Delen Private Bank: Perfectly Combining a Personal Touch with the Latest in Digital Technology

The Belgian bank specialises in private wealth management and has managed to combine what many other banks are finding impossible: keeping a personal touch while introducing the latest technology.

Delen is not afraid to go against the flow. While other banks are replacing staff with robots capable of answering basic queries, Delen continues to put priority on the personal touch. As other banks close branches, Delen has been opening new regional offices across Belgium in recent years. In addition to Antwerp (where it has its headquarters), Brussels, Ghent, Hasselt, Liège and Roeselare, the bank now has offices in Namur, Kempen area, Knokke, Leuven and – since last June – Waterloo.

“We are committed to keeping and even growing our local roots, to ensure we keep the personal touch with our clients,” says CEO René Havaux. “Being able to meet a client close to their home or office is a prerequisite, preferably without unnecessary traffic woes.”

In Belgium the bank has 380 employees; it also has offices in Luxembourg, Switzerland, the United Kingdom and the Netherlands.

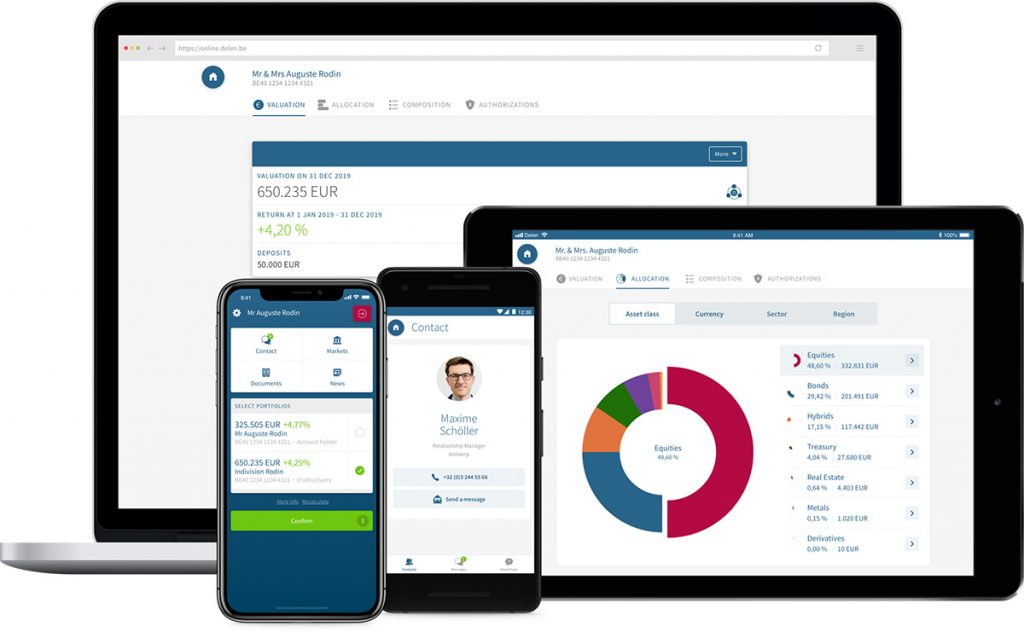

Running parallel with this commitment to the personal touch is a drive to introduce the latest technology. While private banking has long been considered rather slow-moving in its embrace of the digital era, Delen Private Bank once again swims against the flow. It’s been recognised as a trailblazer in harnessing the power of IT to deliver a superior private banking product, with the attendant excellence in client services.

Delen Private Bank is continuously investing in innovative solutions – digital or not, that’s up to its clients – and making substantial efforts to improve them and enhance client satisfaction. Having this in mind, it launched Delen Family Services, a platform that brings all of the client’s assets together to offer an excellent overview of his investment portfolios, real estate, insurances, art etc. All neatly arranged in the bank’s safe IT environment. Moreover, this platform can be smoothly integrated in the existing Delen app for mobile devices and Delen Online. Delen’s efforts to improve the functionalities and user experience of its award-winning app convinced the jury to reward the bank once again with the award.

From Family Business to Acknowledged Niche Player

Established by André Delen in 1936, Delen Private Bank initially operated as an exchange office. The bank has grown steadily since then, acquiring various private banks and asset managers. “Their teams are still part of the Delen Investments group today,” adds René Havaux, “since continuity is key to the bank’s growth strategy.”

In 1975 the founder passed the management of the company to his sons. Delen Private Bank is now part of the holding company Finaxis, which is mainly controlled by Ackermans & van Haaren, and Promofi. The Finaxis portfolio also comprises Bank J. van Breda and Co., which caters mainly to entrepreneurs and professionals.

In 2011 Delen acquired a 74% (today 91%) majority stake in UK brokerage JM Finn and Co. In July 2015, it reached an agreement to acquire Oyens & Van Eeghen, a transaction which marked the company’s debut on the Dutch market. On 16 September 2019, the bank took over the assets of Nobel Vermogensbeheer, consolidating its position in the region.

Delen Private Bank is a credit institution under the supervision of the NBB (National Bank of Belgium) and the FSMA (the Belgian Financial Services and Markets Authority).

Delen Private Bank has no corporate finance, a limited credit activity, a sound financial base and a highly stable and healthy balance sheet. On June 30, 2019, the equity capital amounted to €741,6 million thanks to a Tier 1 capital ratio of 31,5%, and a cost/income ratio of 58,6%.

Focused, No-nonsense and Personal Approach

Delen Private Bank prides itself on its focused and no-nonsense approach, which covers discretionary asset management and Estate Planning, and enables client assets to grow in a balanced and sustainable manner.

Clients can leave the financial management of their portfolio (Discretionary Asset Management) to a team of financial experts who closely follow the markets. They act proactively, always from a long-term perspective. For the financial planning of clients’ property (Estate Planning) the bank’s lawyers and tax consultants provide detailed and personal advice. They are experts in all matters concerning succession, donations and business transfer, and follow the current fiscal and legal affairs.

A Passion for Art

Art and interior design are among Delen’s passions. This is reflected in the selection and design of the bank’s various offices, as well as in its involvement with artistic events. The bank partners with BRAFA, the Brussels Art Fair (created in 1956). BRAFA has become one of the world’s most prestigious art fairs, famous for fine art, antiques, modern and contemporary art and design. In 2020 BRAFA and Delen Private Bank will celebrate their 14th year of co-operation.

You may have an interest in also reading…

Rubicon Leadership Driven by Passion to Put an End to Waste

Rubicon is a software platform with a mission: to end waste. It provides smart recycling solutions for businesses and governments

Alexander Forbes Group: Three Strategies for Growth

Alexander Forbes Group Holdings Limited, a specialised financial services group headquartered in South Africa, successfully listed on the main board

Co-op Legal Services: Opportunity and Optimism Abound in the Exciting Legal Services Sector

Co-op Legal Services, which is part of the Co-op Group, offers legal advice and services for estate planning, probate, family,