KPMG: India – Banking on New Banks

India’s financial sector has tons of questions to ask since the Reserve Bank of India (RBI) spelled out the new bank guidelines and allowed new entrants onto the market.

India’s financial sector has tons of questions to ask since the Reserve Bank of India (RBI) spelled out the new bank guidelines and allowed new entrants onto the market.

- Is there a need for new banks?

- Will these be able to compete with pioneers in the industry or will history repeat itself?

- How will they impact current banks’ balance sheet?

In boardroom discussions all across the country the same unknowns dominate the agenda as industry leaders are trying to complete the jigsaw puzzle with their own answers. The truth may lie somewhere in between the many different answers to these same questions.

“The country also has a relatively low domestic credit-to-GDP ratio.”

Currently, the Indian banking system is made up of 26 public-sector banks, 20 private-sector banks and 43 foreign banks. Most banks have a country-wide presence and are complemented by another set of banks/credit institutions that work on a much smaller scale and mostly cater to niche clients such as the 61 Regional Rural Banks (RRBs) and the more than 90,000 credit co-operatives [Profile of Banks 2012-13, Reserve Bank of India].

Despite the impressive strides made by the Indian financial sector in business expansion, profitability, RoA (Return on Assets) and competitiveness, vast segments of the population remain untouched by banks and credit co-ops. This gives rise to questions regarding the need to bridge the gap between the privileged and under-privileged sections of society. RBI Deputy Governor Kamalesh Chakraborty mentioned the following facts in his recent speech on Financial Inclusion and Financial Literacy – The Indian Way:

- 145 million is the number of households still excluded from banking

- 50% percent of the population does not have a bank account

- Only 34% of the population is engaged in formal banking

- Only 17% of the population has any credit exposure

- Out of 600,000 villages, only 30,000 (5%) have a commercial bank branch

- Only 10% of Indians have life insurance while just 9.6% have any non-life insurance coverage

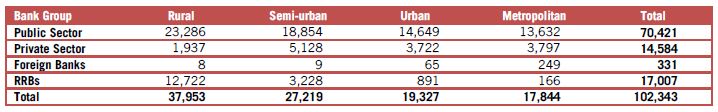

Until now, financial inclusion was the sole responsibility of public-sector banks. However, by using inclusive growth as a condition for the issuance of new licenses – new banks are required to locate one out of every four branch offices in rural communities – the RBI has now split the onus equally between public- and private-sector banks. As one can see from the table below, publically-owned banks currently have more branches than any other bank group in rural and semi-urban areas.

Apart from the introduction of financial inclusion as a parameter for new bank licenses, the regulator also nudges the sector toward consolidation. The RBI would not be opposed to mergers and acquisitions in the financial industry of the country and would like to see large Indian banks emerge that can compete globally.

The Attractiveness Index

What precisely is attracting the 26 applicants for new bank licenses to the Indian financial sector?

India is of course one of the Top 10 economies of the world by size. The country also has a relatively low domestic credit-to-GDP ratio and as such provides great opportunities for growth to financial institutions. In fact, the Indian banking sector is widely expected to become the world’s fifth largest by 2020 and its third largest just five years after that. Banking credit is likely to grow at about 17% annually over the medium term (from FY12-FY17) resulting in a significantly increased credit penetration [KPMG in India Analysis].

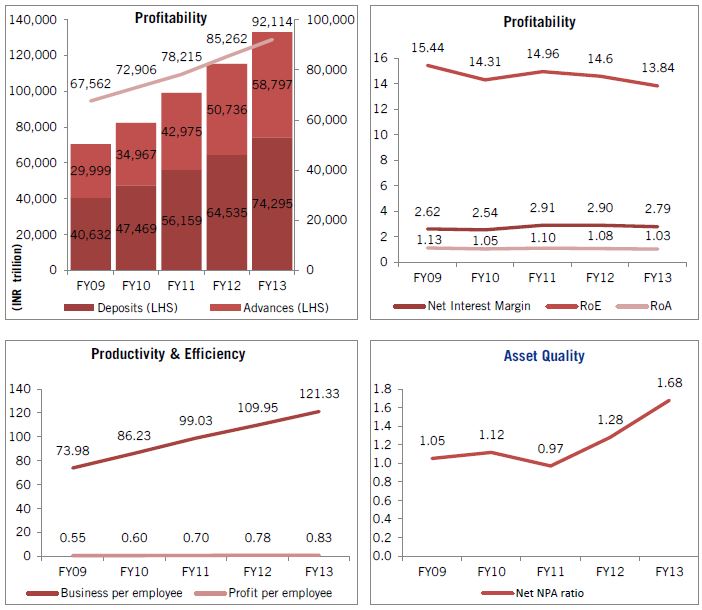

Currently, the banking sector is facing tremendous pressure on its profitability and struggles with the quality of its assets. While total business grew at an average annual rate of 17.16% to INR 133,092 trillion over the past five years, profitability decreased. This was primarily caused by a sharp deterioration in asset quality which in turn may be ascribed to the economic slowdown.

Table 1: Number of branches of scheduled commercial banks on March 31, 2013. Source: Department of Financial Services, June.

However, if we are to believe the statistics, the future looks bright. The emerging middle class has an evolving appetite for debt and is becoming a big driver of growth in retail banking and the mortgage business. Moreover, the profile of India’s rural economy is changing fast. This long-dormant sector is now getting increasingly diversified and has started moving to beyond mere agriculture. The share of agriculture in the overall GDP has declined from approximately 30% in 1990-91 to less than 15% in 2011-12 [Indian agriculture-performance and challenges, press information bureau, Government of India].

