Finance

Back to homepageThe Importance of Promoting Financial Stability and Growth through International Regulatory Coherence

By Nandini Sukumar, Chief Executive Officer, The World Federation of Exchanges One of the World Federation of Exchanges’ (WFE) strategic priorities for 2019 is the issue of regulatory coherence. The primary reason for this is that the WFE and its

Read MoreWorld Federation of Exchanges (WFE): Encouraging Investment in Emerging Markets Hinges on Co-operative Effort

Emerging market exchanges and policy makers are keen to encourage international investors, who play an important role in the development of emerging economies’ public markets. International investors can provide additional capital, enhance liquidity, promote greater competitiveness and adherence to standards

Read MorePartners Who Put Their Faith in Egypt’s Burgeoning Economy

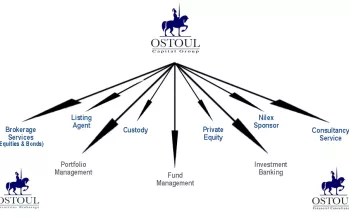

Aly El Ghannam and Marwan El Khedry – “The Partnership”, as they choose to be called – established Ostoul Capital Group in Egypt in 2015. With more than a quarter of a century of experience between them in the capital

Read MoreFrom Little Things, Big Things Grow: Ostoul’s Acorn Becoming an Oak

At a time when the risk of setting up a fully fledged investment institution that offers an incomparable range of services was exceptionally high, Ostoul Capital Group still took on the challenge and over a mere span of three years,

Read MoreOtaviano Canuto, Center for Macroeconomics and Development: China’s Rebalancing Act is Slowly Addressing Sliding Growth Figures

China’s economic growth has been sliding since 2011, while its economic structure has gradually rebalanced toward lower dependence on investments and current-account surpluses. Steadiness in that trajectory has been accompanied by rising levels of domestic private debt, as well as

Read MoreMIGA Exclusive Interview: Business Priority to Work With All People

Interview from February 2019, with Keiko Honda, Executive Vice-President and CEO of the World Bank Group’s Multilateral Investment Guarantee Agency (MIGA). CFI.co: You have been at the head of MIGA for almost six years. Is there a key lesson that

Read MoreOtaviano Canuto, Center for Macroeconomics and Development: How to Heal the Brazilian Economy

If I were to encapsulate the current situation of the Brazilian economy in one sentence, I would say: “It is suffering from a combination of ‘productivity anemia’ and ‘public sector obesity’”. On the one hand, the country’s mediocre productivity performance

Read MoreStacey Ferreira: The Billion Dollar Pitch

Few people make their first million before they turn twenty, and fewer still can say they have penned an international best-seller to boot. Stacey Ferreira, however, has done both. And, as if that wasn’t enough, she is also the CEO

Read MoreFinancial Centres Promote Economic Development: AIFC Goes for Growth by Backing SMEs Globally

International Financial Centres (IFCs) are a necessary component of national and global economic growth. And increasingly, it is co-operation between IFCs, rather than competition, that drives the development agenda of the world’s established and emerging financial centres. As the Astana

Read MoreLawrence Summers: Setting the Record Straight on Secular Stagnation

Joseph Stiglitz recently dismissed the relevance of secular stagnation to the American economy, and in the process attacked (without naming me) my work in the administrations of Presidents Bill Clinton and Barack Obama. I am not a disinterested observer, but

Read More