Financial Centres Promote Economic Development: AIFC Goes for Growth by Backing SMEs Globally

International Financial Centres (IFCs) are a necessary component of national and global economic growth. And increasingly, it is co-operation between IFCs, rather than competition, that drives the development agenda of the world’s established and emerging financial centres.

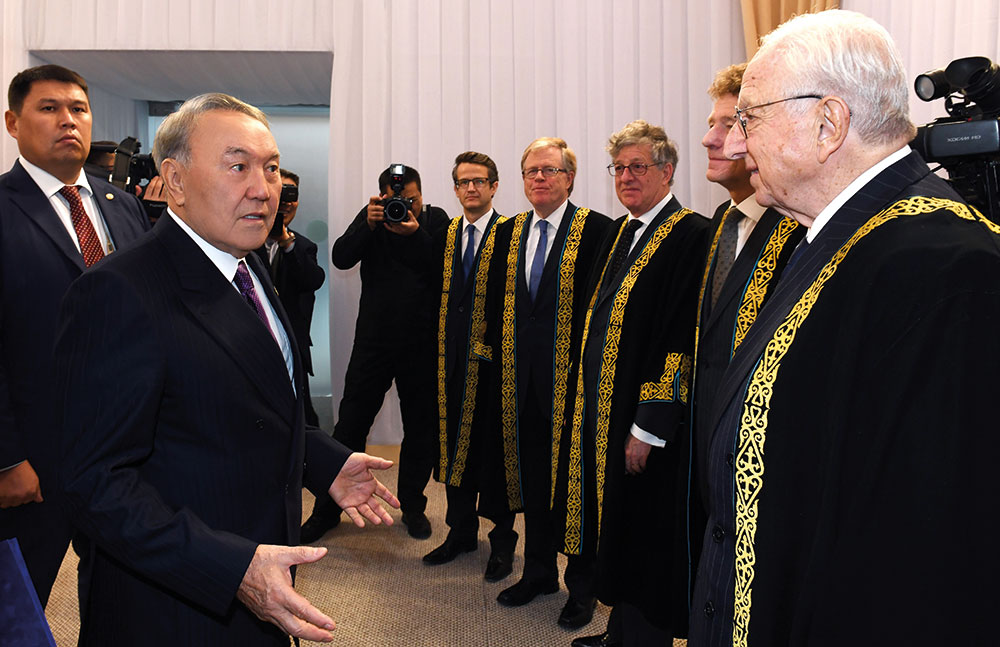

Kazakhstan’s President Nazerbayev greets Lord Woolfe, Chief Justice at AIFC Court

As the Astana International Financial Centre secures its place alongside the top level of global IFCs – and as a vital hub for finance in Central Asia – it has chosen support for SMEs as one of its major contributions to global IFC co-operation. SME support is also a core programme for the World Association of International Financial Centres, with the SME initiative to be led by Astana IFC.

Globalisation and the increasingly transnational nature of financial events have accelerated, and brought more attention to, the role of International Financial Centres.

IFCs provide clusters of excellence and expertise in financial and related professional services, which can benefit the development of a national economy and – as part of an integrated network – deliver a stronger, safer and more prosperous world.

The major global IFCs of London, New York, Hong Kong and Singapore reinforce the structural moves towards global IFCs acting as a template for the development of others. A series of IFCs have developed into regional hubs. Astana, Tokyo, Shanghai and Toronto are being joined by the likes of Moscow, Istanbul and Dubai as they develop. Specialist hubs and local centres which have a strong, but more limited, international footprint are – for example – Geneva/Zurich, Sao Paulo, Johannesburg, and Mumbai.

HE Dr Kairat Kelimbetov, Governor of Astana International Financial Centre

Whilst not all IFCs aspire to be global, a well-targeted local or regional offer can bring success for emerging centres as they seek to develop niches or provide a set of products. Dublin and Luxembourg are successfully pursuing a focused strategy. Rather than seeing the growth of other IFCs as a threat to older, more established IFCs, they see the development as an opportunity for partnerships to stimulate growth. Newer IFCs have challenged larger ones to be more innovative, and to respond to competitive dynamics. TheCityUK – a membership organisation that supports the UK-based financial and related professional services industry and promotes London’s leading position as an international financial centre is seen as playing a major role in this regard.

This puts regional IFCs at the heart of a trend with mutual benefits of co-operation in a changing pattern of world trade, and the focus will remain on those regional developments. The concentration, or cluster effect, of financial and related professional services will facilitate innovation, diversification and flexibility.

Financial centres, therefore, are key to sustaining economic growth, and the importance of SME support must be recognised as crucial. The IFC concept can provide the infrastructure for investment and savings that drives entrepreneurial endeavours and economic growth. They embrace innovation in finance and actively contribute to its development. And innovation, especially in the area of financial technology, or fintech, is increasingly a cross-border activity, with its developers setting-up wherever their work can flourish.

Leading IFCs, Astana among them, have identified this phenomenon and, through international co-operation and the adoption of best international practice, look to build an environment that will encourage and support the innovators and disruptors of the next generation.

So what are the needs and constraints acting as a barrier for SMEs to expand and export, given that they provide more than 60% of employment worldwide, and 80% of jobs in the developed world – while contributing 50% of gross value added?

The majority of SMEs are still primarily reliant on bank financing, but innovations in technology and market-based financing solutions offer viable and sought-after alternatives. This reinforces the focus on the contribution of IFCs to introduce a product range with innovation, backed by experience and the necessary delivery systems.

Step forward the World Alliance of International Financial Centres (WAIFC) , with its 11 financial centres. The formation launched a strategic alliance in July 2018 which intends serve the greatest needs by sharing best practice and cross-fertilization between IFCs in a developing dialogue. Importantly, it is project-driven.

