Author: Otaviano Canuto

Back to homepageOtaviano Canuto

Otaviano Canuto, based in Washington, D.C, is a former vice president and a former executive director at the World Bank, a former executive director at the International Monetary Fund, and a former vice president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at the University of São Paulo and the University of Campinas, Brazil. Currently, he is a senior fellow at the Policy Center for the New South, a professorial lecturer of international affairs at the Elliott School of International Affairs - George Washington University, a nonresident senior fellow at Brookings Institution, a professor affiliate at UM6P, and principal at Center for Macroeconomics and Development. Otaviano has been a regular columnist for CFI.co for the past 14 years.

Otaviano Canuto: The Dollar’s ‘Exorbitant Privilege’ Remains

Otaviano Canuto discusses the ongoing role of the greenback in international monetary systems… There has been talk of “de-dolarisation” of the global economy, with recent initiatives and policy moves by China and other countries to extend the reach of use

Read MoreOtaviano Canuto: Macro-economic Policy Change – We’re Not in Kansas Any More

The possibility of multiple financial shocks lies ahead. Three significant changes to the macro-economic policy regime in advanced economies have unfolded in the past two years. Fears of a chronic insufficiency of aggregate demand as a growth deterrent — which

Read MoreOtaviano Canuto: Going Around the Bend? Assessing the Phillips Curve May Be of Help

Unemployment and wage rates are theoretically linked, and may hold a key to our immediate economic future. Current global stagflation may evolve to become a soft landing, a sharp downturn, or a deep recession. It will all depend on how

Read MoreDollar Dominance: Greenback Will Endure Current Hardships

Financial sanctions on Russia after its invasion of Ukraine sparked speculation that the weaponisation of access to reserves in dollars, euros, pounds, and yen would spark a division in the international monetary order. China would strengthen its international payments system

Read MoreTightening Financial Conditions Bring Impacts to Asset Values

In the first half of this year, US stock markets suffered a fall not seen in more than 50 years. The S&P 500 index on Thursday June 30 was more than 20 percent down compared to January, a drop not

Read MoreQuantitative Tightening and Capital Flows to Emerging Markets

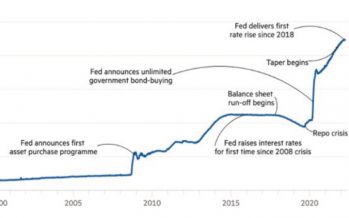

In its May 15th meeting, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve (Fed) lifted its benchmark policy rate by 0.75% to 1.50%–1.75%, the most significant increase since 1994. The central bank also signaled an additional increase

Read MoreGreenbacks for a Green Future: It’s the Cost of Decarbonisation

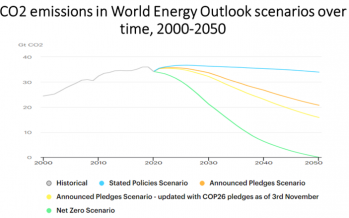

Accelerating the transition toward low- or zero-carbon emissions is necessary to keep global warming at theoretically safe levels. That will probably bring price shocks associated with rising metal prices, energy costs, and carbon taxes — what has been called “greenflation”.

Read MoreOtaviano Canuto: Some Economies May Soon Face a Hard Landing

Weaker performance of emerging markets is expected in the immediate future. This year began with simultaneous signs of a slowdown in global economic growth and a reorientation toward tightening of monetary policies in advanced economies. In its latest Global Economic

Read MoreSanctions Against Russia Resemble a Boxing Match

The economic sanctions against Russia announced last week by the US and Europe are having a profound impact on the Russian economy — and repercussions at home. As in a boxing match, the expectation is that blows to the opponent

Read MoreDecarbonisation and “Greenflation”

Accelerating the transition toward low or net-zero carbon emissions is necessary to keep global warming at theoretically safe levels. That will likely bring price shocks associated with rising metal prices, energy costs, and carbon taxes – what has been called

Read More