Corporate

Back to homepageMutually Beneficial New Investment Strategies

Old Mutual Investment Group’s Rob Lewenson explains how he and his team stay ahead of the game when it comes to responsible investing. Old Mutual Investment Group (OMIG), an entity within the 177 year old South African life assurer, Old

Read MoreAmInvest: Conventional and Shariah-Compliant Funds Guided by Deep Expertise

Malaysian fund-management firm AmInvest has four decades of experience in the sector. AmInvest is the funds management arm of AmFunds Management Berhad and AmIslamic Funds Management. Based in Malaysia, AmInvest has 40 years of experience managing unit trust funds, wholesale

Read MoreMutual Benefits: Scottish Friendly Puts Its Money Where Its Heart Is

Looking after members, not shareholders, makes for a healthy workplace. Scottish Friendly is one of the UK’s largest mutual life offices, with a history reaching back 160 years — and it has never been driven by the needs of shareholders.

Read MoreHow Bernard Arnault Turned One Franc Into a Dynasty

French billionaire Bernard Arnault’s off-beat approach to business would be hard to replicate By KITTY WENHAM It started with one franc, one small acquisition. In 1984, Bernard Arnault purchased an almost-bankrupt textile company by the name of Boussac for one

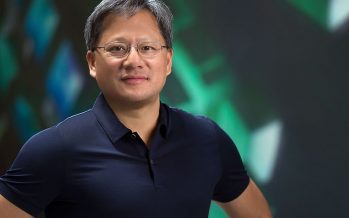

Read MoreJensen Huang: Is the Matrix already here?

Nvidia CEO and founder Jensen Huang sees the world differently — and believes we soon will, too. Report by TONY LENNOX. Fortune-tellers are old hat. If you want to know about the future, listen to Jensen Huang, the flamboyant chief executive

Read MoreGrit, Loyalty and Optimism are the Baron’s True North

David Thomson, quite possibly the richest man in Canada, finds value in art — and ice hockey By TONY LENNOX When the fans of the Winnipeg Jets ice hockey team sing the O Canada anthem before a game, the line

Read MoreARCA Fondi SGR: Another Year, Another Profit Record

ARCA Fondi SGR has won recognition — and financial rewards — with go-ahead strategies, transparency, and a focus on client needs. Italian asset management specialist ARCA Fondi SGR has become a leading light in the sector thanks to collaborative innovation,

Read MoreNicole Hu: Tackling Disaster with Data — and First-hand Experience

California-based One Concern lets tech do the thinking and take the fear out of preparation for disasters and extreme weather events By HEATHER LEAH SMITH Extreme weather events are wreaking global havoc. The US suffered nine billion-dollar weather and climate

Read MoreModest, Frugal, Retiring, and Famous for Being Anonymous: the Founder of Zara, Amancio Ortega

By TONY LENNOX When the famously private Spanish entrepreneur Amancio Ortega finally gave his consent to a biography, he had one simple request: “Don’t just put in the good parts.” Ortega, the 86-year-old founder of the Zara fashion brand and

Read MoreRich Pickings for Carlos Slim, a Financial Prodigy who Started Young — and Kept on Going

Wealth and status mean little to the founder of Grupo Carso who allows himself the occasional indulgence of a fine cigar… By TONY LENNOX Depending on the state of the world’s stock markets and which wealth-list you consult, Carlos Slim

Read More