Sasseur REIT: Unique EMA Model Aligns Interests of All Stakeholders

Singapore Exchange-listed Sasseur REIT is the first retail outlet mall real estate investment trust listed in Asia.

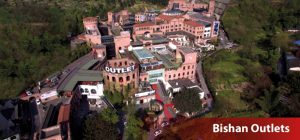

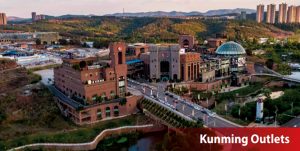

It offers investors the opportunity to invest in the fast-growing sector in the People’s Republic of China through its initial portfolio of four mall assets strategically located in the fast-growing cities of Chongqing, Bishan, Kunming and Hefei, with a net lettable area of 312,844 square meters.

Sasseur Cayman Holding Ltd, the REIT’s sponsor, is a leading premium outlet group ranked among China’s top 500 service companies. With 13 outlet malls in 12 major cities, Sasseur is recognised for the integration of art, aesthetics, operational excellence and prudent capital management.

China’s retail outlet industry has remained resilient in the face of the pandemic. Sasseur REIT has bounced back from temporary closures early in 2020, with sales from July to September nearing pre-Covid levels. The rise of China’s middle class — Sasseur REIT’s main customers — and government policies to encourage domestic consumption have contributed to the performance of the REIT, and to the continued growth of the sector.

Sasseur’s malls stand out because of their unique “A x (1 + N) x DT” Super Outlet business model, where A = arts, 1 = outlet business, N = lifestyle activities and DT = data technology. Sasseur combines art, commerce and other activities to position its malls as lifestyle centres that offer an attractive range of retail, cultural, tourism and entertainment activities.

Unlike many traditional retail-related REITs, Sasseur — through its entrusted management agreement (“EMA”) — does not collect a fixed rent from the majority of its tenants. Instead, it pegs the rent to tenant sales, which aligns the interests of mall owner, entrusted manager, tenants and REIT unit-holders. Based on the EMA, the REIT’s income comprises a fixed component, which grows at three percent annually according to contract, and a variable component that is pegged to sales. The fixed component provides income stability while the variable component allows investors to enjoy upside derived from commercial activity.

With several projects in the pipeline, Sasseur REIT’s manager intends to acquire high-quality outlet malls with good investment characteristics in China, or other parts of Asia and the world.

You may have an interest in also reading…

Patient Capital for Industrial Growth: Inside Aurora Growth Capital’s Investment Approach

Aurora Growth Capital, formerly known as NB Aurora, has built a reputation for offering patient capital to Italian SMEs, taking

Meet the SATORP Team: Guardians of the Rolls-Royce of Refineries

Sulaiman M Ababtain Sulaiman M Ababtain, president and CEO of SATORP, oversees one of the world’s most advanced refineries, capable

FAMA Investimentos: Shared Economy Investment Opportunities that Meet the Highest ESG Standards

If, five years ago someone approached a fund manager and said: “I come from five years in the future and