Otaviano Canuto: Are We on the Verge of a New Commodity Super-Cycle?

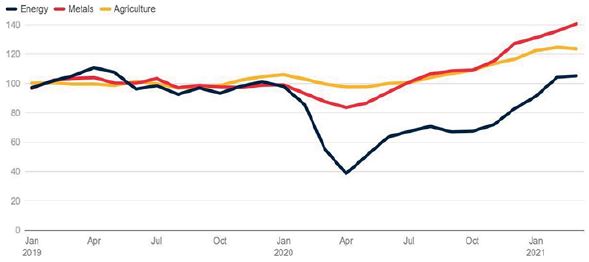

Commodity prices have recovered their 2020 losses and, in most cases, are now above pre-pandemic levels (Figure 1).

Figure 1: Commodities Price Indexes, Monthly. Source: World Bank (2021), Commodity markets outlook, April.

The pace of Chinese growth since 2020 and the economic recovery that has accompanied vaccine rollouts are driving demand upward, while supply restrictions for some items — oil, copper, and some food products — have favoured their upward adjustment.

Some analysts have started to speak of a new commodity price “super-cycle” after the downturn that started in 2010 (Holmes, 2021; Sullivan, 2020). There is an expectation that Chinese growth will eventually return to the levels of its “rebalancing”, below those rates that sustained the global demand for commodities in the previous long price upswing.

But there is the perspective of a strong macroeconomic acceleration in the US — and possibly in Europe — driven by public spending packages in green infrastructure.

Why are Commodity Prices so Cyclical?

Commodity prices go through extended periods during which they are well above or well below their long-term trends. The upswing phase in commodity super-cycles occurs when unexpected, persistent, and positive demand trends contrast with typically slow-moving supply. Eventually, as more supply becomes available and demand growth slows, the cycle enters a downward swing.

Individual commodity groups have their own price patterns. But when charted together, they display extended periods of price trends known as commodity super-cycles.These are different from occasional supply disruptions, because high or low prices persist over time.

Four distinct commodity price super-cycles since the end of the 19th Century can be linked to dramatic structural changes and corresponding growth periods in some regions of the planet.

- 1899 to 1932 — with up and down phases — that coincided with the industrialisation of the US

- 1933 to 1961, the upswing phase of which reflected the onset of global rearmament before World War II

- 1962 to 1995, with the boom period associated with the reindustrialisation of Europe and Japan in the late 1950s and early 1960s

- Finally, the current cycle which started in the mid-1990s, mostly related to the rapid industrialisation of China up to its re-balancing phase.

The pattern of high growth of the global economy in the current period saw fast-growing countries generating higher proportions of GDP from natural resources and commodities.

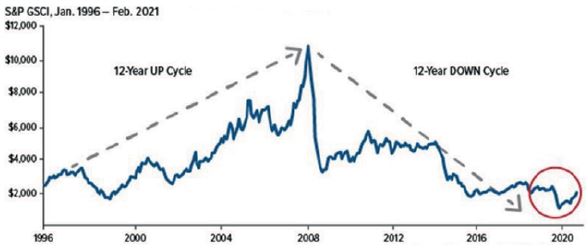

Figure 2 depicts the latest super-cycle, as measured by the S&P GSCI spot index, which tracks price movements for 24 raw materials. The abrupt decline in 2015 mainly reflected a sharp drop in oil prices, as US shale gas and oil altered the supply landscape. After the impact of the pandemic in 2020, the index has risen by close to 25 percent in 2021.

Figure 2: The Latest Commodity Super-Cycle.

Source: Homes, F. (2021). A New Commodities Supercycle Could Be Powering Up After A Long Freeze, Forbes, February.

Some Commodities are More Equal than Others

It should be recalled that different groups of commodities have their own histories, reflecting their own conditions of demand and supply. Although it is always possible to find moments of joint fluctuation, in which commodities remained for a long time above or below their long-term trends, constituting commodity price super-cycles, there are differences.

Take the case of oil, the price of which plunged in 2020 when mobility restrictions directly impacted demand. Oil’s recent recovery happened at record pace, helped by production cuts in the Organisation of Petroleum Exporting Countries (OPEC) and partners. But the recovery in demand has been gradual, and is expected to remain steady over the course of 2021, especially in advanced economies. However, the global level of idle oil production capacity remains high.

Agricultural prices, on the other hand, are 20 percent higher than a year ago, reaching levels not seen for almost seven years. Price increases have been driven by declines in the supply of some food commodities, especially corn and soybeans, strong demand for feed in China, and the devaluation of the US dollar. Soy has recently hit its highest price in eight years.

