Greenbacks for a Green Future: It’s the Cost of Decarbonisation

Accelerating the transition toward low- or zero-carbon emissions is necessary to keep global warming at theoretically safe levels.

That will probably bring price shocks associated with rising metal prices, energy costs, and carbon taxes — what has been called “greenflation”. Greening the economy will also require public spending and redistributive policies.

Moving to Decarbonisation

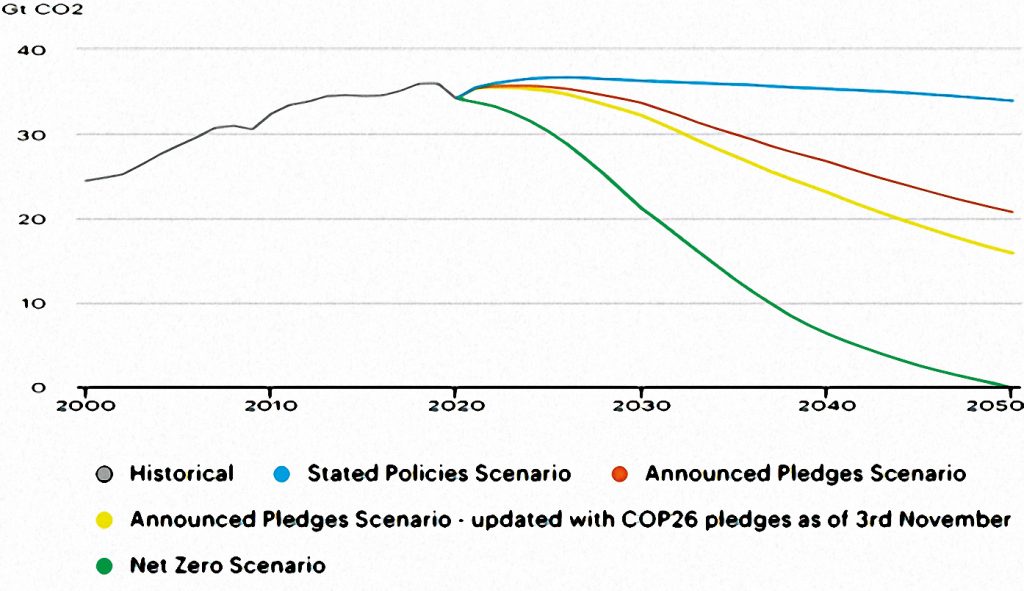

In the wake of the COP26 Climate Change Conference in Glasgow, the International Energy Agency has updated the CO2 emissions scenarios in its World Energy Outlook, taking into account the most recent pledges. Despite a steeper decline in emissions, the world would still be far from reaching the dreamed-of net-zero scenario by 2050 (Figure 1).

Figure 1: CO2 emissions in World Energy Outlook scenarios over time, 2000-2050.

According to the IEA, if all Glasgow commitments are met, global warming will be bound to 1.8 degrees above pre-industrial levels by 2100. That would be a substantial decrease from the 2.7 degrees which pre-COP policies would have been expected to lead to — but far from the levels promised in the 2015 Paris Agreement.

