Valores Unión S.A. Agencia de Bolsa: Quarter-Century of Dedication and Experience in Bolivia

Valores Unión S.A. Agencia de Bolsa (Brokerage Agency) has dedicated the past 25 years to managing stocks and bonds on the Bolivian stock market and over-the-counter trading market.

The firm provides the community with comprehensive services and a business model that offers customers efficient, tailored solutions. Technological and IT development at Valores Unión evolves according to the needs and nature of its customers. The agency’s human capital allows it to carry this out with professionalism.

The mission of Valores Unión S.A. — part of the financial conglomerate Banco Unión S.A. — is to contribute to the economic and social development of Bolivia by democratising access to financial services via capital markets to all Bolivians.

Its noteworthy values include:

- Ethics: Work with transparency, honesty and integrity according to the interests of the Grupo Financiero Unión (Financial Group).

- Innovation: Create ideas and solutions that improve service offerings and customer satisfaction.

- Responsibility: Fulfill commitments and assume responsibility for actions.

- Commitment: To believe in the mission and put every effort into achieving the objectives set by the Unión Financial Group.

- Solidarity: Understand and support the needs of customers, colleagues and the country.

In 2017, Valores Unión S.A. became the first Bolivian brokerage to carry out the structuring, registration and placement of equity bonds for a Small and Medium-sized Enterprise. It supports Bolivian SMEs with long-term stockmarket financing featuring standardized, simple and swift procedures.

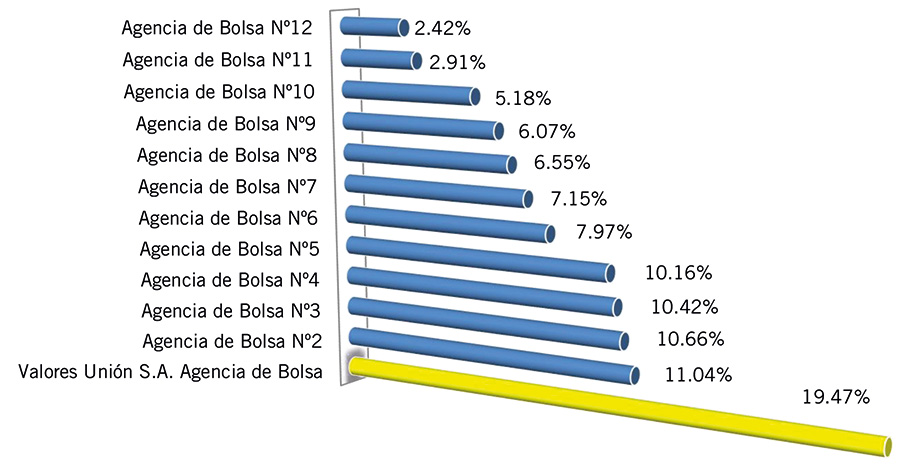

In 2018, the agency managed to surpass its record in volume traded on the Bolivian Stock Exchange (BBV), reaching $6.62bn — an increase of 25 percent on the previous year. This represents 19.47 percent of the overall volume traded in the BBV, both in fixed income and equities instruments. Valores Unión has marked the greatest movement in the stock market and obtained — for the third consecutive year — the award for Best Stock Exchange Agency in a Secondary Market.

The firm has a lot of history and experience invested in the Bolivian Stock Market. It is fortified by a team of professionals dedicated to financial and legal advisory services and committed to customer satisfaction.

The firm also has extensive experience in structuring, recording, and placing financial instruments on the securities market, including bank bonds, corporate bonds, equity bonds, and promissory notes.

Source: Boletín Informativo Bursátil y Financiero

Banking entities represent one area of the agency’s diverse client list. One challenge for management is the search for new customers, both for the development of stock instruments and for financial intermediation. The firm is always looking to innovate in the stock market in support of the national productive sector.

Valores Unión S.A. offers a full suite of services to a wide range of customers. When it comes to financial advice, the team assesses and evaluates companies’ current situations from different perspectives, and defines optimal portfolio structures according to stock market conditions. The team will also recommend financing alternatives by structuring financial obligations through instruments on the Bolivian Securities Market.

The Investment Advisory team also provides advice for decision-making in the purchase and sale of securities in all modalities complying with current Bolivian regulations. An investment portfolio allows clients to maximize the return on liquidity surpluses for institutional investors, banks, investment fund management companies, and pension fund managers.

Anyone who wants to participate in the securities market through discretionary and non-discretionary accounts can create a portfolio that reflects their needs and objectives.

Valores Unión S.A. also provides a National Securities Market Intermediation Service. At client request, the Stock Exchange carries out buy-and-sell operations with fixed income and equity financial instruments for all its modalities on the Bolivian Stock Exchange.

In the area of treasury, each client is different in terms of portfolio needs and objectives. Valores Unión S.A. collaborates to structure each portfolio according to the current securities market. In turn, it performs the management of liquidity surpluses, in order to maximize its performance.

If the situation calls for it, the agency provides the possibility of leverage through the securities market. Other services offered include portfolio valuation, securities custody and the collection of economic rights. Among benefits offered to clients is the publication of weekly reports of stock trades to clients, including relevant information about the securities market. This report is an important complement to making any investment decision — an added value to the brokerage service as a whole.

The institution has marked major achievements in recent years, including:

- Creditor for past three consecutive years, recognized with the Best Stock Exchange Agency in Secondary Market award from the Bolivian Stock Exchange, recognizing the high volume of operations carried out by the agency.

- Recognition for performing the first operation on the SMART BBV electronic platform in 2017

- Recognition in 2018 as Best Stock Exchange Operator, awarded by the Bolivian Stock Exchange.

To stay ahead of challenges, Valores Unión S.A. ensures its technological innovation is in line with market changes. It prides itself on being a benchmark of the Bolivian Securities Market, and aims to support more Bolivian SMEs with stock market access.

Esta entidad es supervisada por ASFI.

You may have an interest in also reading…

AMC Natural Drinks: Research & Innovation to Achieve Sustainability & Circular Economy Commitment

AMC Natural Drinks is a leader in the research, development, production and sale of chilled fruit juices, smoothies and other

Whitecroft Capital: Banks, Buffers, and One Strategy’s Vital Role in Bolstering Battered Economies

Bank risk sharing – what is it? When asked to write a few words about Whitecroft Capital and our investment

Supporting African Businesses: A Focus on Sustainability and Close Customer Relationships

The Access Bank UK Ltd is making significant strides with its international expansion – and there are good reasons for