Emerging Market Debt Has Promise that GoldenTree Understands and Harnesses — Even In Trying Times

Macro-economic crosscurrents have led to a broad opportunity set in credit markets, and global credit manager GoldenTree has delivered compelling returns to investors despite the turbulent times.

Lead Portfolio Managers: Matias Silvani and Vladimir Liberzon

GoldenTree Asset Management, to give it its full title, is an employee-owned firm founded in 2000 by Steve Tananbaum. It is one of the largest independent global credit asset managers, with some $46bn in AUM across a broad platform of alternative and fixed-income strategies, with a dedicated offering in emerging market debt.

GoldenTree’s value-based investment approach — consistently implemented over 25 years — emphasises a high margin of safety, attractive relative value, and a catalyst to drive total return. The team comprises 65 professionals with an average of 15 years of investment experience.

GoldenTree’s dedicated emerging markets debt (EMD) strategy opportunistically invests across EM sovereign, quasi-sovereign, and corporate debt in hard and local currencies. GoldenTree has been investing in EMD since its inception, and has made over $25bn in these investments.

The dedicated strategy is managed by lead portfolio managers Matias Silvani and Vladimir Liberzon, who each have more than two decades of expertise in the area. Before joining GoldenTree as head of emerging markets, Silvani was MD and head of New York Sovereign Emerging Markets Debt at JP Morgan Asset Management, responsible for portfolios worth $15bn.

“The strength of GoldenTree’s EMD team, and its differentiated approach, has resulted in a fund that has outperformed the JP Morgan EMBI Global Diversified by an average of nearly 230 basis points per annum, net of fees and expenses, through the end of Q2 2021.”

Before joining GoldenTree, Liberzon spent a decade at Goldman Sachs Asset Management, where he was a portfolio manager for hard currency EMD across the entire GSAM fixed-Income platform. The lead portfolio managers are supported by a team of analysts in New York, London, and Singapore. The EMD specialists work collaboratively with the firm’s 65-person investment team, which has expertise across industries and asset classes, as well as significant legal and restructuring expertise.

The strength of GoldenTree’s EMD team, and its differentiated approach, has resulted in a fund that has outperformed the JP Morgan EMBI Global Diversified by an average of nearly 230 basis points per annum, net of fees and expenses, through the end of Q2 2021. On a calendar year basis, the strategy has outperformed every calendar year since inception by preserving capital during drawdowns and generating outperformance in years of strong market returns. Compared to its peer group, as measured by the Lipper Emerging Market Hard Currency sovereign universe, the strategy has outperformed by over 330 basis points per annum, net of fees and expenses, through the end of Q2 2021.

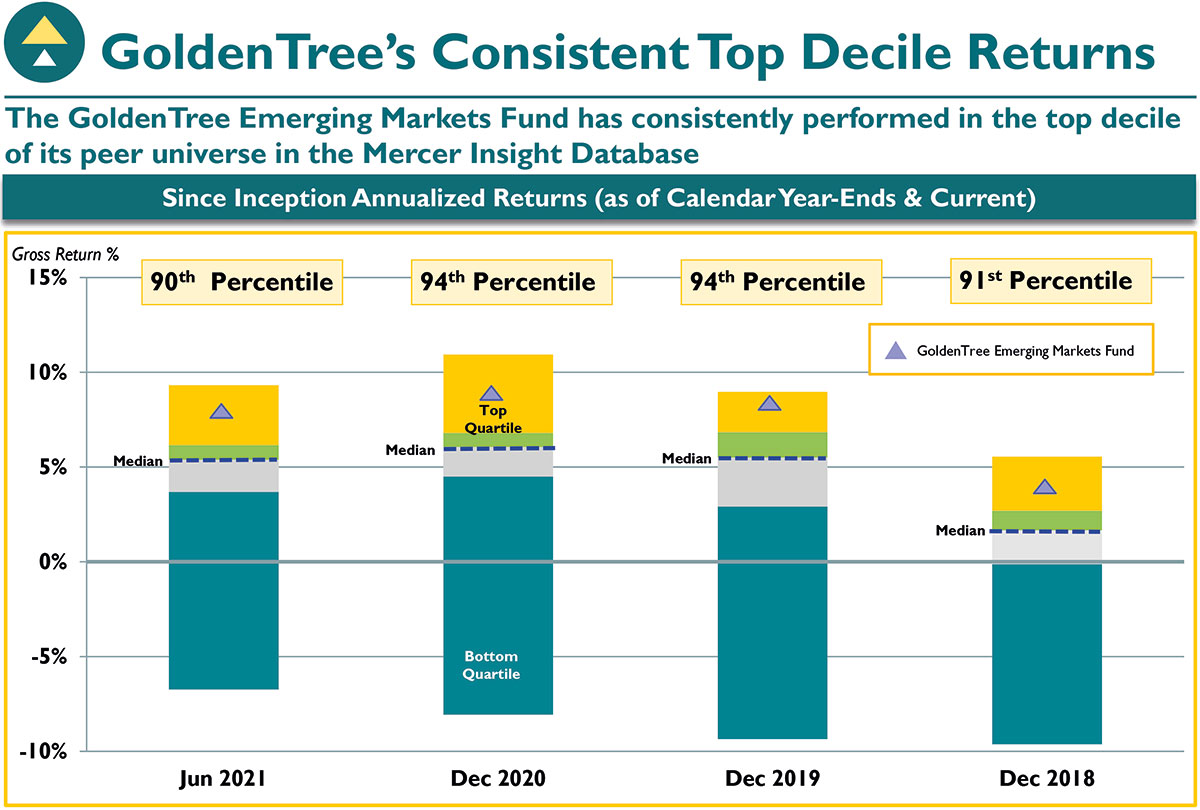

Since inception, GoldenTree’s EMD strategy’s annualised return has consistently been in the top decile of its peer group, as shown in the Mercer Insights Database. GoldenTree has achieved these results through an investment process focused on fundamental country and security selection that considers the entire capital structure of emerging market countries and opportunities in securities excluded from the EMBI GD.

