RegTech to the Rescue

The banking and other parts of the financial services industry are undergoing an all-encompassing digital transformation. Soon, disruptive technologies will revolutionise the sector globally.

Since the global crisis in 2008 there has been no shortage of new regulations. Banks have subsequently added a costly headcount by hiring large teams of professionals to fulfil compliance and manage risk. For instance, 80% of the budget for anti-money-laundering (AML) is for tasks done manually. Part of RegTech’s merit is to substitute human capital with robotics to cut cost.

“RegTech has computer geeks trying to fix a dysfunctional global banking system unfit for purpose.”

RegTech is short for ‘regulatory technology’, a catch-all phrase for the use of new technologies for compliance with regulation. For example, RegTechs are trying to tackle pain points such as onboarding whilst observing simultaneously know-your-client (KYC) requirements.

Corporate Governance in Action

Much of RegTech is about the critical business of improving corporate governance. Some of RegTech’s key deliverables include:

- Risk management,

- Identity management,

- Transaction monitoring, and

- Reporting and transparency.

Blockchain was the buzzword of 2015; insurtech arrived in 2016, and last year, RegTech appeared on the scene.

FinTech is a term from the last century which can now be applied to digital innovation in financial services. FinTech exists in two broad categories: (a) the ‘original’ B2B or institutional – such as technology for the back offices of banks and trading companies, and (b) the evolved ‘current’ retail B2C which includes personal finance apps, alternative investments (such as crypto), crowdfunding, and lending platforms.

Both categories potential clients of RegTechs. However, some FinTechs compete with banks as disruptors, while RegTechs do not compete with banks, but supply solutions which comprise information technology systems that may add disruptive benefits to banks.

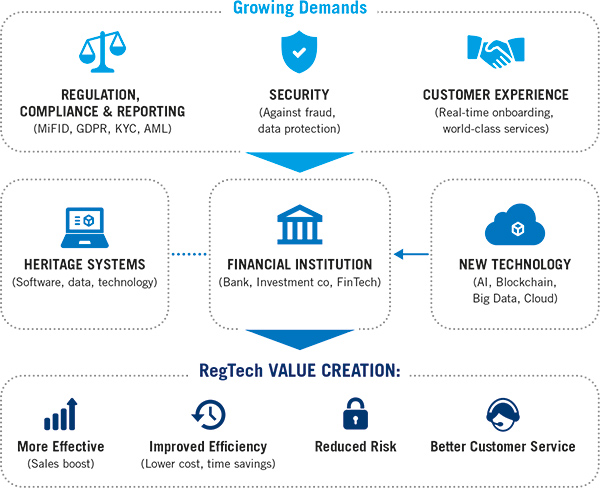

FinTech and RegTech are similar in that both rely on innovation and employ new technologies such as artificial intelligence, blockchain, big data, and cloud computing.

Cost-Effective Compliance

The comprehensive and ongoing regulatory reforms and tighter control mechanisms (see tag chart) drive the need for more RegTech. The need for efficiency and cost cutting push for more digitally automate compliance. And solutions must be able to do all better, cheaper, quicker, and safer than manual labour currently employed – minimising the human intervention in the daily course of cumbersome and time-consuming compliance.

Also, growth in e-commerce, mobile payment systems, and fintech rouse RegTech as a must have add-on. Strengthening security and fighting fraud are also strong motivators. Breach of compliance can lead to severe fines, such as 4% of a bank’s turnover.

Value Creation

The drivers reside not only in risk and cost reduction, but also in improved decision-making processes and in future trends such as predictive and prescriptive analytics and intelligence. Agility and speed in execution, combined with strategic direction, creates value.

The 3C conundrum is a balancing act between (a) investing in fulfilling the compliance requirements, (b) cost-effectiveness and efficiency, and (c) the client’s (often near or real-time) experience.

Legacy Systems

New RegTech solutions must integrate into existing and often very complex and heterogenous internal IT legacy systems. Also, new solutions must serve entities across multiple jurisdictions and multidiscipline purposes such has treasury management, risk management, corporate governance, supervisory reporting, etc.

