Search Results for ""

Back to homepageTightening Financial Conditions Bring Impacts to Asset Values

In the first half of this year, US stock markets suffered a fall not seen in more than 50 years. The S&P 500 index on Thursday June 30 was more than 20 percent down compared to January, a drop not

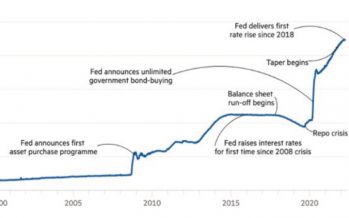

Read MoreQuantitative Tightening and Capital Flows to Emerging Markets

In its May 15th meeting, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve (Fed) lifted its benchmark policy rate by 0.75% to 1.50%–1.75%, the most significant increase since 1994. The central bank also signaled an additional increase

Read MoreGreenbacks for a Green Future: It’s the Cost of Decarbonisation

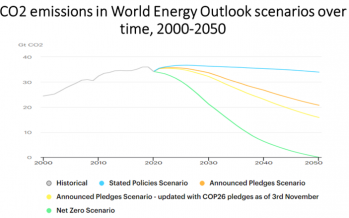

Accelerating the transition toward low- or zero-carbon emissions is necessary to keep global warming at theoretically safe levels. That will probably bring price shocks associated with rising metal prices, energy costs, and carbon taxes — what has been called “greenflation”.

Read MoreBiggest Commodity Price Shock in 50 Years is Here

In addition to death and destruction in Ukraine, the Russian invasion brought several significant shocks to the global economy. The geopolitical consequences of the war reinforce the downward trend in trade globalisation and financial integration, with fresh rounds of disruption

Read MoreSanctions Against Russia Resemble a Boxing Match

The economic sanctions against Russia announced last week by the US and Europe are having a profound impact on the Russian economy — and repercussions at home. As in a boxing match, the expectation is that blows to the opponent

Read MoreDecarbonisation and “Greenflation”

Accelerating the transition toward low or net-zero carbon emissions is necessary to keep global warming at theoretically safe levels. That will likely bring price shocks associated with rising metal prices, energy costs, and carbon taxes – what has been called

Read MorePermanent Output Losses from the Pandemic

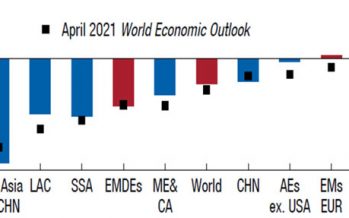

In the World Economic Outlook, published October 12, the International Monetary Fund (IMF) slightly lowered its forecast for global economic growth this year to 5.9%, while maintaining a forecast of 4.9% for 2022. It also emphasized the “divergence” in the

Read MoreThe Road to Decarbonisation

The transition to zero emissions will involve three simultaneous economic processes: change in the relative prices of goods and services, with prices starting to reflect the intensity of emissions of carbon; labour relocation; and asset value scrapping. The socioeconomic return

Read MoreGlobal Imbalances and the Pandemic

The International Monetary Fund’s tenth annual External Sector Report (ESR, August 2021) shows how current account deficits in the global economy widened in 2020 during the pandemic. On the other hand, the ESR also argues that overall, the misalignment between

Read MoreMatchmaking Private Finance and Green Infrastructure

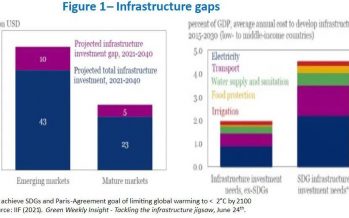

The contrast between the scarcity of investments in infrastructure and the excess of savings invested in liquid and low-return assets in the global economy must be dealt with. Greening infrastructure in emerging and developing economies would benefit from being able

Read More