Supporting African Businesses: A Focus on Sustainability and Close Customer Relationships

The Access Bank UK Ltd is making significant strides with its international expansion – and there are good reasons for that…

The Access Bank UK Ltd provides trade finance, commercial banking, private banking and asset management products and services for customers in OECD markets and supports companies in Africa, MENA, and Asian markets.

The Access Bank UK Paris Branch, located between Place de l’Opéra and the Bourse, was launched in 2023

It is a wholly-owned subsidiary of Access Bank Plc, listed on the Nigerian Stock Exchange, authorised in the UK by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA.

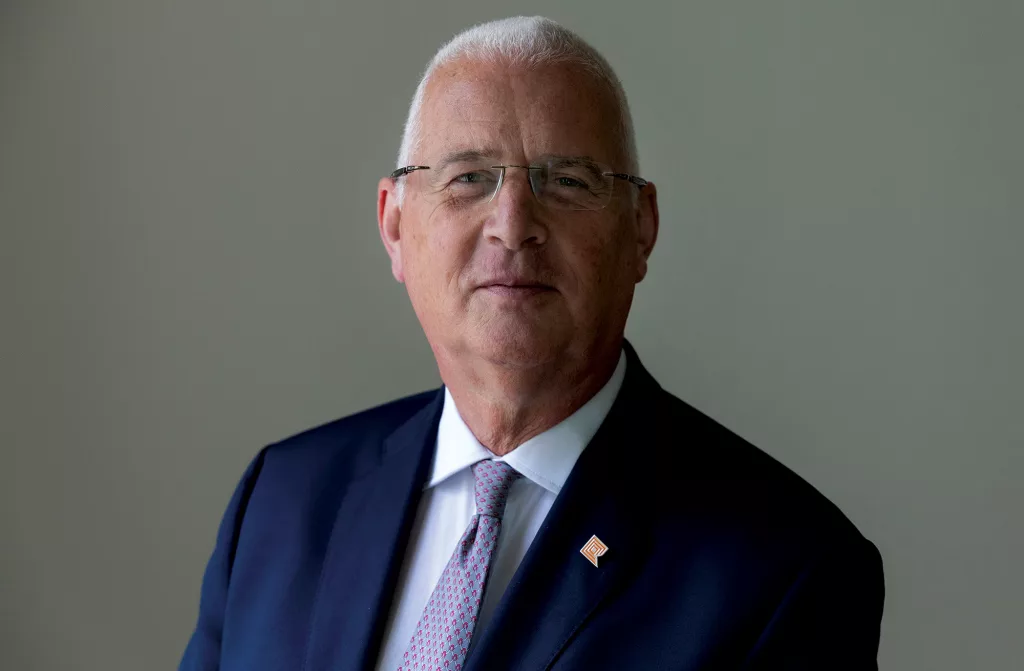

“Like our parent, we are committed to developing a sustainable business model for the environment in which we operate,” says CEO/MD Jamie Simmonds. “This is reflected in our moderate appetite for risk, our passion for customer service and our commitment to build long-term relationships with our customers.”

CEO/MD of The Access Bank UK Ltd: Jamie Simmonds

The Bank has a Dubai branch in the iconic Gate Building of Dubai International Financial Centre (DIFC), regulated by the Dubai Financial Services Authority. Its Paris Branch is regulated by the French Prudential Supervision and Resolution Authority.

The Access Bank UK Ltd plays a key role in the Group’s vision to be “the world’s most respected African bank”. As such, it refuses to chase unsustainable yields as a route to growth. “We focus on building our business through the strength of our customer relationships,” says Simmonds.

The Access Bank UK Ltd provides services to support business activities in Africa — and across the world. It has been awarded Confirming Bank status by the International Finance Corporation as part of its Global Trade Finance Programme. “We were the first Nigerian Bank in the UK to be appointed as correspondent bank to the Central Bank of Nigeria,” notes Simmonds with pride, “to undertake infrastructure work on behalf of the Nigerian government.” The institution also issues letters-of-credit on behalf of the Nigerian government and Nigerian National Petroleum Corporation (NNPC).

“The Access Bank UK Ltd plays a key role in the Group’s vision to be ‘the world’s most respected African bank’. As such, it refuses to chase unsustainable yields as a route to growth.”

The commercial banking team offers relationship-based services for corporate and individual clients, with a range of products, competitive rates, market-leading systems, and top-quality service.

The global private bank has been built around a passion for that last point: excellent service. “We deliver innovative solutions to clients who value trust, integrity, and accountability as well as investment performance,” the CEO/MD says. “We take a proactive approach to product and service delivery, and offer investment solutions tailored to our customers’ needs.”

