Quantitative Easing: Another Shot for the Caffeine Junkie

Early in March, the European Central Bank (ECB) announced its intention to flood the market with about €1.1 trillion in quantitative easing (QE) monies over the course of 18 months by buying debt instruments – mostly government bonds – on the secondary market.

Early in March, the European Central Bank (ECB) announced its intention to flood the market with about €1.1 trillion in quantitative easing (QE) monies over the course of 18 months by buying debt instruments – mostly government bonds – on the secondary market.

This way of hovering up bonds essentially equips commercial banks with significant volumes of new liquidity. Pessimists fear that the fresh money will be leveraged and used to invest in dubious financial products. This may cause bubbles to reappear in the financial market which, in turn, could trigger a situation similar to the one at the starting point of the 2008 crisis.

Critics emphasise that quantitative easing is a short-term measure only. They often refer to Japan where QE has been used since 2001 on a serial basis to little effect, but with huge implications for the country’s public debt.

Optimists, such as US economist Jeffrey Sachs, celebrate the ECB’s current “macroeconomic realism,” since fresh liquidity will increase the availability of credit to the real economy. This is expected to boost investment and consumption. When accompanied by a long-lasting policy of low interest rates, expanding the money supply will fuel inflation, stimulate demand, and strengthen investor confidence. The export sector also stands to gain on the back of a weakened euro.

There is indeed reason to hope that what has worked out pretty well in the US and the UK, will also do the job in Europe. In conjunction with low oil prices, the ongoing revolution in information technology, and the €315 billion investment package assembled by the European Commission, the new course of action followed by the ECB could conceivably end Europe’s economic lethargy and allow the continent to catch up with its transatlantic counterpart, currently busy gloating over its 3.2% economic growth.

While everybody – including the proverbial dog – is focused on getting GDP to grow by leveraging of the ballooning and largely fictitious balances of likewise improbable bank accounts, very real and tangible problems are waiting for a solution: the soaring wealth gap between rich and poor and the systematic destruction of the environment remain largely unaddressed.

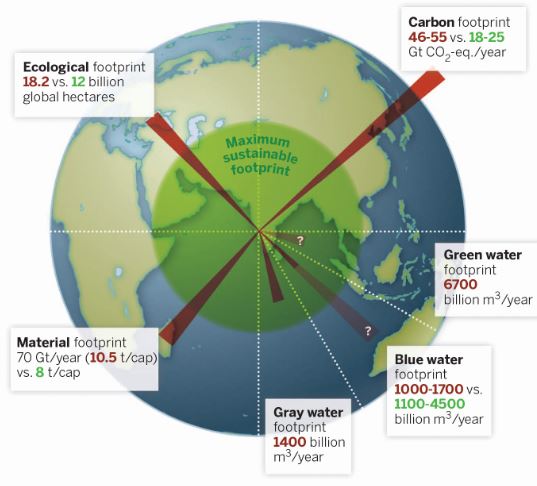

With shocking empirical clarity, scientists like Johan Rockström of the Stockholm Resilience Centre show that since the end of the 1980s mankind has drastically overstepped planetary ecological boundaries. Climate change is just one of the irreversible phenomena mankind has put in motion over a period of just a few centuries.

Moreover, socio-economic studies have conclusively proved that in both emerging and developed nations social disparities are on the increase. A large number of people are simply barred from sharing in economic benefits.

The rationality of economic growth and profit maximisation – the driving doctrine of the capitalist system which we are so eager to boost – is responsible for the global imbalances of social and ecological nature.

In his revolutionary book Capital in the Twenty-First Century, French economist Thomas Piketty expressed the issues at hand from a mathematical perspective. His conclusion is summarised simply as R > G – Rent is larger than Growth. This means that the return on invested capital is higher than the return on labour. Those who depend on labour cannot accumulate wealth at the same pace those possessing capital can.

The current economic model is defined by rules and mechanisms that counteract distributive justice. Also, the economic growth paradigm – the impetus to expand activities in order to prevail in the marketplace and generate an excess cash flow that allows for the payment of credits bearing high compound interest rates – results in an ever-increasing consumption of resources and environmental degradation. This is incompatible with the earth’s finite capacity for sustaining environmental damage.

At present, mankind already consumes more than 1.5 times the resources planet earth can replenish. With emerging economies now rising, the burden on our planet is likely to become heavier yet. Scientists know that mankind must drastically reduce its global footprint in order to be sustainable. This reduction cannot be achieved by technological progress only or by a switch to green energy; mankind will also have to significantly modify its ways of production and consumption.

Therefore, the motto for most resource- and pollution-intensive branches of the economy must emphasise de-growth – at least in the industrialised world. Here, the overheated economies need to relax and corporate behaviour must be more in tune with social and environmental concerns. This cannot be achieved by just boosting our economy while blindly accepting all the harmful tendencies – inherent to capitalism – that create social and ecological imbalances.

