Whitecroft Capital: Banks, Buffers, and One Strategy’s Vital Role in Bolstering Battered Economies

Bank risk sharing – what is it? When asked to write a few words about Whitecroft Capital and our investment strategy, I suddenly realised what a challenge it may be to explain this succinctly. For more than 15 years, we have been living in this small world consisting of specialist investors and large financial institutions, working on multibillion transactions and allocating capital to the world economy. Sounds exciting, right? For many not so much; perhaps even a boring topic. When asked what I do for a living, a specific caricature always comes to mind where the wife is saying to her husband: “Dear, it is getting late and the guests aren’t going home. Could you please start talking about credit derivatives?” However, I hope you will not “leave” like the guests while I introduce you to our strategy; you are very welcome to stay.

We founded Whitecroft Capital in 2016 with a clear objective – to focus on one narrow, unique, but successful risk sharing strategy. We planned to further popularise it among institutional investors such as pension funds, insurance companies and foundations looking to diversify from mainstream strategies.

Risk sharing can be traced back to the implementation of the Basel capital accord. In 1988, following lengthy deliberations among the world’s central banks, a new regulatory pact was born. It set the globally uniform, minimum regulatory capital requirements for all banks.

What is regulatory capital? Major commercial and universal banks provide commercial loans, working capital lines and trade finance advances as a standard part of their service relationship with the customer. This comprises the core business of the bank, and what customers have come to expect. Each credit exposure that the bank acquires through lending must be supported by regulatory capital. This is to create a buffer to absorb credit losses should a client be unable to pay back the loan.

The underlying idea is simple, but the amount of such regulatory capital is far from trivial. After the taxpayer-funded bailouts of the banking system in the 2008 global financial crisis, supervisors were tasked with making the financial system more resilient. They came up with a new framework, known as Basel III. It required all banks to hold significantly increased amounts of regulatory capital to support the whole range of their exposures. Capital has become a scarce resource which could limit further lending growth. Banks are now motivated to find ways to manage their capital more efficiently. Risk-sharing transactions provide an important solution.