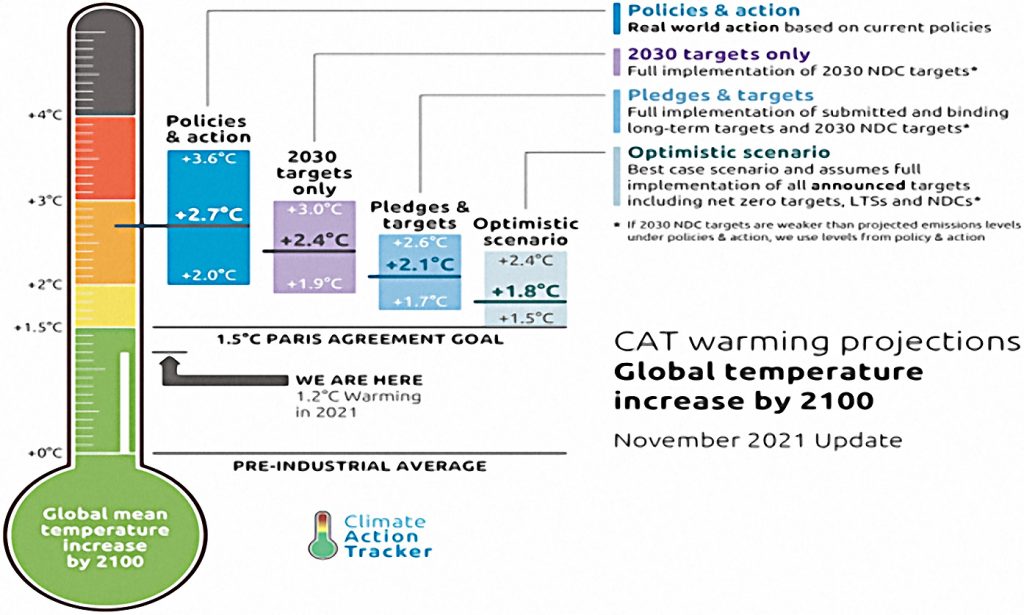

Estimates by Climate Action Tracker (CAT) suggest that current pledges for 2030 will not deliver the reductions necessary to push long-term effects unless further revisions are made. Figure 2 shows that, while the continuation of current policies would imply a 2.7 degree increase in global mean temperatures, the full implementation of nationally determined contributions (NDCs) — efforts by each country to reduce national emissions and adapt to the impacts of climate change — up to 2030 would lead to more warming by the end of the century. Climate Action Tracker’s pledges-and-targets scenario reflects all NDCs and submitted or binding long-term targets, including the net-zero targets of the US and China. The optimistic scenario of 1.8 degrees requires faster reductions in the coming decade.

Figure 2: Impacts on temperature estimates.

Agriculture, forestry, and land-use correspond to about 20 percent of total greenhouse gas emissions, and forest cover can help remove CO2 from the atmosphere. Preventing deforestation can play a significant role in lowering CO2 emissions, and can even provide a net sink.

Metal Price Shocks

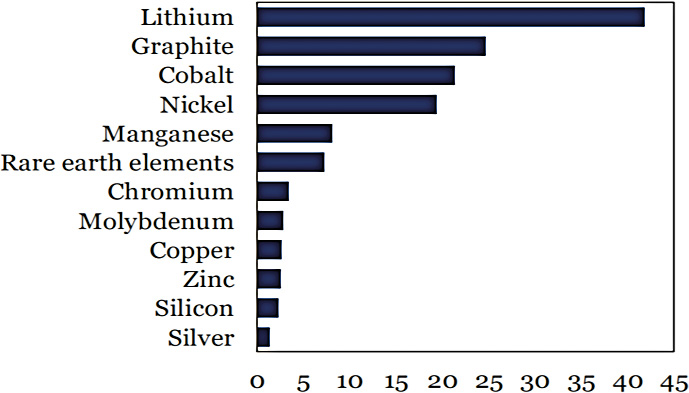

Supplies of renewable energy and biomass need to rise to meet global primary energy needs, and the trajectory towards decarbonisation will bring a sharp increase in the demand for metals, including copper, nickel, cobalt, and lithium. IEA (2021b) predicts that lithium and cobalt consumption will need to increase more than sixfold to meet battery needs.

Figure 3 shows how many minerals used in green technologies will go through a significant surge in demand during the energy transition. Demand for raw materials used in existing clean-energy technologies, such as solar panels and wind turbines, is expected to increase.

Figure 3: Times compared to 2020 level, demand for minerals in 2040.

Such an increase in demand will face a slow-motion supply response. Copper, nickel, and cobalt mines are investment-intensive and take on average of more than a decade from discovery to production, according to the IEA. Lithium is often extracted from mineral sources and brine through salt water pumped from the ground. This reduces lead times to about five years. There will also be the challenge of ramping-up production without going against social and environmental safeguards.

The combination of increasing demand and slower changes in supply could cause the prices of these metals to skyrocket. According to International Monetary Fund projections, if mining were to satisfy consumption in the IEA’s net-zero emissions scenario, prices could reach historic highs (Boer et al, 2021). The price of lithium could rise from $6,000 a metric tonne to about $15,000 this decade.

The production value of the four metals could increase up to six times to $12tn in two decades, according to the IMF.

Energy-Cost Shocks

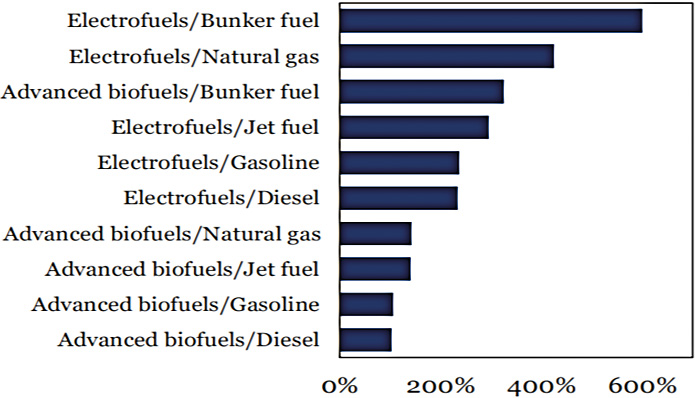

There may have to be a switch to more expensive non-carbon energy alternatives if they are to replace conventional fossil fuels. Green premia — costs of clean technology/price of carbon-emitting alternative — will have to be paid. Figure 4 illustrates this in the case of transport fuels.

Figure 4: Green premia – cost of zero carbon alternatives vs traditional fuels.