New Banks or Mirror-Images of Existing Ones?

Once the aspiring entrants to banking have been awarded their licenses, what will they do to succeed? How will they differentiate themselves and establish brand recognition?

Past experience shows that not all new banks possessed the grit and determination required to scale business. New banks may at first go for a niche market or limit operations to a well-defined geographical area. While setting up shop, new banks also need to create a profitable and a viable business model as they too have to adhere to a regulatory regime – that may ultimately affect their access to credit – just like the pioneers of the industry did. The regulator is unlikely to give any leeway to new banks and would expect them to maintain their SLR (Statutory Liquidity Ratio) at 23%, a CRR (Cash Reserve Ratio) of 4% and comply with all Basel-III norms. In due course, these banks are also expected to meet the 40% PSL (Private Sector Lending) standard.

New banks cannot hope to survive by just being a mirror-image of any other bank. They have to harness their specific knowledge of – and expertise in – the financial needs and requirements of specific industries. This deep understanding of the inner workings of well-defined economic segments most new banks accumulated as non-banking financial companies (NBFCs). However, the successful transition from an NBFC to a full-fledged bank will depend, as usual, on strong management armed with foresight as they move their businesses into uncharted risk areas.

Good customer service is a given in the industry. New banks have to deliver on that parameter but what would really set them apart is to find – and claim – the gaps between saturated markets – MSME (Micro, Small and Medium Enterprises), women-only businesses, traders and middlemen in agriculture, wholesale banking, markets not yet served focused on unorganized professions or corporate banking. Different operating models are required in order to reach customers in these niche markets.

Last but not least, the new banks must also find a way to maneuver into rural areas with cost-effective operating models and develop strong alliances with MFIs (Micro Finance Institutions) and BCs (Banking Correspondents). Proper governance control, coupled to local market knowledge, might spell success for these start-up banks.

Industrial Houses as New Banks

A few voices have expressed concern regarding the issuance of bank licenses to industrial conglomerates. The main reason the RBI discouraged these groups from applying for bank licenses in the past was a perceived shortcoming of corporate governance. However, this time there are a few good reasons to allow some of these large corporations into the banking sector. Industrial conglomerates come with deep pockets and these are a welcome addition to the RBI’s policy of financial inclusion.

Figure 1: Indian banks – performance at a glance. Source: A profile of banks 2012-13, Reserve Bank of India.

Many of the conglomerates now admitted into the banking sector already possessed other financial services businesses and are well aware of their customers’ needs. The regulator has put a number of safeguards in place such as the proposed non-operative financial holding company (NOFHC) structure which is expected to ring-fence the regulated financial service entities of these corporate groups – including their new banks – from other businesses owned by the same conglomerate.

The RBI will gladly hand out bank licenses to industrial groups as long as strong governance and risk management processes are in place. New banks are required to adhere to solid risk management processes in order to ensure that there are no lapses in the adherence to regulatory norms. This also reduces systemic risk in the entire banking system.

The Road Ahead for the Banking Industry

The regional spread of banking services has remained skewed over decades. There is a pronounced mismatch between the aggregation of deposits and the deployment of credit with Southern India at one end and the North-East at the other. It would be interesting to watch the regulator’s policy on regional and sectorial disparities take shape and see how the new banks fit into that strategy.

The regulator now mulls the possibility of the future issuing of differentiated bank licenses. These could help new banks focus on niche lending which might then also entail them receiving a distinct regulatory treatment. Some countries already have such a differentiated bank licensing regime where permits are issued precisely outlining the limited range of activities the licensed entity can undertake.

For example, Singapore has five different kinds of bank licences – full bank, qualifying full bank, wholesale bank, offshore bank, and representative bank – while Hong Kong has a three-tier structure based on fully-licensed, restricted-licenced, and deposit-taking companies.

The Indian regulator is also considering a move to make bank licenses available on tap, rather than opening this window for a limited time only. The coming changes brought to the banking landscape by the arrival of all these new kids are sure to be a topic of continued interest and discussion.

The new bank licenses now granted constitute just a single aspect of wider financial sector reforms. The government, along with the new RBI governor, is committed to this reform agenda and significant discussions on policy and direction may shortly be expected. Questions remain on the need for sectorial consolidation, the presence of foreign banks, and on the future outlook of the entire banking sector. The reform agenda is designed to eventually lead to the implementation of a four-tier banking structure comprised of:

- Large Indian banks with both a domestic and international presence;

- Mid-size banks including niche banks;

- Old private sector banks, Regional Rural Banks, and multi-state Urban Cooperative Banks;

- Small privately-owned local banks and cooperative banks.

By KPMG Team

You may have an interest in also reading…

Barclay’s CEO Bob Diamond Tops the List of High Earners

Bob Diamond, CEO of Barclays Bob Diamond, the CEO of Barclays Bank, is named as the highest paid CEO of any

Davos: Till We Meet Again – Bankers Packing Up

Dutch Finance Minister and President of the Eurogroup Jeroen Dijsselbloem is worried that the increased insularity of thought displayed by

Why an Expo 2020 Win Will Not Determine the Strength of Dubai’s Property Market

By Mat Green, Head of Research & Consultancy UAE, CBRE Middle East Property markets around the world have proven to