The Dubai branch focuses its attention on customers with trade and investment interests in Nigeria, Africa, and the greater MENA region. It is committed to building enduring regional relationships in line with the approach that has proven so effective for the UK branch. “The combination of the Dubai branch and our presence in the UK and Nigeria delivers a wealth of expertise to benefit our customers.”

The Access Bank UK DIFC/Dubai Branch situated in the iconic Gate Building of Dubai International Financial Centre

Its dedicated and experienced team is devoted to delivering superior financial solutions to companies and individuals. “Our staff have worked in international marketplaces, and offer a wealth of knowledge and in-depth experience,” says Simmonds. “We provide all employees with ongoing support and development opportunities. We are very proud that the Investors in People organisation once again accredited us with Platinum status in 2023.”

The Bank is committed to developing a sustainable business model in harmony with the environments in which it operates. This is apparent in its moderate appetite for risk, that passion for customer service, and a commitment to close client partnerships.

Last year was notable for the significant progress The Access Bank UK Ltd made in its mandate to expand its international operations. The French branch went fully operational at the end of last year, and is well placed to capture business flows between France and Francophone countries in Africa.

Asia is equally important to the Group, says Simmonds. “Our Hong Kong operation — the first West African bank to have a presence in the territory — was granted regulatory approval in the final quarter, and we are moving to be fully operational by Q3 this year.

“Opening in Hong Kong is a key development in our expansion strategy. With our growth across Africa, the dominance and size of the Nigerian economy, and historic trading links, Hong Kong is the perfect conduit for trade flows in and out of major Asian markets.”

A strong presence in Hong Kong allows the Bank to replicate its proven relationship-based model in Asia, as it has done in Dubai for MENA, and France for Francophone countries in Africa. The Access Bank UK Ltd has also applied for a banking licence in Malta.

The Annual Report and Financial Statements 2023 reveal that the Bank has met some impressive strategic milestones, highlighting adept execution and strategic vision.

Entitled Expanding Our International Footprint, the report highlights a strong operational performance by the main strategic business units, and continued growth in Europe and Asia. The Bank passed the $200m milestone for the first time last year, with 58 percent year-on-year growth taking it to $207.6m.

The Access Bank UK Limited offices in the heart of the City of London

Trade finance continued to be the largest SBU, growing overall income by 69 percent year-on-year, from $62.6m in 2022 to $106.1m last year. Correspondent banks (parent excluded) contributed income of $54.9m, an increase of 68 percent on 2022. Access Group income amounted to $28.2m, a stunning 92 percent year-on-year increase.

The commercial banking department also posted substantial growth, reaching $78.9m from $49.7m in 2022 — a year-on-year increase of 59 percent. “The commitment to supporting customers is crucial for Nigeria’s economic emergence,” notes Simmonds. “Being flexible to market conditions is a key factor.”

The Bank’s direct membership of Sterling clearing, and of Euroclear, further consolidated its status as a safe haven for customer deposits, which reached $1.451bn, an increase of 16 percent last year.

Asset management continued to provide innovative solutions through discretionary strategies and a flexible, execution-only share portfolio. The sector grew its income to $10.4m, a 28 percent increase over 2022. Assets Under Management (AUM) grew by 37 percent to reach $458m.

Jamie Simmonds says the results underline the solidity of the Bank’s five-year plan. “With the progress we have made on growing our international footprint, we will continue to make a comprehensive and sustainable contribution to Access Group.

“Our investment in staff and infrastructure development is creating a more efficient and streamlined operation.”

David Charters, The Access Bank UK Ltd’s Chairman and independent non-executive Director, said 2023 had been notable for the significant progress made. “We opened a regulated branch in France in May, we were authorised to open a Restricted Licence branch in Hong Kong towards the end of the year, and we made further progress in growing our international bandwidth in Europe.”

Once approvals from the relevant financial and regulatory authorities are in place, The Access Bank UK Ltd will be making further announcements about its international ambitions. Its progress shows no sign of slowing.

You may have an interest in also reading…

World Bank MENA Chief Economist: Towards a New Social Contract in the Middle East and North Africa

By Shanta Devarajan A snapshot of the Middle East and North Africa (MENA) Region today reveals a diverse and discouraging

Martha Lane-Fox: Dot Everyone to Reclaim the Net for Civil Society

Seeking succour for the digitally-challenged, Britain’s Martha Lane-Fox – or Baroness Lane-Fox of Soho as she is known around Westminster

Citigroup CEO Jane Fraser

Jane Fraser, the CEO of Citigroup, is no stranger to glass ceiling and glass cliffs. Fraser, the first woman tapped