Strategy, Structure, Shared Purpose: There are Rules to Protecting Family Wealth

Maurice Ephrati

Bedrock Group partner Maurice Ephrati outlines his philosophy for family governance and next-generational financial education.

The key ingredients for successful multi-generational wealth management go beyond investment management. We see those keys to wealth protection and successful generational transition as having:

- A long-term strategic approach, whereby the family is clear on how they want the assets to evolve over the course of the next 10 or 20 years

- A clear shared purpose which defines the family’s commitment as stewards of the wealth. Also, a clear set of values that reflect the family’s identity and behaviours.

- A solid governance structure, to ensure good decision-making and the right checks and balances

- A next generation that is educated in the family’s wealth and has the right competencies to maintain it, but more importantly to grow it. This can be achieved directly, as managers of the family office or indirectly, as responsible shareholders.

- A mindset that fights against complacency and focuses on innovation and new ways of contributing towards the family wealth

There are too many cases still where the next generation is thrust into the management of assets and/or a family business that they don’t understand, don’t want, or feel completely overwhelmed by.

Our purpose is to educate and provide expertise to the next generation: in skill development and a candid understanding of what it means to be part of a wealthy family. We know this helps them to shoulder the responsibility in the right way; not as an imposition or a reason for entitlement, but as something to be proud, grow and protect.

This notion inspired the creation of the Bedrock Community for Future Leaders, which is led by our in-house Family Governance specialist, Maria Villax, and brings together like-minded next gens to connect, learn, and exchange ideas. We host a series of events throughout the year, covering a broad range of topics including investment, family governance, entrepreneurship, leadership, strategic philanthropy, and succession planning.

A Passionate Team

Bedrock Group team members are passionate about their work. It is an innate part of our firm’s culture, and something that is actively encouraged.

Partners create an environment and have a leadership style that allows people to identify opportunities through their own individual lenses and pursue them.

People are attracted to the entrepreneurial spirit that the firm and partners inspire. Having this type of environment enables people to create their own path — but also there is a shared sense of direction that creates passion and enthusiasm amongst the team.

Responsibility

CSR is a core pillar of Bedrock Group’s framework and approach. We support the team by engaging with CSR in a number of ways. We create the opportunity to directly impact the communities local to our offices, by encouraging volunteering. We offer time off to all staff members to give back to society while working on issues they feel passionate about. From supporting hospices to delivering food parcels, our team members continue to create and promote diverse impact in their communities.

Philanthropy

We donate a percentage of annual profits to philanthropic causes. Donations are further enhanced by employees via payroll giving; with the company having a matching scheme, which helps maximise the impact and helps support causes that individuals are passionate about.

For more information regarding Bedrock’s Community for Future Leaders events, please reach out to our Head of Family Strategy and Governance, Maria Villax

We are always on the search for passionate and enthusiastic individuals. If you would be interested in joining our team, please contact us here

You may have an interest in also reading…

The Access Bank UK Limited: It’s All About Service for Nigerian Bank Making Impact on the World

Fundamental to the growth of the The Access Bank UK is an operational culture built on strong customer relationships and

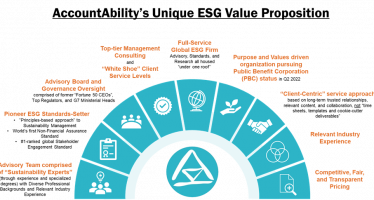

Setting the Standard for Sustainability and Advancing the ESG Agenda

AccountAbility is an expert Sustainability / ESG consulting and standards firm that provides objective counsel to CEOs and boards on

Kickstart Seed Fund: From Recession to Co-operation

Kickstart Seed Fund was founded in 2008. Yes, 2008 — and despite the recession, the company closed its first fund