GoldenTree’s strategy has been optimised to capture a broad opportunity set with the ability to invest in securities issued by nearly 90 sovereigns, along with quasi-sovereigns and corporates across EM domiciles. The approach, applied to the asset class, has been successfully executed since 2000.

As of June 30, 2021 and since inception of the GoldenTree Emerging Markets Fund on March 21, 2017. Returns are sourced from the Mercer Insight Database, and are stated gross of fees. Mercer maintains the peer universe and determines the appropriate peer universe for the GoldenTree Emerging Markets strategy. Calendar year-ends are only displayed for years in which the GoldenTree Emerging Markets strategy has a full year track record. March 2017 performance is for a partial month. The Fund was incepted on March 15, 2017. The Fund was not fully ramped until March 21, 2017; as such is the case, the return period begins March 21, 2017. A holding period return methodology was used to calculate the return during the ramping period, whereby the full contribution amount was applied to the March calculation. Please note that the figures above are audited through year-end 2019. Past performance is not indicative of future results.

The investment process is complemented by a proprietary system, the FSI, designed in-house specifically for the Emerging Market asset class. The FSI outputs a score that quantifies the credit quality of each sovereign within the strategy’s investable universe. The emerging markets team aggregates data from sources including the IMF, International Institute of Finance, World Bank, Bank for International Settlements, and national authorities. An important differentiator is the forward-looking nature of the data incorporating GoldenTree’s projections and analysis.

This analysis is based on extensive research involving discussions with fiscal and monetary policymakers and third-party providers of alternative data that can provide meaningful insights. GoldenTree’s proprietary system allows the emerging markets team to efficiently collect data, analyse the data, and calculate a real-time FSI score. The FSI database also allows the team to analyse macro-economic thematic exposures, such as sovereign sensitivities to various commodities. The team also incorporates GoldenTree’s macro-economic views into portfolio construction, and is deliberate with its duration exposure and correlation to variables. This FSI database enables the team to continuously perform relative value analysis on the sovereign universe and creates a foundation for decision-making.

GoldenTree ESG considerations

ESG considerations are incorporated into the team’s analysis. GTAM has partnered with Verisk Maplecroft, a leading data-modelling and risk analysis firm that calculates and maintains indices that measure environment, political, social, and economic risks. The UN’s Sustainable Development Goals (SDGs) provide a framework for assessing emerging market countries from an ESG perspective. Verisk Maplecroft has mapped their proprietary ESG / risk indices to each of the 17 SDGs.

The goals include eliminating poverty and hunger, and promoting education and gender equality. Others are environmentally focused, including climate action, protecting wildlife, reducing waste, and providing basic infrastructure. They require progress across sectors that address economic and environmental sustainability as well as social issues.

Through the team’s decades of experience, GoldenTree believes an actively managed and opportunistic approach is optimal to capitalise on opportunities in EMD. GoldenTree views local currency as an opportunistic exposure in the strategy, seeking to gain exposure to the asset when it is optimal and being deliberate with exposures so local assets do not adversely impact the strategy’s volatility or return profile.

GoldenTree does not have a required minimum exposure to local currency investments. It will exit or avoid investments entirely when the risk-return profile is unfavourable. This provides an advantage over managing blended EMD strategies with more index-constrained guidelines that force the manager to own an investment regardless of the fundamentals.

GoldenTree takes an index-aware approach to ensure a comprehensive relative value analysis. It views the index as an important risk-management tool, providing insights into exposures of the strategy relative to the index. It is important to monitor various portfolio characteristics such as correlation and Beta to the index.

GoldenTree’s EMD team has identified a breadth of opportunities across the asset class. In 2021, as in previous years, sector, security selection and active portfolio management have been critical to generating out performance and delivering positive performance through a year when most EM benchmarks were negative.

The firm’s investment team, its process, and the flexible nature of its strategy, enable GoldenTree to identify investments with the most attractive risk-return profiles across market environments.

You may have an interest in also reading…

National Bank of Ethiopia (NBE): Putting the Central Bank at the True Centre of Economic Revival

The National Bank of Ethiopia has, since its establishment in 1963, done its utmost to remain a valid entity dedicated

Farazad Investments: Boutique Investment Bank Believes in a Tried and Tested Formula with Innovation on the Side

Farazad Group consists of four subsidiaries: Farazad Investments, Farazad Advisory, Farazad Ventures and Farazad Facility Services. Established in 1996, Farazad

African Risk Capacity (ARC): Towards Resilience – Africa Takes Disaster Management Into Its Own Hands

African Risk Capacity (ARC) has been named by CFI.co, for the second year running, as the most innovative environmental, social,