Austria’s CQ Investment Group is Winning Firm Partners in Global Corporate Circles

Not too big, not too small, recognised by all as a leader in impact investment — CQ Investment Group has proven itself time and again.

Somewhere between corporations and SMEs is a sweet spot — the medium-sized enterprise — and Austrian firm CQ Investment Group has been comfortably settled in that niche since 1991.

The group consists of several asset management companies with the emphasis on quantitative strategies, as well as ESG and impact investing. Other strengths are specialisations in private debt and alternative investments; particular expertise has also been developed in the management of international pension funds. CQ Group investment products and services are rated among the best in their respective categories. They have won multiple awards and recognition from institutional clients.

In the three decades since it was founded in Vienna, CQ Investment Group has established itself in 21 countries. Its financial products and services are distributed to institutional clients and via wholesale channels in the respective markets.

Pioneering Forays

In 2003, the group launched the first trend-tracking fund in co-operation with ARTS Asset Management. The pioneering move introduced the first quantitatively managed retail fund to the market. The CQ-ARTS trend-tracking funds are now a major fixture in the product landscape, included in many unit-linked life assurance products. It has, again, been recognised with awards for its performance.

Loans to Developing Countries

Vision Microfinance is a platform established by Impact Asset Management GmbH (previously CQUADRAT Asset Management GmbH) in 2006. It allows entrepreneurs without access to funding to take out small loans, giving them the opportunity to develop or establish their small businesses — sometimes to escape poverty.

To date, more than $2.05bn has been awarded to 309 microfinance institutions in 67 countries. This meaningful and sustainable aid helps families gain access to food, medical care, and education. Vision Microfinance was recognised by CGAP (Consultative Group to Assist the Poor) in 2010 for the transparency of its reporting. It has several times been awarded the LuxFlag label by the Luxembourg rating agency.

Leader in Green Investments

As a subsidiary of CQ Investment Group, Impact Asset Management is one of the leading non-bank asset-management companies in German-speaking territory, specialising in the selection, analysis, and management of absolute return and sustainable investments.

As far back as 2011 — years before the rest of the sector stumbled across this area — American non-profit ImpactAssets included Impact Asset Management GmbH in the top 50 impact investment firms. Not only are the products’ financial returns considered; their social and environmental impacts are decisive for selection.

Social Engagement: a Priority

The CQ Investment Group has been supporting social projects in various areas over the years. Many of these focus on young people from disadvantaged backgrounds, orphans, or children with disabilities.

The group finances projects worldwide to promote health, improve education, and combat poverty. When deciding which support, it places particular emphasis on economic understanding, making an important contribution to social co-existence.

CQ Investment Group: A Partner for Global Players

In conjunction with Talanx, the third-biggest German insurance group, the CQ Investment Group is operating a joint venture in Armenia to manage the state pension fund on behalf of the Armenian Central Bank. Co-operation with Raiffeisen Bank International AG has led to initiation of a private equity growth fund, which concentrates on SMEs in and around Austria. Pension funds and other institutional assets are being managed as part of a joint venture with the Vienna Insurance Group (VIG), based in Poland.

Over its 31-year history, the group has proved itself to be a strong and reliable partner for global players in 21 European countries.

You may have an interest in also reading…

OctaFX Launching in Europe: A Global Forex Broker that Means What it Says and Sticks to its Word

OctaFX brand has been established in 2011, provides a state-of-the-art online trading experience to seven million accounts. The company is

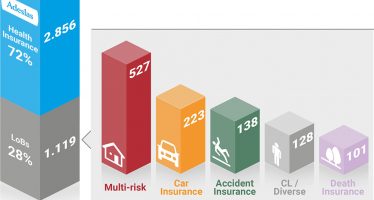

SegurCaixa Adeslas: The Year that Put Healthcare in Focus

It’s certain that 2020 will go down in history as the year of Covid. The pandemic has affected almost all

Swiss Precision, African Spirit with CEO Daouda Fall: Brahms Group has Found the Perfect Balance

Switzerland-based and Africa-led, the Brahms Group was born as a consultancy in 2009 — and has grown into an established