Banking

Back to homepageBanks and Work-Life Balance: A Step in the Right Direction

How BNY Mellon’s Recharge Period Sets a New Benchmark for Employee Well-Being The finance industry and work-life balance have long been uneasy bedfellows. Despite periodic efforts by banks to improve working conditions, many employees remain sceptical, often dismissing these initiatives

Read MoreKBC Group: A Digital-First Pioneer with an Eye on Sustainability and Growth

KBC Group has positioned itself as a leader in the financial services sector by combining its digital-first with a human touch approach, sustainable strategies, and wide geographic reach. With the Pearl+ strategy at its core and an innovative bancassurance model,

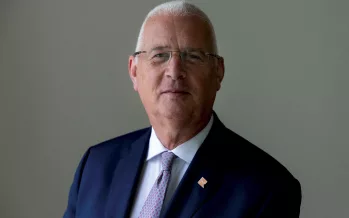

Read MoreJohan Thijs: Steering KBC to Continued Success

Johan Thijs, CEO of KBC Group, is one of Europe’s most successful corporate leaders. Under his guidance, the group has flourished as a top player in banking and insurance, all while remaining firmly rooted in his values-driven leadership. A Transformative

Read MoreFrom Barter to Blockchain: Banking Through the Ages

From trading seashells to investing in crypto, our relationship with money and financial institutions has seen some serious changes… For millennia, money in its various forms has been the lifeblood of human civilisation. From barter systems to sophisticated digital networks,

Read MoreIs Islamic Finance Now Mainstream?

Combatting usury, ensuring ethical standards, and sweeping the world: a new financial cornerstone emerges. Islamic finance has progressively gained traction in the global financial scene, transitioning from niche to mainstream alternative. This rise has been driven by factors including the

Read MoreLiterally Centuries of Experience and Expertise Behind This Bank

The oldest financial institution in Germany has been going strong since the 16th Century… Berenberg is Germany’s oldest private bank — founded in 1590. Over the centuries, it has embraced change but preserved its values. Owned and led by the

Read MoreInvesting in Africa: What to Know About Impact Funding… and More

Thavin Audit, deputy head of corporate and investment banking at Bank One, explores how Mauritius and the Middle East could partner for deeper impact financing. Bank One has gleaned — and shared — some exclusive insights from a meeting with

Read MoreSmall is Beautiful in Banking: Little US Institutions Form a Financial Backbone

Yerbol Orynbayev, former Deputy Prime Minister of Kazakhstan and World Bank governor, reports for CFI.co on the American banking sector. In the US, there are some 4,001 community banks and 134 regional ones. The majority of the country’s banking system

Read MoreSupporting African Businesses: A Focus on Sustainability and Close Customer Relationships

The Access Bank UK Ltd is making significant strides with its international expansion – and there are good reasons for that… The Access Bank UK Ltd provides trade finance, commercial banking, private banking and asset management products and services for

Read MoreContinued Improvement and Resilience – The Path to Banking Success and a Strong Reputation

Dedication to strong governance and a philosophy of community support have stood Afghanistan International Bank (AIB) in good stead – and resulted in recognition in the form of awards. Since 2004 AIB has been proudly providing essential financial services to

Read More