The solution is to change the values and the rules of economic life. The following analogy may illustrate the point: Imagine you are a doctor and workaholic comes to see you complaining about physical and mental exhaustion. What would you advise him to do? Have a double espresso with sugar whenever performance levels taper off? Or, relax a bit, have more sleep, enjoy some fresh air, and spend more time with family and friends?

This metaphor, in principle, reflects quite well the present state of global economic affairs and the options available. Quantitative easing is fuel for a machine that works the wrong way. By producing poverty and destroying nature, this machine does not serve us, rather it ruins us.

The entire global economic model – i.e. the economic and financial systems, including their institutions (WTO, IMF, OECD, etc.) and legal framework (international trade and investment law) – is arranged in such a way that it serves a small, but powerful, financial, industrial, and political elite. The model institutionalises capitalism, de-regulation and trade- and investment liberalisation in its raptorial globalised shape.

The model imposes rules, institutions, and dependencies which jointly ensure that the right of the stronger prevails. This legalises exploitation not just in North-South relations but also along the dividing line between the rich and poor within individual states.

These social and ecological imbalances should be in the public’s focus instead of the boosting of an economic system which is responsible for creating them. It is not by chance that in 2015 three international conferences – on the sustainable development goals (SDGs), on their financing, and on climate change – will take place that are of utmost importance to mankind’s future.

Of course, the keywords are “sustainable development.” This requires us to strike a completely new balance between economic, ecological, and social issues. That balance will not be attained, unless a fundamental change takes places in economic values and the rules that ensure compliance by all actors.

In my view, it is indispensable that an international authority is established to oversee global and regional resource consumption as well as any resulting damage to the environment. Such an authority would be guided by the absolute limits imposed by planetary boundaries. At the same time, it is necessary to change the framework of incentives for economic actors.

That means that we should put those companies at an advantage which behave in a socially and ecologically responsible manner. Companies should get legal and fiscal advantages for their ecological and social contributions to a degree that compensates them for their loss of competitive advantage vis-à-vis companies that act in a classically profit-oriented way.

It is also necessary to shrink the financial sector down to its original purpose: the granting of loans at affordable rates for ecologically and socially sound projects and connecting investors to responsible investments. Complex derivatives and high-frequency trading should be banned completely.

As for the North-South gap, I would recommend developing countries adopt a far more protectionist behaviour. A strong self-sufficient union of developing countries that carefully selects incoming investments and trade flows. There are many other supplementing ideas on how to rearrange the global economic and financial systems. Although it is impossible to present these ideas here in detail, the above outline makes quite obvious that I do not believe the current monetary policy of the ECB will address the basic economic problems.

A first realistic starting point on the way to improve the economic architecture of the European Union could be the implementation of an EU-wide property tax as well as a financial transaction tax. Additionally, a more careful approach to ecologically and socially responsible investment could make a difference.

China is already successfully using five-year plans for public investment. These plans are managed by its National Development and Reform Commission. The Juncker Plan, which was launched nearly simultaneously with the ECB’s quantitative easing initiative, is structurally promising but should have a more pronounced eco-social focus. The most important issue in this context would be channelling huge investments into green energy.

There is, however, a form of quantitative easing which is justifiable from time to time, at least from a social perspective: instead of throwing €60 billion monthly at the insatiable financial sector, the ECB should consider releasing the money directly to the states or, even better, to the people.

This idea is not new. It was Milton Friedman who first made the suggestion of throwing money out of a helicopter. He is not the only one with that vision. US economist Mark Blyth, former BCG (Boston Consulting Group) consultant Daniel Stelter, as well as the magazine Foreign Affairs have only recently suggested the ECB should give four-digit euro sums to each European citizen.

The concept is not unattractive. First, it could be used as a social welfare measure by supporting low-income people (distributive justice). Second, it would immediately strengthen spending power and demand (boosting the economy). Third, the inflation rate would jump which would increase consumption even more.

I bet this would be more effective than feeding commercial banks and insurance companies. They will definitely not pass all that fresh money on to the real economy. However, the ECB has made its decision and fixed its course. So, I will end my comment by stressing, once more, the metaphor of the tired workaholic unwilling to follow the doctor’s advice: Go on, have your next shot of caffeine, but don’t expect to be cured.

By Christoph Greil, PhD student of public international law at the University of Vienna.

Response: Climate Change: Good Luck with That

You may have an interest in also reading…

Nordea Asset Management: Uniting Investors to Confront Rising Menace of Methane

By Eric Pedersen, Head of Responsible Investments at Nordea Asset Management If the world has any chance of slowing the

Barrow Hanley: Insights from a Global Value Investing Leader

Cory Martin, CEO of Barrow Hanley Global Investors, reflects on the firm’s growth, its value investing philosophy, and how technology

FMO: Unlocking Scale Potential of Green Bonds in India – Lessons from Global Markets

The global green bonds market has gone from strength to strength in recent years, with issuance for 2017 already exceeding