From Little Things, Big Things Grow: Ostoul’s Acorn Becoming an Oak

At a time when the risk of setting up a fully fledged investment institution that offers an incomparable range of services was exceptionally high, Ostoul Capital Group still took on the challenge and over a mere span of three years, managed to cement its position in an extremely competitive market.

The stability of the Egyptian Stock Market over the past decade encouraged the establishment of Ostoul Capital Group in 2015 with the sole intention of becoming one of the largest financial institutions in Egypt.

Ostoul’s highly qualified and experienced team was determined to engrave the company’s name among the top-20 providers of similar services and within a short three years, Ostoul was indeed able to achieve its target through solid investment strategies, sound technical approaches, secure fundamental tactics, and a firm operational and managerial system.

The success story started off with the set up of the brokerage arm of Ostoul in 2015 – with only 21 clients in place. To secure recognised status in the brokerage world, Ostoul succeeded in obtaining a number of crucial operational licenses including online trading, same-day trading, margin trading, GDRs trading and foreign securities trading.

Ostoul Capital Group also became a listing agent in September 2016, and was the first company to obtain a Delivery vs Payment (DVP) line starting from $1.14m (EGP20m) in less than one year of operations. That line has now been extended to reach $5.7m (EGP100m) if needed.

Ostoul Capital Group also became a listing agent in September 2016, and was the first company to obtain a Delivery vs Payment (DVP) line starting from $1.14m (EGP20m) in less than one year of operations. That line has now been extended to reach $5.7m (EGP100m) if needed.

With a solid plan in place, Ostoul succeeded in heading the brokerage firms in terms of growth for 2016, jumping 79 slots, from 111th position in 2015 to the 32nd in 2016. Then, in 2018, it leapt to an overall ranking of the 19th – with a whole-year total turnover of $321m (EGP5.64bn). The client base also grew to include a total of 940, with the assets under management standing at $28.9m (EGP507m) as of December 2018. Ostoul Brokerage has a presence in two Cairo districts, and is broadening its coverage with the launch of further branches throughout the country.

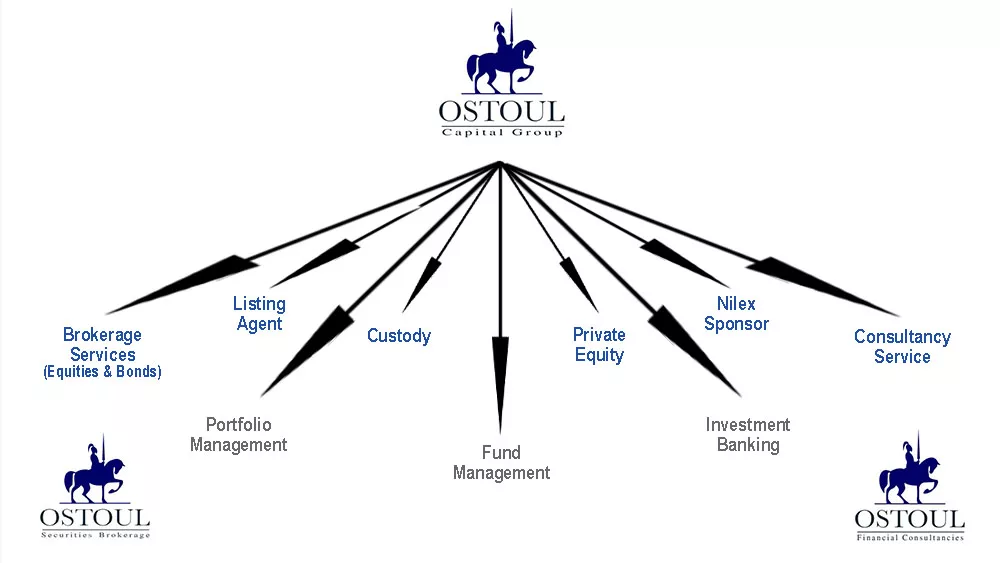

With a list of prominent shareholders in place, Ostoul Capital Group was established with the intent of incorporating all the licenses that would guarantee its clients a comprehensive bouquet of investment-related services.

By April 2016, Ostoul was licensed to provide the services of private equity, asset management and fund management. With an acute business vision, aggressive strategies, and a competent banking-experienced board, Ostoul’s portfolio management assets under management grew from a mere $261,877 (EGP4.6m) in 2016 to an outstanding $7.2m (EGP127m) in February 2019.

Ostoul is in the process of launching its first equity fund this year. In November 2017, it acquired the license to act as custodian, a service which earned it a client base of 306, with an assets value of $588m (EGP 10.34 bn) and with $398m (EGP7bn) in the pipeline due to Ostoul’s additional service of registering companies with the Central Depository System. In the same month, Ostoul also became an official Nile Stock Exchange sponsor.

Besides these services, Ostoul provides advice and solutions in mergers and acquisitions, loan and equity fundraising, sourcing new investment opportunities and divestitures or partial shares sales. In this specialised area, it provides client support throughout the deal cycle from initiation to completion, including due diligence, valuation, deal structuring, fundraising, documentation and negotiation.

Ostoul is aware of the country’s growing projects and future development plans, and went on to establish Ostoul Financial Consultancies in 2016 to assist investors in making informed business decisions through a variety of services including the performance of economic and financial research and studies, valuations, feasibility studies and the provision of solid business plans.

With all the right tools and expertise in place, Ostoul Capital Group’s vision is to continue to grow – and engrave its name, once again, at the top of the tree – this time among the top 10 service providers – within the shortest time possible.

You may have an interest in also reading…

Arab Countries In Transition: Where are they Heading?

By Masood Ahmed Director of the IMF’s Middle East and Central Asia Department “You can tell whether a man is

UNCDF: Revolutionising International Municipal Finance is Focus of Bid to Tackle Climate Change and Open Global Markets

“They have been drivers of progress throughout history, and now – as the knowledge economy takes full flight – they

The Renewable Electricity Grid: The Future Is Now

New World Bank report finds that with the right policies and investments, countries can integrate high levels of variable renewable