A report from the Eurasia Group (Food inflation and rising political risk, May 7, 2021) has called attention to rising political risks associated with recent food inflation in emerging markets. Several factors have accounted for that, including exchange rate depreciation, shipping constraints, logistical difficulties, and weather events.

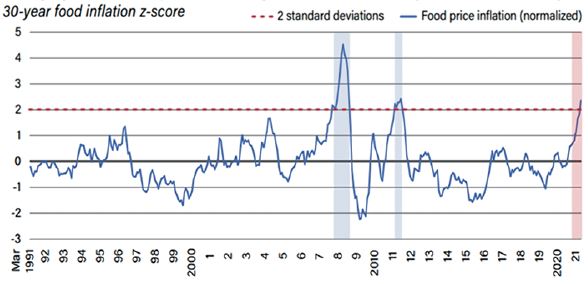

Figure 3 shows the normalised food inflation rate on the World Bank’s measure of food prices for low- and middle-income countries over the last 30 years. According to this index, food inflation for developing countries was above 37 percent year-on-year in March 2021, or more than 2.3 standard deviations above the 30-year mean. In the past three decades, the index has matched or exceeded this level only twice, during the food price crises of 2007-08 and 2011.

Figure 3: Emerging-market food prices are rising at a rate matched only twice in the last 30 years.

Source: World Bank; Haver Analytics (extracted from Eurasia Group, Food Inflation and rising political risk, May 7, 2021).

In its April 2021 report on commodities, the World Bank suggested factors that could stabilise food prices starting next year. According to the US Department of Agriculture’s survey of planting intentions, the land allocated for corn, soybeans and wheat in America is expected to increase next season — especially in the case of soybeans and wheat. This will follow supply growth below long-term trends during the last harvests. Given the weight of the US in these commodities, if intentions are followed-through, increased planting will help stabilise global food commodity markets.

Agricultural prices are expected to stabilize in 2022, after a 13 percent increase this year. However, developments will also depend on the trajectory of energy costs in the short term and biofuel policies in response to the energy transition in the long term. Some analysts go as far as saying that the elasticity of agricultural production has become such that it makes cycles more a matter of quantity than prices.

Copper is King!

It is in metals that a strong bullish cycle is most evident. Prices currently on the rise reflect strong demand in China, the ongoing global recovery, and interruptions in the supply of some metals. In March 2021, copper, tin, and iron ore prices reached 10-year highs (Figure 4).

Figure 4: Copper prices and global manufacturing PMI. Sources: Haver Analytics; World Bank. Note: The PMI (Purchasing Managers’ Index) is a leading indication of global manufacturing sector activity. Readings above (below) 50 indicate an expansion (contraction). Last observation is March 2021.

In the years ahead, the infrastructure spending package proposed by President Joe Biden and the global energy decarbonisation will impact demand and prices of commodities in different ways. Biden’s infrastructure package will favour renewable energies, associated with the use of electric vehicles and batteries. The raw materials needed for batteries and electric vehicle engines — lithium, rare earths — are already experiencing market euphoria. Copper, because of its conductivity, tends to be used four or five times more in electric cars than in conventional combustion engine cars. Oil, of course, will not be in line with the green recovery.

Nicholas Snowdon, commodities strategist at Goldman Sachs Research, argues that because it is “the most cost-effective conductive metal [for] capturing, storing [and] transporting electricity”, copper will be key in the green transition. “Copper is the new oil,” he says. Lithium, niobium, and rare earth metals will also star.

As it is typically the case under classic super-cycle conditions, there will be a delay in the supply response. It is only now, with the return of the US to the Paris Agreement and the Biden programme, that the infrastructure greening is being taken seriously. No major copper investment project has been approved in the past 18 months, and such projects take four to five years to become fully operational. Investment losses at the start of the downturn in the past decade have led investors to hesitate to embark on new ventures.

Three things to note:

- First, even copper scraps are going to be valuable in the near future.

- Second, it will be interesting to see how copper mining projects that respect environmental, social, and governance safeguards are put together.

- Third, the next time you hear about commodity super-cycles, ask what the commodity is.

About the Author

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, a visiting public policy fellow at ILAS-Columbia, and principal of the Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil. Otaviano has been a regular columnist for CFI.co for the past nine years.

Follow him on Twitter: @ocanuto

You may have an interest in also reading…

Salman Khan: Standing In for Newton

Looking for a practical means of tutoring family members, Salman created the Khan Academy YouTube account in late 2006. Initially

European Investment Bank: Investment Plan for Europe

Investment Plan for Europe – Paradigm Shift in the Use of Public Resources The Marshall Plan did much to inject

La Trobe Financial: Unpacking the Rise of Private Markets and Private Credit

Private markets—particularly private credit—have experienced a marked surge in investor interest in recent years. Though this asset class has existed