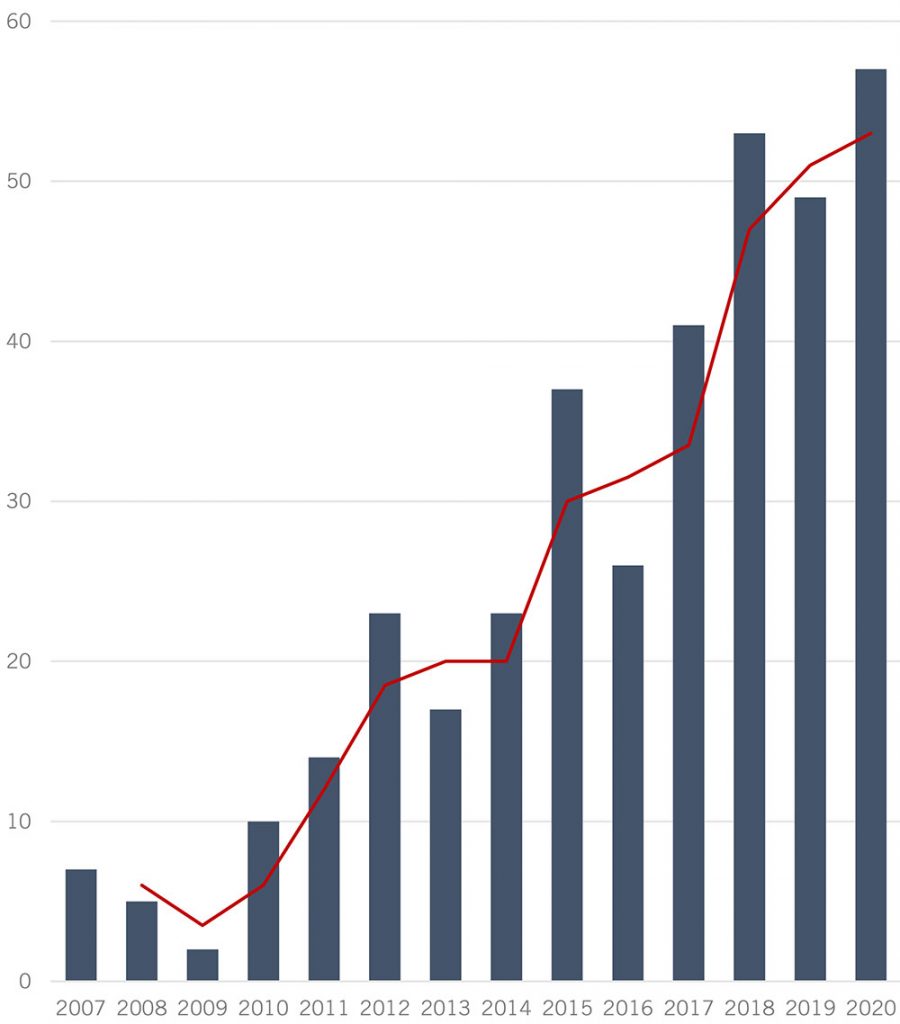

Number of completed transactions in a calendar year. Source: Whitecroft Capital Mamagement

It is a partnership in which banks share the credit risk of their loan portfolios and, consequently, free-up some capital. This is released through risk sharing, then recycled into the lending business providing room for further growth. Monetary and political authorities, particularly those in Europe and the US, have long realised the increasingly crucial role of risk sharing for banks. Banks now have the means to actively manage their balance sheet capital requirements and increase their lending activities, in particular to the SME sector. This endorsement of risk sharing by the authorities is encouraging its use as a strategic tool.

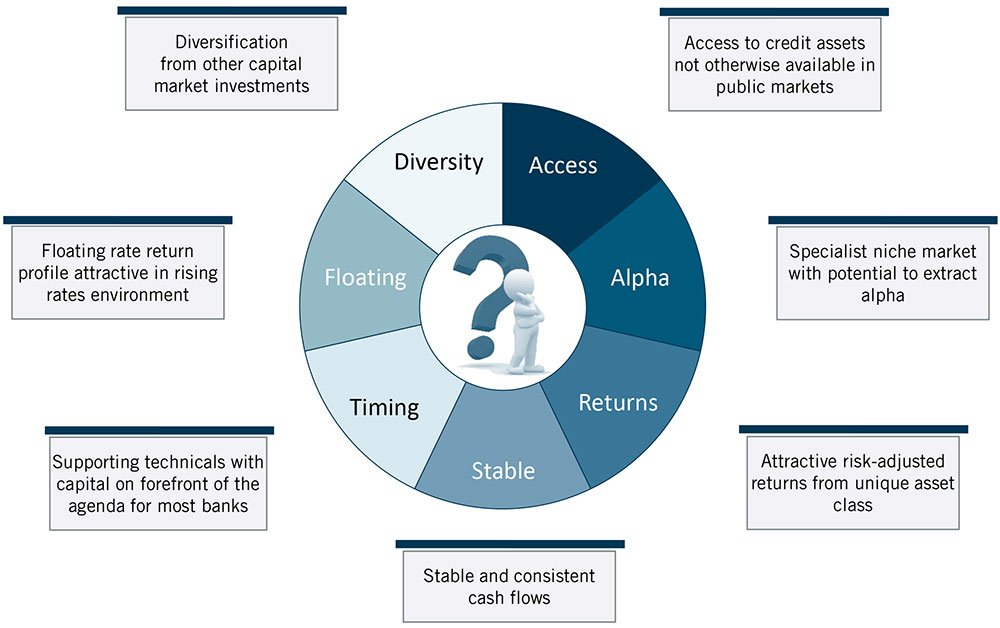

What does risk sharing provide to investors? They can use it as a route to begin directly investing in a specific business of the bank and participate in its growth and performance. The best part being that the investors don’t need to build the same complex and expensive infrastructure as the banks. All loan portfolios used in risk sharing are performing, good quality with an average rating equivalent of BBB/BB, and comprised of hundreds of private loans on the banks’ balance sheets. The banks then offer these credit exposures for regulatory reasons – to improve their capital position – rather than for risk management purposes. These loans are not easy to come by, as they are not available to institutional investors outside of the risk-sharing structures.