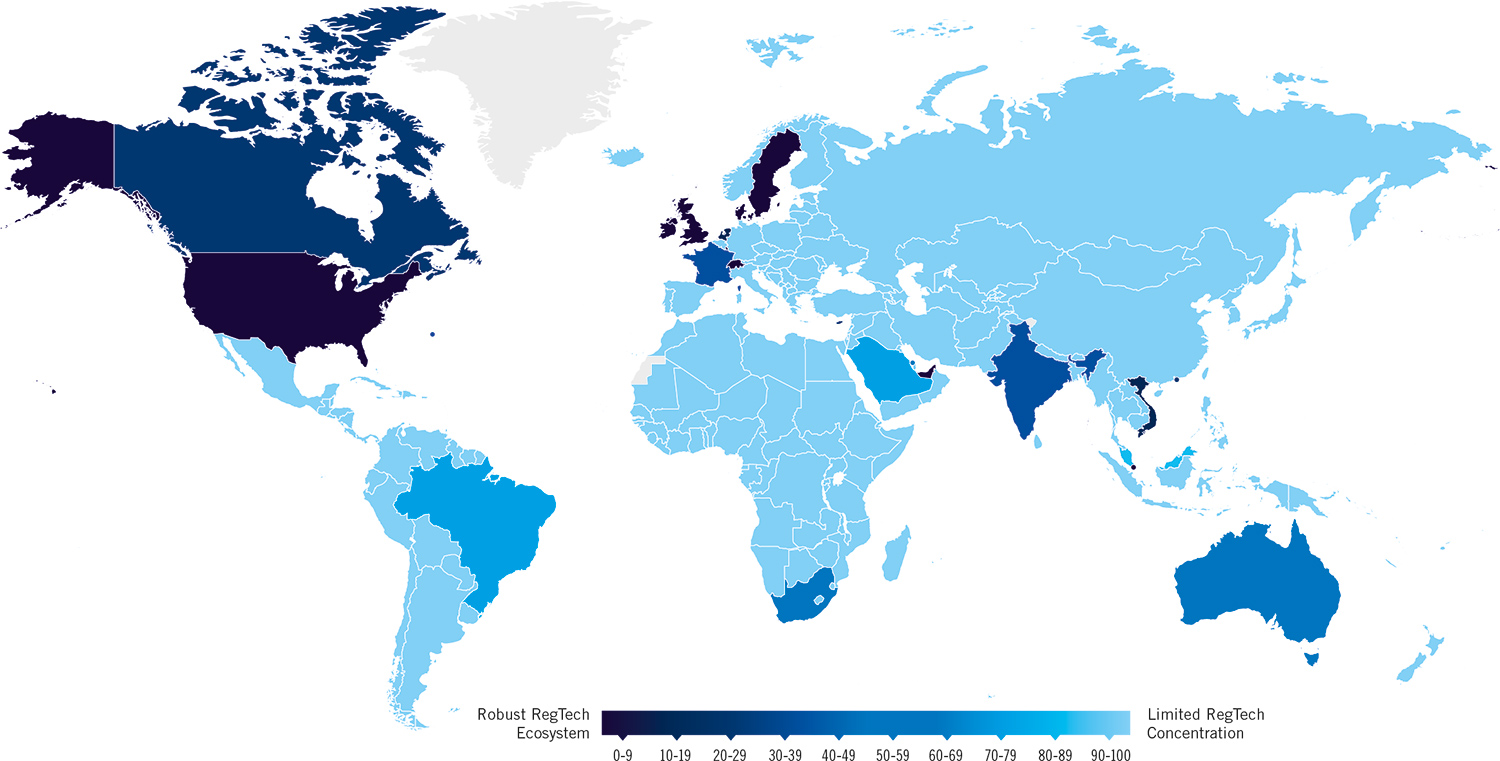

The RegTech industry is still pretty fragmented with without any players dominating. Around the globe there have appeared a number of promising start-ups. The top RegTech firms in both size and numbers are based out of the United States and United Kingdom. Also, many countries in Europe are working at becoming RegTech ecosystem hotspots, including in Ireland, Austria, Switzerland, and the countries of Scandinavia. Several emerging economies are also making strategic moves to boost their RegTech sector, including Brazil, South Africa, Cyprus, India, the United Arab Emirates, and Bahrain.

In Asia, Singapore is a natural RegTech ecosystem hub as the seat of regional headquarters of financial institutions for Asia Pacific. The city state’s government’s long-standing dedication to regulation and prudence is well known and documented.

RegTech depends on the continuous integration of an evolving ecosystem which includes a financial services industry and skilled labour. The RegTech ecosystem also requires an engaged regulator as well as the collaboration of all stakeholders.

Regulators Join In

Many regulators are updating their market monitoring systems and working with RegTechs to strengthen information gathering. For instance, the Austrian Central Bank is in the process of improving the regulatory report processes for banks and, in doing so, reduce both costs and systemic risk exposure.

The Monetary Authority of Singapore (MAS) has introduced a regulatory sandbox for exploring innovation, including to test blockchain technology.

Blockchain is a record (or ledger) of digital events between different parties that collectively guarantee the integrity of the ledger – a true integrity record with no interference possible. Such blockchain (or distributed ledger technology – DLT) has the potential to fortify (near) real-time trade settlement, market surveillance, identity management, and smart contracts for post-trade lifecycle management.

RegTech solutions are often cloud-based, meaning the data is remotely maintained, managed, and backed-up. This increases the flexibility of access control and sharing of the data – as well as the potential for reducing costs.

Big data and data mining compute numbers to intelligence and can be used to improve visibility and transparency, including the mapping of potential systemic risks.

RegTech forms part of the answer to how agile banks and other financials can plot their future by leverage innovation coherently and align it with their corporate strategy, across business lines and across jurisdictions, in the face of the ever-changing regulations.

Read the article from the CFI.co Summer 2018 print issue, or from the CFI.co app (download from iTunes or Google Play).

You may have an interest in also reading…

Collaboration, Fintech and Crypto Dominate Italian Summit, and New VC Fund Announced by Generali

Why Italy is bucking a downward trend, and some take-aways from the 2023 Milan Fintech Summit… Italian insurance giant Generali

Strategy&: Meeting the Big Data Challenge

Recent research on Big Data should sound an alarm bell for companies. On the one hand, there is a link

Science-Based Emissions Targets: A New Foundation for Corporate Climate Action

Corporate emissions-reduction targets have become commonplace. In 2014, 80% of companies that reported their emissions to CDP, an international NGO