Author: marten

Back to homepageThe Oyster’s Gift to the World: Gods’ Tears, Symbols of Purity, and Mourning Wear for Royalty

Passion, beauty, wisdom and wealth — these natural wonders are as rich in meaning as they are in lustre. The opalescent orbs have been a go-to accessory for style icons past and present: Coco Chanel, Princess Diana, Madonna, Anna Wintour,

Read MoreCompelling Case for Making Guinea the Destination for Your Next Investment

When you consider the appeals and advantages of the West African country, think beyond extractives… World renowned as the home of the largest bauxite and untapped high-grade iron ore reserves, the West African nation of Guinea is open for business

Read MoreThe Changing Face of Business Travel (and How Best to Reap the Benefits)

Some major changes are impacting business travel — and one of the most noteworthy is the new digital ID system. The move was recently proposed as a way to close the technological gap between the UK and other countries. The

Read MoreCommitted to the Future, Driven by Passion, Dedicated to Clients, and Steadfast on Sustainability

Swiss asset management firm keeps a tight focus on its core values, customer needs, and the drive for responsible investment Taurus Asset Management SA Lugano is committed to a prosperous future, emphasising growth and the diversification of its service offerings.

Read MorePoland Votes: PiS Stranglehold on Power in the Balance

Clutching at straws. With the slimmest of margins, voters in Poland opened a narrow path for the pro-EU opposition to reclaim power after eight years in the proverbial wilderness. With fear and ill-disguised loathing, the European Union watched as the

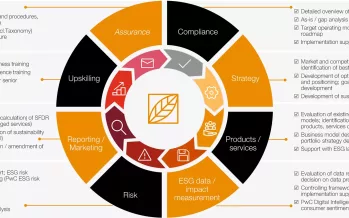

Read MoreEmbracing ESG Transformation: Turning Ambitions Into Action

Two PwC Luxembourg partners giving support and guidance to companies in their transformation journeys. This year brought with it the urgent need to dive deeper into the evolution of ESG and sustainability priorities. At PwC Luxembourg, two partners have been

Read MorePwC: ‘When it Comes to Securing the Future, There’s No Time Like the Present’

ESG and sustainability priorities are increasingly important business considerations; PwC Luxembourg is on the case… Goodbye theory, hello action — PwC Luxembourg is empowering company leaders to execute successful ESG transformations. ESG is proving to be a bigger disruptor than

Read MoreGimme an E! Gimme an S! Gimme a G! What Does that Spell? Future Prosperity — and a Healthy Planet

Society has always demanded that companies serve a social purpose — and Hungary’s MBH Bank has consistently stepped up to that mark… Leading Hungarian financial institution MBH Bank has lofty aims — and an ambitious strategy to match. It wants

Read MoreWhen Environmental Considerations Are a Driving Force, Banking Needs a Keen Eye — and Unfailing Dedication

MBH Bank and its risk assessor have taken that message to heart. MBH Bank management firmly believes it has a responsibility towards sustainability — as a financial institution, in lending and investment practices, and in day-to-day operations. It has taken

Read MoreWhen Wheels Fall Off a Gender-Balance Bid by a Wall St Hedge Fund, It Turns to Woman vs Man

Fair Play, screening on streaming service Netflix, shows that entrenched, society-imposed values can be hard for individuals to shake off… Businesses are paying more attention to diversity in their senior teams, and things are gradually moving into positive territory. The

Read More