Convergence Partners: Impact Investing, and the Metrics Needed to Ascertain the Benefits

It’s possible to fudge the definition of ‘impact’ in one’s favour – and that’s just not acceptable for South Africa’s Convergence Partners.

It’s possible to fudge the definition of ‘impact’ in one’s favour – and that’s just not acceptable for South Africa’s Convergence Partners.

Business owners, communities and the environment must – as a precondition for sustainability, inclusion and prosperity – participate as a collective, and not as competitors.

This is the premise of impact investing, and beyond “doing well by doing good”, there is a further demand. That impact must be measurable – and not as a box-ticking exercise, administrative duty or afterthought.

This is something pan-African Convergence Partners, based in South Africa, understands. The firm’s ambition was to build a model to ascertain the impact of its investment in information and communication technology infrastructure.

“We have created tool for investors across sectors, industries and borders,” says CEO Brandon Doyle. “Our objectives are to record and report the nature and extent of the impact of our investments. The instrument we have developed will be able to be adopted by other participants in this and other industries as a flexible, customisable and standardised metric.”

For Convergence Partners, no definition would be complete without the requirement for measurement. “That is not to suggest for one moment that measuring impact is easy,” Doyle admits. “If anything, this sets the frame of reference for what needs to be done to measure impact, but it offers little guidance on how to go about it.”

Analogous fault lines exist in financial measures of economic prosperity. Using only industry-standard measures such as an internal rate of return (IRR), return on equity (ROE) or multiples at exit mean that results would ignore external “good” and “bad”.

“We know that competitive financial returns are not incompatible with positive impact. But if meaningfully measuring output and returns on a strictly financial basis is fraught, measuring total impact has proven vexing.

“Our departure point was the hard principle that to be viable and sustainable, every investment must earn at least its cost of capital. Both the impact industry and commercial reality demand this.”

At the same time, every investment has positive and negative effects on society and the environment. These pecuniary and non-pecuniary impacts must be evaluated as fully as possible, encompassing economic, social and environmental impacts.

“Our measure has the capacity and capabilities to communicate meaningfully to all our stakeholders,” says Doyle, “in line with our mandates and philosophy. This places emphasis on a process that is repeatable and a framework that is meaningfully portable across the borders of firm and geography.

“We recognise that we are by no means the first to try to quantify the impacts of our investments. It has long been a concern for investors. But it’s an unsettled discipline that is often clouded – or even confused – by a multitude of approaches, varied and wide-ranging toolsets, and modest standardisation.”

Quantified results can range between superficial narratives, amounting to little more than storytelling, and complex methods that engage sophisticated technical tools. This translates into outcomes which risk being “an opinion with adjectives”, where assessment is descriptive, unscientific and without framework. At the other extreme, sophisticated technical tools – embracing networking mapping, live data, complex algorithms, econometric models, stakeholder theory, randomised controlled trials or Herfindahl-Hirschman Indices – put the evaluation of impact beyond the reach of repeatability, common understanding or widespread application. Other risks in measuring investment impact take the form of self-serving calculations or intuitive, descriptive guesswork lacking rigour.

The blind spots and distortions are acknowledged in a healthy drive to find more reliable and robust indices. “We believe we have designed a model that holds up to the true standards of measurement: quantifiable, repeatable, portable and understandable.”

Convergence Partners’ model uses four pillars. The first scores capital contribution, or the nature and circumstances of investment. The model recognises the impacts of replacement capital and growth capital, placing higher weight on the latter. Re-invested capital (retained profit) that funds growth also offers greater impact than replacement capital. This relatively simple weighting provides scores and distinguishes between investors in the same company at different stages of its life cycle.

The second pillar maps the impact of the investment to the UN’s Sustainable Development Goals (SDGs). “We have focused on the mathematical correlations between the improvement of the SDG scores and the development of the industry in which the investment operates,” says Doyle. “This creates a ranking of SDGs per opportunity, with the most highly correlated SDG providing the highest score.”

This second pillar is moderated by the operating performance of the investment and multi-purpose scoring mechanisms to capture the particulars of any metric identified. Put simply, good ideas that are badly managed translate into low impact.

The third pillar “flexes” the baseline impact score for context and location. Impacts are influenced by a range of factors, most notable the country, community and form of the corporation invested in. “For example, an investment in long-haul fibre network in South Sudan will have higher impact than the same investment in South Korea,” explains Doyle. “Similarly, marginal impacts are greater in smaller companies than in meg-caps, and marginal benefits are larger in under-serviced rural areas than in urban hubs.” Nuances must be accounted for in making these evaluations, but “we must start somewhere to get from ‘adjective’ to ‘measured impact’,” he adds.

The fourth and final pillar holds the investment to account: it must produce a return above the cost of capital. An asset that cannot do so fails a primary requirement. This doesn’t necessarily make it “bad” – it may offer valuable social or economic elements – but to be a sustainable financial investment, the return must cover cost.

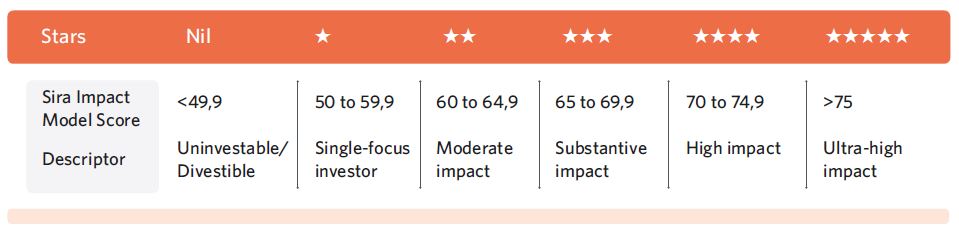

These factors are brought together to produce an investment impact score out of 100, in what Convergence Partners terms the Sira Impact Model.

“Drawing these elements together equips us as investors to go beyond sentiment,” says Doyle. “We have made investments with the intention of substantial positive impact since our first deployment in 2007. Our previous work and – admittedly anecdotal – evidence suggests we had achieved the requisite positive impact.

“But the spirit of the definition of investment impact demands more robust evidence than that, and this model holds us to that standard. It is robust and repeatable, which means that we are equipped to better manage our portfolio companies and people. We are also able to demonstrate the impact of our investment to shareholders, policymaker, funders and the societies in which we invest.

“In line with our investment philosophy, the model is designed with broad use and wide application. With publication of our source code, we invite participants from across our industry – and other industries – to adopt, implement and advance this model.”

You may have an interest in also reading…

Hydropower and its Prospects

Alternative energy sources, and hydro in particular: CFI.co interviews Wolfgang Kröpfl, CEO of enso GmbH, Gilbert Frizberg, CEO of eHydro500

Forging an Enviable Reputation in the Investment Sphere — via Consistency, Teamwork, and Risk-Modelling Genius

This UK asset management firm stands out — and here’s why… In the investment world, success hinges on a combination

ORBIAN: Supply Chain Finance? This Firm has Made It a Speciality

ORBIAN is the longest-standing provider of supply chain finance (SCF) solutions. The firm is decidedly “buyer-centric” with its traditional SCF