Finance

Back to homepageAccess Granted: Simple Policies in a Complicated Financial Ecosystem

The Access Bank UK is a Nigerian success story that has passed the $100m milestone for three years in a row. The Access Bank UK Ltd, a wholly owned subsidiary of the Nigerian Stock Exchange-listed Access Bank Plc, is having

Read MoreCare, Fairness, Trust, and Respect Allow Copernicus to Look Beyond

Deep financial expertise and a holistic approach to business drive Swiss firm’s expansion Independent financial group Copernicus is true to its name: it puts its clients firmly at the centre of the business universe. Founded in Switzerland in December 2016,

Read MoreOtaviano Canuto: The Dollar’s ‘Exorbitant Privilege’ Remains

Otaviano Canuto discusses the ongoing role of the greenback in international monetary systems… There has been talk of “de-dolarisation” of the global economy, with recent initiatives and policy moves by China and other countries to extend the reach of use

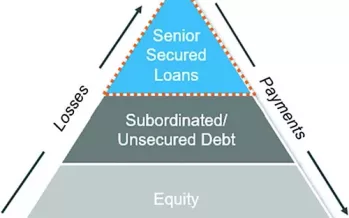

Read MoreMiddle-Market Direct Lending

A Lucrative Alternative Asset Class The US is home to some 200,000 companies dubbed “middle-market” — typically with EBITDA up to $150m. On a stand-alone basis, America’s middle-market represents a $6.3tn economy, third-largest in the world. Non-bank lending to these

Read MorePaolo Sironi, IBM: 7 Bets for 7 Trends That’ll Future-Proof Industries and Society

From generative AI to quantum technology, things are moving on a-pace. When US President John F Kennedy gave his famous “Moon speech” in September 1962, against the backdrop of the Cold War, he described “an hour of change and challenge,

Read MoreA Challenger with its Head and Heart in the Cloud has Dropped Latency to Mere Microseconds

Aquis Exchange, the UK-based creator and facilitator of financial markets, has a track record of innovation and disruption — and this leopard isn’t changing its spots CFI wanted to know more about Aquis, and the developing technologies and strategies in

Read MoreWorld Bank: Tackling Development Crisis Through Financial Innovation

The World Bank uncovers fresh avenues to increase financing capacity. Global development faces multiple crises: Growing debt burdens, inflation, and the rising cost of finance have made the economic path rockier. These challenges, together with the escalating climate emergency, have

Read MoreEY: Haunted by Phantom Income and at the Mercy of Economic Patterns — Inflation Distorts World Tax Systems

Recent IMF data show developed economies are running at an annual inflation rate of three to 10 percent. Some eastern European and Asian countries currently sit between 10 and 25 percent — and 10 nations are struggling with higher rates

Read MoreOtaviano Canuto: Macro-economic Policy Change – We’re Not in Kansas Any More

The possibility of multiple financial shocks lies ahead. Three significant changes to the macro-economic policy regime in advanced economies have unfolded in the past two years. Fears of a chronic insufficiency of aggregate demand as a growth deterrent — which

Read MoreDaily Challenges of a Matchmaker: Linking the Benevolent with the World’s Most Deserving Projects

Club10mPlus is a London-based investment club seeking ethical investors for projects that benefit people and planet — and Relationship Director Christa Atwood is the matchmaker in the middle. “We find projects and then we find investors. Our core business is

Read More