News

Back to homepageThe Top Traits of a Great CEO

Does your chief exec have what it takes? Do you? Naomi Snelling tells you how to find out… Nothing can properly prepare you for parenthood, and the same is true for being a CEO. The challenges are immense, but the

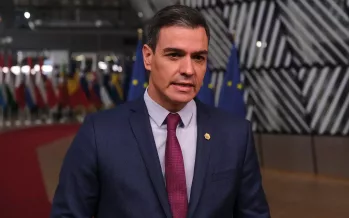

Read MorePrime Minister Pedro Sánchez: Seldom Down, Never Out

Echoes of the Franco Era still haunt Spain in subtle and often divisive ways. Now, a vibrant democracy, the country has taken decades to shed its past and rid society of the last vestiges and symbols of authoritarianism. A watershed

Read MoreTaking on Giants, and Winning: Aquis Exchange Shares Equinox Benefits with Trading Ecosystem

‘We’re regularly beating these 800-pound gorillas, and winning deals out from under them,’ says Aquis MD Adrian Ip… Aquis Exchange Plc is celebrating Equinox, a world first that took 10 years to perfect and reduces the latent time of a

Read MoreRugby Injuries Tackled Head-on as Fans, Clubs and Ruling Bodies Put Renewed Focus on Player Safety

Tony Lennox reports on the ruck forming around rule changes to the rough-but-popular game of the oval ball. Hollywood legend Richard Burton had a true Welsh passion for rugby. He once said he’d rather play for his country at Cardiff

Read MoreDavid Hume’s Philosophy, Controversy, Superstition, Atheism — and Lucky Toes

The Scots philosopher’s sometimes divisive words gave him prominence in life, as in death. It’s ironic that a statue of the 18th Century Scottish historian and philosopher David Hume, situated at the top of Edinburgh’s Royal Mile, has earned a

Read MoreNew Cause for Celebration on Biodiversity and Conservation

Experts and enthusiasts in biodiversity and conservation have been collaborating for years to curb humanity’s destructive practices and accelerate positive change. At the end of 2022, representatives of 190 countries met in Montreal at the United Nations Biodiversity Conference (COP15)

Read MoreNew World Development: Leading Disruptor in Real Estate Industry

Founded in 1970, New World Development Company Ltd (“the Group”, Hong Kong stock code: 00017) was publicly listed in Hong Kong in 1972 and is a constituent stock of the Hong Kong Hang Seng Index. The Group’s core businesses include

Read MoreAccountAbility CEO Sunny Misser Leading the Charge in a Changing ESG Universe

The days of turning a blind eye to the impact of Environmental, Social and Governance (ESG) matters are over. Today, organisations of every scale, across industries and in all geographies are active in moving the ESG agenda forward in ways

Read MoreUNCDF: Secrets to Easing Funding Process for Less Wealthy Countries’ Climate Battle

Qatar’s under-sung conference shared the limelight with larger international events — but it provided some key points for decarbonisation… A high-level conference addressing climate change was convened in March — and we aren’t talking about COP28. It was a high-level

Read MoreThe ‘Miracle’ Plant Once Hailed as a Cure for Cancer: Tobacco’s Rise … and Fall

We’ve come a long way from the first importation of nicotiana tabacum, through early praise and TV ad campaigns to its eventual unmasking as an addictive drug. Tony Lennox puts that in his pipe… and writes. Aruggedly handsome man stands

Read More