In recent years, direct lending strategies have become popular as a way to intermediate banks and lend directly to companies. The goal of the risk sharing strategy is quite the opposite: to provide capital to banks so that they can grow their market share and leverage their existing lending platform. Risk sharing investors do not compete with direct lenders; they largely complement one another by providing finance to the full spectrum of borrowers.

The risk-sharing market has been around for over 20 years. The issuance has been growing steadily since 2008. We estimate the market size to be around $30-35bn of issuance, supporting up to $500bn of lending. Most global banks in Europe and North America are now active in the sector.

Banks are a vital part of the solution to revive world economies, battered by the pandemic and ensuing lockdowns. Capital buffers have been dented by the conservative provisions made at the start of 2020. Capital is key to credit flow, and there is a significant impetus on increased issuance as a means for banks to manage these pressures. And 2020 turned out to be one of the most active on record.

The investor base in the risk sharing sector has been steadily growing, mostly due to increased awareness and steady performance even in times of stress. Whitecroft has been striving to ensure more investors are able to allocate to risk sharing. Our investment team, with product expertise in the sector, has over 70 years of industry experience and more than eight years of investments in the asset class. The team has executed more than 50 transactions in this space over the past decade.

Access to risk-sharing partnerships is still limited because the transactions are structurally complex, large in size, and typically, privately offered to only a handful of buyers. Specialist managers such as Whitecroft Capital can access exclusive opportunities with the global banks. Our relationships with these institutions, which have strengthened over the years, encourage banks to turn to us when they are looking to undertake such transactions.

Our flagship product, WHITECROFT Core Bank Risk Sharing fund, is a combination of 18 core businesses of 10 leading international banks with strong underwriting and credit controls. The overall portfolio is very granular, referencing 13,500+ borrower groups, with maximum average borrower concentration of only 0.15 percent. It is well balanced and diversified, with exposure to obligors in 77 countries and 37 industry sectors.

While some private strategies are being flooded with capital eroding value, risk sharing is not. It remains a hidden gem, offering steady and consistent returns of L+ 8-10 percent. Risk sharing has outperformed leveraged loans and high yield bond indices before and during the pandemic. Especially stark is the extent of outperformance of the strategy against the bank equity index. It all goes to show the relative value of risk sharing for specific portfolios compared to generic investment into bank stocks.

No doubt last year was very difficult for everyone. Fortunately, the vaccination programmes seem to be effective in containing the pandemic. We expect a sharp economic rebound, cementing the solid performance of risk sharing through this crisis. With strong regulatory support, banks will increasingly set up such programmes providing even further diversification to investors looking for stable and uncorrelated strategies. We are confident that risk sharing will continue to have a positive and successful future, and look forward to the busy year ahead.

Portfolio Manager & Partner:

Michael Sandigursky, CFA

Michael has more than 25 years’ experience in the financial services industry. Prior to founding Whitecroft Capital in 2016, he was a portfolio manager running a risk sharing strategy at BlueCrest. Michael positioned BlueCrest as a market leader in risk sharing, building up an investment portfolio of over $800m. The strategy invested across more than 30 risk sharing transactions and has had a successful track record since 2006. Prior to BlueCrest he had a career at Citi working in corporate bank, trade finance and structured credit. He holds an MBA from the London Business School and is a Chartered Financial Analyst.

You may have an interest in also reading…

Pavilion Global Markets: Global Recognition in Niche Market as Company Expands its Horizons

Pavilion Global Markets Ltd was founded in Canada more than 50 years ago as an institutional agency-only broker-dealer. For over

Containers Printers: Expanding Horizons for Packaging Industry and Customers — Despite Covid-19’s Ravages on the World

The Covid-19 pandemic has been the defining event of 2020 for businesses and individuals alike. This was equally true for

KIB – More than a Bank: A Partner for Life with Customer Interests at its Heart

Change is necessary to ensure growth, development and sustainability — in individuals and organisations. For KIB, life has always been