A Rewarding Blend of Personal Touch and Present-day Efficiency

Member of the Executive Committee and Head of IT: Alexandre Delen

Delen Private Bank is an independent Belgian wealth manager specialising in discretionary management and estate planning. Its mission is to protect the wealth of its clients and to achieve sustainable growth of their assets through a prudent yet proactive investment philosophy and via concise estate planning. The bank’s strategy and vision is inspired by five core company values: personal and family-oriented approach, efficiency, sustainability and prudence.

Both asset management and estate planning are tailored to client needs with dedicated relationship managers on hand. To René Havaux, CEO of Delen Private Bank, the personal element cannot be underestimated in the private banking business: “Wealth management is fundamentally an emotional matter. That is why our personal service is so essential. We want our clients to feel at home in our offices. It’s a prerequisite to start an open and tactful conversation about complex or delicate subjects.”

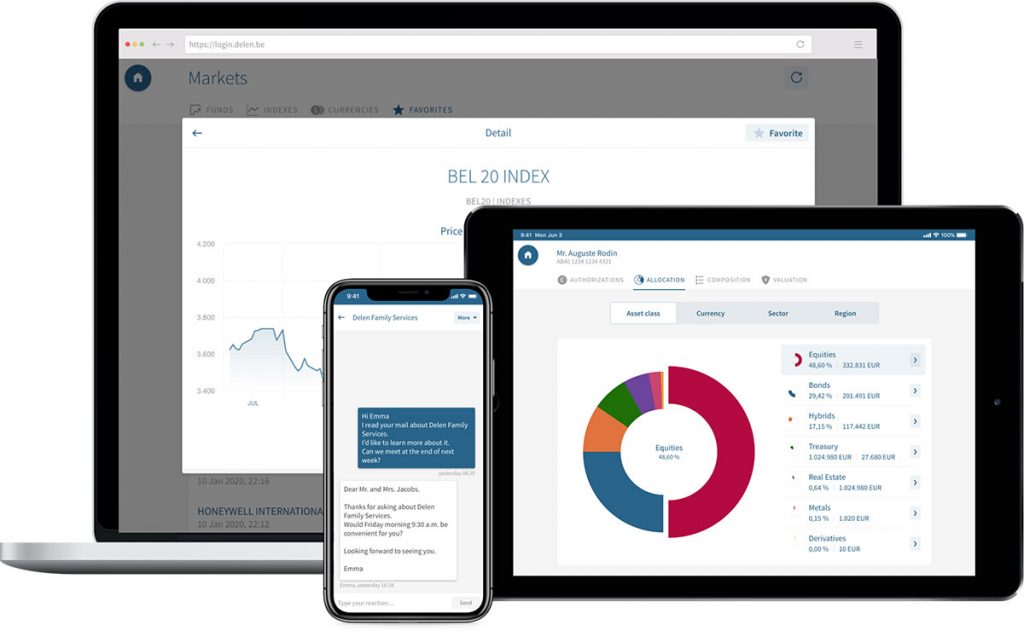

Next to the all-important personal touch, Delen Private Bank offers clients a powerful digital platform of tools (apps and online). Since its establishment, the bank pioneered in using state-of-the-art technology as a means – not the goal – to improve the quality of its services and clients experience. “The client chooses how he wants to enjoy our services: online or the traditional way”, emphasizes Alexandre Delen, member of the Executive Committee and head of IT. “It’s up to the client, not us”,

Since its launch in 2016, the Delen app went through a process of continuous improvement. Starting as a tool to get 24/7 insight in the return and composition of the client’s portfolio, it evolved steadily towards a digital means to manage financial affairs, as well as to communicate effectively and securely with the relationship manager. Recent features include remote signing for contracts and account and credit openings, the digital archive to store important documents, the itsme® log-in and the discrete mode. “We constantly look for new ways to add efficiency, agility and comfort to our clients’ lives”, says Alexandre Delen. “In times where physical contact is not always the best option, the digital channels offer true value. Lots of clients happily use online video calls to keep in touch with us.” In addition, the recently launched Delen Family Services allows the client to get a detailed overview of total assets, including real estate, group insurance contracts and works of art. A family-tree format includes insights into current property rights. That is a perfect starting point for projections, simulations and tax calculations, navigating the client to concise and proactive estate planning.

Delen Private Bank was established by André Delen in 1936, operating as an exchange office. In 1975 his son Jacques Delen, the current president of the Board of Directors, was appointed CEO. In 1992 holding company Ackermans & van Haaren became a shareholder of the bank, besides the Delen family. The company gradually but steadily increased her footprint, both through internal growth and smart acquisitions in Belgium, the UK (in 2011, JM Finn and Co) and the Netherlands (2015, Oyens & Van Eeghen). By the end of 2019, the Delen Group had €43.6bn in assets under management.

You may have an interest in also reading…

First Qatar: A Development Company Casting Pearls on Doha’s Golden Beaches

First Qatar was founded in 2005 and has steadily expanded to become an international leader in the investment, development and

My Clinic in Saudi Arabia: Taking the Lead in Premium Care and Relieving the Strain on Patients

My Clinic, the largest such out¬patient facility in Jeddah – with a premium approach to patient care – is located

No Relation, but Shared Values: The ‘Other’ CFI with the Goal of Becoming ‘The’ Investing Brand

The CFI Financial Group — no relation to CFI.co — has been a leading trading provider for the past two