Complimentary Currencies: Development Tool on Trial in Kenya

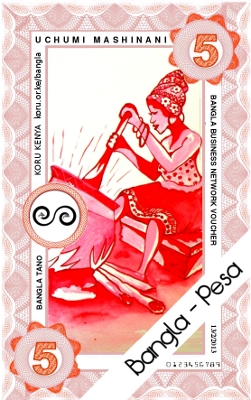

Bangla-Pesa: Alternative Currency

The Central Bank of Kenya has asked the public prosecutor to charge American economist and former Peace Corps volunteer Will Ruddick with forgery. Earlier this year Mr Ruddick and five others were duly arrested by police and thrown in jail. Released on bail, Mr Ruddick and his co-workers now face criminal trial.

Will Ruddick leads the non-profit organization Koru-Kenya that aims to alleviate poverty in the slums of Mombasa. In May of this year the group succeeded in rallying the small businesses of a poor district known as Bangladesh around the idea of the Bangla-Pesa: An alternative and strictly local currency that would facilitate the exchange of goods and services.

The setup worked. Within a matter of weeks local businesses reported an increase in their turnover of some 22% on average. Employment levels are also on the increase.

However Kenyan authorities were not impressed. Mombasa is home to a secessionist movement and the colourful Bangla-Peso vouchers were initially seen as a possible precursor to a national currency of a future state. When it proved impossible to sustain these far-fetched suspicions with solid evidence, Will Ruddick and his co-workers were simply charged with forgery.

The Bangla-Pesa is at heart a zero interest loan. Any business wishing to sign up for the program must first find four others to vouch for its solvency. Once that is done, the new member gains access to a credit of 400 Bangla-Pesa (about €3.50). This money may then be freely spent at any of the 200 or so businesses already participating in the project.

“The Bangla-Pesa is merely a promissory note. As such it is a perfectly legal financial instrument. Moreover, the Bangla-Pesa cannot be exchanged for Kenyan Shillings. The state prosecutor has basically no case.”

The Bangla-Pesa is by no means unique. In a group of settlements collectively known as Kongowea, elsewhere in Kenya, a complimentary currency – the Eco-Pesa – was introduced as far back as August 2010 to facilitate and enable residents to tackle a serious waste management problem. The Eco-Pesa soon proved a success: It stimulated trade between local small businesses while simultaneously ridding the community of 20 tonnes of trash.

According to investment banker Jimnah Mbaru, who helped develop the Nairobi Stock Exchange, the criminal proceedings against Mr Ruddick make little, if any, sense: “The Bangla-Pesa is merely a promissory note. As such it is a perfectly legal financial instrument. Moreover, the Bangla-Pesa cannot be exchanged for Kenyan Shillings. The state prosecutor has basically no case.”

A demo Tano (5) Bangladesh Business Network Voucher

Will Ruddick remains optimistic that the Kenyan courts will allow him and his organization to continue the project. The American has great plans and would like to see the system of complimentary currencies replicated not just in poverty-stricken Kenyan communities but all over Africa: “This system now has a proven track record of reducing poverty. It costs next to nothing to set up and manage. No other means of development is so cheap and effective”.

In Brazil complimentary currencies are now part of official government policy although here too the central bank initially tried to have the people involved charged with money laundering and forgery. However the Banco Palmas, issuer of Palmas vouchers, obtained a resounding victory when a judge ruled that it is a constitutional right for people to have access to credit. In a sneer to monetary authorities, the court also pointed to the fact that the central bank was doing “nothing of note” for poor people.

The Brazilian Central Bank has since embraced complimentary currencies as a tool for development and now actively supports such initiatives all over the country.

It is hoped that the Kenyan authorities will come to see the light as well. Alternative means of exchange do not, as some economists argue, drive up inflation or – conversely – devalue the official currency. When goods and services remain unsold and people unemployed, as is the case in many developing countries such as Kenya, adding liquidity to the system merely encourages productivity and employment, not inflation.

A crowd-funding drive is currently underway to gather funds for Mr Ruddick’s legal defense. A number of European NGOs have already pledged support and even the United Nations Non-Governmental Liaison Service (UN-NGLS) has now weighed in with an official letter of support.

You may have an interest in also reading…

Principles for Responsible Investment: Fiduciary Duty – Coming of Age

Unfortunately, fiduciary duty can be a contested term when it comes to investments, with different legal interpretations in countries around

Patrick Awuah: Educating the Future Leaders of Africa

The prestigious and pioneering Ashesi University in Ghana is on a mission to educate a new generation of business leaders.

ECB | European Central Bank: President’s Address at the 14th ECB and its Watchers Conference

Mario Draghi, President of the ECB, Frankfurt am Main, 15 June 2012 Ladies and Gentlemen, It is a great pleasure to