolfe’s (fictional) The Bonfire of the Vanities and Barbarians at the Gate: The Fall of RJR Nabisco by Bryan Burrough and John Helyar – Liar’s Pokers tell the story of how the Salomon Brothers investment bank, since absorbed by Citigroup, almost single-handedly invented the mortgage bond and scooped up untold billions as a result. If anything, Liar’s Poker, published in 1989, reads like a work of prescient knowledge, announcing a crisis thus foretold.

With his first book, Mr Lewis set the tone for many others to come. He has since authored no less than fourteen books, mostly about the inner working of the usually opaque financial world. Mr Lewis displays a knack for explaining in clear layman’s terms even the most complex and esoteric of stratagems deployed by the financial wizards of Wall Street and London’s City to extract maximum profit from equity trading.

His latest work Flashboys: A Wall Street Revolt reveals how vast amounts of human ingenuity, intelligence, and resourcefulness are employed to empower the HFT groups set up by most large trading firms and investment banks to claim profit from arbitrage. Mr Lewis profusely laments the vast amounts of human talent wasted on a wholly unproductive pursuit. While doing so, he also provides fascinating insights such as details on the 830-mile long dark fibre cable put in between Chicago and New York at a cost of $300m to decrease line latency from 17 to 13 milliseconds.

The cable allows HFTs that use it a tiny, but hugely lucrative, edge over the competition. However, just as the secretive cable became operational, an even faster microwave link between the two financial centres was established, reducing latency to barely nine milliseconds. Because microwave transmission only covers small distances and requires repeaters, a new transatlantic cable is now being laid to connect New York and London fully five milliseconds faster than the current infrastructure allows.

In Flashboys, Mr Lewis concludes that the market is “rigged” and argues that HFTs cost regular brokers and fund managers anywhere between $5bn and $15bn annually in profits lost to the jacking up of equity prices in the split second it takes for a buy or sell order to travel from broker via exchange servers to trading floor. The allegations contained in Mr Lewis’ book prompted an investigation by the Securities and Exchange Commission (SEC) which earlier this year imposed a $4.5m fine on the New York Stock Exchange and two of its affiliated exchanges. Pointedly, the NYSE has refused to admit to any wrongdoing.

Just how profitable high-frequency trading can be was gleaned from the corporate filings and disclosures of Virtu Financial – one of the world’s leading HFT firms – as it prepared to obtain a NASDAQ listing. Using proprietary trading software, Virtue Financial managed to beat the markets and rake in a profit on 1277 out of 1278 days of trading over the past five years. The company had to postpone its IPO on a number of occasions due to the firestorm that erupted after Flashboys was first published. Virtue Financial operates on over 250 exchanges and maintains dark pools – private trading spheres – in 34 countries.

Whereas high-frequency trading is not unlawful per se, front-running most certainly is. This is when less savoury brokers profit from the advance knowledge of large orders placed by their clients. A front-running broker trades on his own account before putting through the client’s order and so easily rides the tailcoats of the market as it moves in either direction. The distinction between high-frequency trading and front-running is rather blurred and comes down to semantics.

Coincidence or not, Flashboy’s publication – and its taking the best-seller charts by storm – occurred just moments before regulators snapped into pursuit-mode to flush out market wrongdoers and other miscreants harvesting profits on the margins of the permissible. HFTs have now been heaped together with ordinary fraudsters as threats to the proper, fair, and transparent functioning of markets.

If it exposes anything, the HFT pseudo-scandal merely emphasises that insiders have always enjoyed an advantage on equity markets. However, it does dispel the equal access myth that keeps smaller investors locked in by perpetuating the notion of a level playing field. As Mr Lewis shows in Flashboys, equal access is just a myth kept alive in order for the party to continue ad infinitum.

Interestingly, high-frequency traders prey on brokers and hedge fund managers who are the high-frequency traders’ true chumps. From the much ado surrounding Mr Lewis’ book, one may be forgiven the impression that wider society actually pities the HFTs’ victims. As such, the book does a disservice, for while regular brokers and flashboys battle over disputed milliseconds, the banksters of old go about their sorry business with renewed vigour, inflating and deflating bubbles, sacrificing private individuals, corporations, and entire nations on the altar of financial propriety.

For anyone interested in getting a real good peek behind the scenes of the sordid finance perpetrated by fraudsters in three-piece suits, there is The Divide: American Injustice in the Age of the Wealth Gap – the much less touted work by Rolling Stone Magazine’s reporter Matt Taibbi who paints a scary picture of an exclusive club hell-bent on destroying whatever stands between its members and other people’s money. That whatever happens to be you.

Flashboys: A Wall Street Revolt by Michael Lewis (isbn 978-0-3932-4466-3)

The Divide: American Injustice in the Age of the Wealth Gap by Matt Taibbi (isbn 978-0-8129-9342-4)

You may have an interest in also reading…

Unleashing the Economic Potential of the Maghreb – the Role of Foreign Investment

Excerpts of a speech given by Christine Lagarde, Managing Director, International Monetary Fund at a conference in Mauritania in January,

Interview with Firas Sleiman – Partner and Technology, Digital & Cyber Leader at PwC in Qatar: Digital Leadership

About Qatar and Digital What technology or digital trends should the Qatari leader watch out for and invest in for

Principles for Responsible Investment: Investors Must Commit to Engaging Policymakers

The recent mobilisation by institutional investors over the climate change issue has captured media attention around the globe, clearly demonstrating