The good news about such replacement is that the evolution towards cleaner technologies with declining costs is happening. The bad news is the presence of obstacles to such investments — particularly in the case of green infrastructure in lagging countries.

Fossil fuels have also provoked price shocks. The expectation has been that their prices will fall as the transition pushes down demand for them. Supply conditions have also deteriorated because of the drop in investment in oil wells, natural gas centres, and coal mines.

In 2021, the lack of investment was one of the causes of the spike in the prices of the three energy commodities. Oil surpassed $81 a barrel after OPEC and allies such as Russia, part of the OPEC+ alliance, at a meeting last year, resisted calls to increase production. Unlike what has been seen since 2015, when oil and gas prices changed levels, this time US gas and shale oil were not ready to close the gap. The trajectory of fossil fuel prices will not be steady.

Public policy measures seen as favourable to the energy transition already place a price burden on fossil fuels. Such policy measures include a tax on carbon, elimination of remaining subsidies, mandatory transparency and sanctions on financial assets, and future bans on internal combustion engines.

We have experienced the first energy shock of the green economy era. Or the last energy shock of the fossil fuel era. In 2021, oil, coal, and gas prices rose 95 percent. This year’s strong economic recovery has been confronted by oil stocks at levels six percent lower than usual, as well as gas stocks in Europe at just 86 percent of previous levels, and below 50 percent in the case of coal in China and India.

At the same time, besides green premia still paid to replace carbon-emitting technologies with clean alternatives, existing stocks of investments in renewable energy have been shown to be insufficient to serve as a full alternative.

The year’s energy shock reflected climatic phenomena — low wind in Europe, droughts affecting hydroelectric production in Latin America, floods in Asia affecting coal delivery — but also that investments in renewable energy are evolving below what is necessary for the transition.

Higher input prices in energy production and use, as well as accelerated spending on climate change mitigation, will be tolls on the decarbonisation route.

Road to Decarbonisation

The road ahead will demand a significant change in the relative prices of goods and services to reflect their carbon-intensity. Gaspar and Parry propose that, at the international level, measures be taken to reach a carbon price equal to or greater than $75 per tonne by 2030.

Such a carbon price may be established and charged explicitly and/or indirectly through regulations or limits on use. Decarbonisation will be negligible if the price of carbon remains that of a “free good” from Nature. Carbon prices will also have to be among the factors influencing people’s behaviours and lifestyles.

Transitioning away from fossil fuels and carbon-intensive production and consumption implies a wide-ranging switch to emissions-neutral alternatives in all sectors. Policymakers can stimulate this transition by raising the implicit cost of emissions. The road to decarbonisation may entail higher costs along the way.

Greening the Economy

The decarbonisation trajectory will also have consequences for public accounts. Necessary public expenditure on infrastructure to enable the transition will be required. Transitioning to a net-zero emissions economy will necessitate investment flows towards mass deployment of green electricity and electricity storage.

The trend will be one of increases in public debt, though in this case without intertemporal injustice, as future generations will benefit.

Decarbonisation could have regressive income impacts. Real estate to be rebuilt or retrofitted corresponds to the largest share of assets of people in the lower half of the income pyramid. Direct carbon taxation will have different impacts on different urban groups. Compensating expenditures for regressive carbon pricing impacts will be demanded. It will be important to ensure income-transfer mechanisms to mitigate the regressive impacts.

Workers will have to move from carbon-intensive activities to greener substitutes. There will be not only the challenge of labour reskilling, but also of ensuring that new jobs are created in large enough numbers in dynamic activities. It is known that the production of electric cars requires less labour than that of combustion engine vehicles.

There will also be accelerated obsolescence of existing stocks of machinery and equipment, buildings, and vehicles, and intangible assets associated with carbon-intensive activities. The counterpart will have to be accelerated investment in new assets to replace them.

Bottom Line

What about GDP? On the one hand, there will be capital destruction, in addition to relative price shocks and the transitional impacts of reduction of potential growth. If the need for higher investment rates in GDP accompanying decarbonisation collides with supply capacity limits, consumption will have to adapt downwards.

High metal prices, carbon taxes, and accelerated obsolescence of capital associated with fossil fuels: these are tolls to be paid. “Greenflation” will be a price worth paying.

And cleaner technologies will offer opportunities to increase productivity.

You may have an interest in also reading…

OECD: Achieving a Resilient Economic Recovery

The recovery from the Great Recession has been slow and arduous, and has at times threatened to derail altogether. However,

African Leaders, Business Community Push for Financing of Priority Regional Infrastructure Projects

Across Sub-Saharan Africa, poor infrastructure is a major bottleneck for sustainable development Signaling a new push and renewed commitment, the

Boutiques Bet Big on 2025: Talent Wars and the Push for Revenue

The investment banking sector is gearing up for what could be a transformative year in 2025. Following a year of