Focus will initially be on concrete projects in

- Data on financial centres

- Contribution of financial centres to Green investment and infrastructure

- New fintech developments

- The role of financial centres in the economy

The founding members of this new international non-profit association are:

- Abu Dhabi Global Market

- Astana International Financial Centre Authority

- Belgian Finance Club

- Busan International Financial City Promotion Centre, BEPA

- Casablanca Finance City Authority

- Frankfurt Main Finance

- Luxembourg for Finance

- Moscow: Analytical Centre Forum

- Oman: The Capital Market Authority

- Paris EUROPLACE

- Toronto Finance International

London currently holds Observer Status at WAIFC.

So, where does the Astana International Finance Centre (AIFC) see its position as an emerging IFC?

AIFC is a new brand of financial centre that, together with its members, will develop a financial ecosystem to enable the creation of a capital market, and an SME financial platform. The centre will play a pivotal role for SMEs by focusing attention on the role that the financial industry provides in assisting to build capacity and support for SMEs.

The perception of the financial industry will change accordingly, as people begin to recognise the importance for financial institutions and centres in which they operate. How financial centres can be enhanced with more SME support projects, including to trade finance, will be at the core of AIFC’s contribution to the emerging association by ensuring access to essential data and delivery as part of the financial ecosystem.

The development of new financial technologies is one of the priorities of the AIFC. The main task is to create the most favourable conditions for the creation and development of fintech projects, with modern infrastructure, flexible regulation and the ability to attract strategic investors.

Astana has now positioned itself as the business and financial hub for Central Asia. The innovative concept has the objectives of attracting investments by creating an attractive environment, and developing the securities market – thus ensuring its integration with international capital markets. As the major financial centre in Central Asia, the AIFC is also positioned to lead for the region on the critical initiatives developing under the China Belt and Road Initiative, the new Silk Roads.

The Astana IFC was conceived in December 2015 by decree from Kazakh President Nursultan Nazarbayev as part of a major package of structural reform, with the purpose of creating a leading centre of financial services at an international level. The Astana Financial Centre has achieved much with the assistance of UK-based firms and their expertise, and through TheCityUK’s network of international relationships. Key goals include a target of getting 500 companies resident at the centre by the end of 2020.

Many of the key points for the successful development of an IFC, recently highlighted by TheCityUK, are relevant as a basis for what AIFC is achieving:

- an independent regulatory environment that is fair and transparent

- a business climate that facilitates new products and ideas

- a fiscal policy that is clear and competitive

- the ability to access markets internationally for both trade and investment

- openness to foreign investors

- a highly regarded and impartial legal system based on common law

- focus on soft infrastructure, including market infrastructure, the exchanges, data management, telecommunications, and security, and hard infrastructure relating to connectivity, transport and accommodation

- a skilled and diversified labour force.

English common law is viewed as being more flexible in responding to the development of financial services, and is the prime reason why more than half of the world’s commercial contracts are governed by English law in judicial and non-judicial dispute resolution. Astana recognises this, and has developed, with the support of TheCityUK and its membership from the Uk-based financial and related professional services industry, the AIFC Court and International Arbitration Centre, independent of the AIFC in its activities. It operates in accordance with the best international standards for resolving civil and commercial disputes under the Common law court system.

The AIFC court has exclusive jurisdiction in relation to the consideration and resolution of disputes arising between AIFC participants, AIFC bodies and / or their foreign employees. Disputes submitted by mutual consent to the AIFC Court are also considered in the jurisdiction of the AIFC Court.

The International Arbitration Centre (IAC) provides an independent, cost-effective and operational alternative to litigation, and acts in accordance with the best international standards for resolving civil and commercial disputes in the AIFC. This offers the parties the most flexible choice of rules and procedures to resolve disputes.

In addition, the Astana International Exchange (AIX) contains four key factors by providing:

- financial services, including issuing bonds and shares, hedging instruments including currency risk, and an offshore centre for the yuan (RMB).

- the main platform for the privatisation of national companies in the framework of the implementation of the Comprehensive Privatisation Plan for 2016-2020.

- trading in securities, commodity and derivative instruments denominated in tenge, rubles, US dollars and yuan; and

- subsoil users, with a new platform for attracting investments.

I have been privileged to have seen the extraordinary regional transformation and growth since the early days of the creation of the newly independent states, and I have attempted to assist in a minor way.

I am delighted for the region, knowing that it will make a significant contribution to strengthening co-operation – including global co-operation – through common endeavours working to internationally agreed standards. This has been confirmed to me by friends around the region who see an ever-closer-knit, and highly professional, community.

The governor of the Astana Financial Centre, His Excellency Dr. Kairat Kelimbetov, reaffirmed this to me. He wishes it to be known that the AIFC will become a centre of excellence, providing high quality services to facilitate regional economic growth and diversification. He intends to increase transparency and business standards, fully aligned to international standards and operating under English common law, creating a single pool of liquidity for local and international investors.

It is my hope that those attending Davos will take note.

About the Author

Lord (JD) Waverley

Member

House of Lords, London

Advisor to the Chairman

CCC group of companies

Founder

SupplyFinder.com

You may have an interest in also reading…

Emerging Managers Summit

The Radisson Blu Aqua Hotel Chicago, Chicago, IL May 30-June 1, 2012 If you are looking to expand and diversify

Paul Krugman: A Plea for a Return to Basics in Finance

Author of no less than twenty books, over 200 scholarly essays in peer-reviewed academic journals and more than 750 articles

Evangelos Marinakis: A Councilman of Note

Though the past made him a rich man, Evangelos Marinakis now wants to break with it. Elected councilman in Piraeus,