Finance

Back to homepageResponsible Investment: What it Says on the Tin, with Added Punch and Attention to Detail

The rise of responsible investment (RI) as a crucial part of the financial industry has been one of the defining themes of the past two decades. Matt Christensen has been at the heart of it for most of those 20

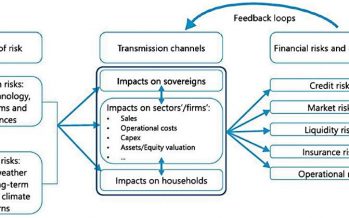

Read MoreOtaviano Canuto on Central Banks and Climate Change: Turning Black Swans Into Green

There are three possible motivations for the engagement by central banks with climate change: financial risks, macro-economic impacts, and mitigation/adaptation policies. Regardless of the extent to which individual central banks incorporate the three prongs of motivations, they can no longer

Read MoreISID, McGill University: Updating the DFIs’ Operating Models to Achieve the UN 2030 SDG Agenda

The UN General Assembly set the Sustainable Development Goals (SDGs) five years ago. The estimated annual amount of investment needed to achieve them is short — by $2.5tn to $3tn. The stakeholders that play a key role in directing and

Read MoreSpain NAB: Setting Agenda for Spanish Impact Investment Market

At an estimated €90m[1], Spanish impact investment is considered an incipient market by European standards[2], well behind Germany, France, Italy and even Portugal. This market counts 14 impact funds[3], and has been developing slowly over the past 10 years out

Read MorePwC Nigeria: Nigeria’s Finance Act Gets a Facelift to Attract Business and Investment

Earlier this year, Nigerian president Muhammadu Buhari signed the Finance Bill 2019 into law as the Finance Act of 2019 — the first amendment to the country’s tax laws since 1999. The Act, which comprises 57 sections, seeks to amend

Read MoreWorld Bank Readies $160 Billion Emergency Aid Package

World Bank President David Malpass has joined IMF Managing Director Kristalina Georgieva in urging bilateral creditors to extend debt relief to poor countries struggling to cope with the corona virus. “Many countries will need debt relief. This is the only

Read MoreDeflation, Inflation, and the Disappearance of Deficit Phobia

Inflation is, essentially, the expression of excess demand or, on its flip side, a sign of depressed supply. The trillions of freshly ‘minted’ dollars and euros that seek to maintain an equilibrium of sorts between supply and demand whilst the

Read More2020 UNCTAD World Investment Forum: More Important Than Ever in an Age of Worrying Trends

In December this year, Abu Dhabi will welcome government leaders, CEOs and investment stakeholders for the seventh biennial UNCTAD World Investment Forum (WIF). The forum’s mission is to promote investment for sustainable development. And there are worrying trends, as well

Read MoreHarvard Business School on Impact-Weighted Accounts: the Missing Piece in Economy Puzzle

Capitalism is in need of a renaissance. Despite headlines of strong global economic growth, there are signs that all is not well. Environmental advocates have been leading calls for change before the climate crisis produces irreversible changes to our world.

Read MoreBusiness in Times of Corona: The Dangerous Fruit of the Magic Money Tree

In one of life’s little ironies, it was not the senator from Vermont but the billionaire businessman from New York who brought social democracy to the United States. The massive federal aid package now working its way through Congress is

Read More