Banking

Back to homepageWalter Mejia, CEO of Banco Ficensa: Providing Solutions with Humility, Gratitude — and a Personal Touch

CFI.co puts the important questions to Walter Mejia, CEO of Banco Ficensa, Honduras… Banco Ficensa, based in Tegucigalpa, started operations in 1974. It provides commercial banking services to individual consumers, small and middle market businesses and large corporations. It has

Read MoreManaging Popular Banking and Practising Financial Inclusion? Challenges Accepted!

Mexico’s Banco Azteca has risen to the top thanks to its inclusive policies — and astute direction from its chairman. Alejandro Valenzuela’s understanding of the banking industry has substantially evolved over his nine years at the helm of Mexico’s Banco

Read MoreRaiffeisen Certificates: Investing in Capital Markets — with Protection

No one wants unnecessary risk — least of all Austrians, who traditionally display caution when investing in capital markets… Raiffeisen Certificates is the Austrian certificate provider of Raiffeisen Bank International, which has been at home in German-speaking countries as well

Read MoreBanco Azteca: Pillar of Financial Inclusion and Innovation in Mexico

A bank that’s about people, as well as profit… Banco Azteca, a key component of Grupo Salinas, has established itself as a major player in Mexico’s financial sector. Formed in 2002 with a mission to provide financial services to underserved

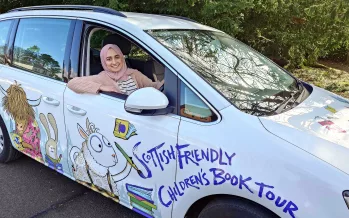

Read MoreFriendly by Name, Supportive and Creative by Nature: This Mutual is True to its Mission and Core Values

Scottish Friendly’s commitment remains firmly on helping its customers achieve optimal financial outcomes. Scottish Friendly remains resolute in its commitment to serving and supporting its customers and their families, whatever the future holds. The organisations status as a mutual means

Read MoreHands-on, Dedicated to Excellence, Driven by Inclusion and Diversity: Meet the Head of Scottish Friendly

This CEO is fulfilling the aspiration for his mutual to become a leader in the UK insurance sector. Scottish Friendly chief executive Stephen McGee’s ambition is “to create a world-class working environment” — one which is open, inclusive, collegiate, and

Read MoreBAWAG Forging Ahead and Staying at the Forefront of Banking Strategy by Maintaining a Long-Term Focus

People, patience, and profits are all allied for Austria’s burgeoning BAWAG banking group. Austria’s BAWAG has emerged as one of Europe’s most profitable and efficient banking groups, with a straightforward goal: to provide transparent and affordable financial products and services.

Read MorePioneering Spirit, Boldness, and a Deep Understanding of ‘Unity’

Nordic firm United Bankers has history and success behind it — and a great future ahead. Helsinki-based United Bankers set out to be a pioneer in real-asset investing for Nordic countries — and to expand its activities across Europe. Over

Read MorePatrick Anderson Knows How to Weather Rough Seas — and Has a Good Crew Behind Him

Patrick Anderson, the chief executive of Nordic asset management and financial markets firm United Bankers, in conversation with CFI.co. United Bankers management team is responsible for the company’s business as a whole. It prepares the corporate strategy and operating principles

Read MoreInvesting in a Future that has Never Seemed Brighter — a True Pioneer Bank in Mongolia

Staying true to its values and aims has taken Golomt Bank to enviable heights. Golomt Bank was established on 1995 as one of the first commercial banks in Mongolia, with just four employees. Today, it boasts 2,500 staff and 1,000,000

Read More