Finance

Back to homepageBlueRock’s Ronny Pifko: A Solid Strategy Built on Strong Foundations

CFI.co’s Jason Agnew finds out from BlueRock Group’s Managing Partner, Ronny Pifko, how they’ve kept constructive during testing times. When Ronny Pifko co-founded BlueRock in Zurich back in 2010, the focus was entirely on Swiss commercial real estate. The company

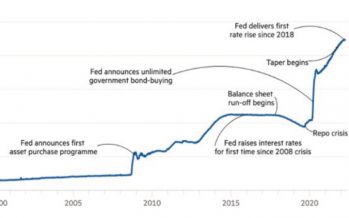

Read MoreTightening Financial Conditions Bring Impacts to Asset Values

In the first half of this year, US stock markets suffered a fall not seen in more than 50 years. The S&P 500 index on Thursday June 30 was more than 20 percent down compared to January, a drop not

Read MoreQuantitative Tightening and Capital Flows to Emerging Markets

In its May 15th meeting, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve (Fed) lifted its benchmark policy rate by 0.75% to 1.50%–1.75%, the most significant increase since 1994. The central bank also signaled an additional increase

Read MoreBiggest Commodity Price Shock in 50 Years is Here

In addition to death and destruction in Ukraine, the Russian invasion brought several significant shocks to the global economy. The geopolitical consequences of the war reinforce the downward trend in trade globalisation and financial integration, with fresh rounds of disruption

Read MoreQNB ALAHLI: Covering All of a Country’s Financial Needs — but Never Losing that Personal Touch

QNB ALAHLI, established in April 1978, is the second-largest private bank in Egypt, and one of the country’s leading financial institutions. The full-service bank is organised around several diversified business lines, serving corporate, individual, professional and SME clients through a

Read MoreOtaviano Canuto: Some Economies May Soon Face a Hard Landing

Weaker performance of emerging markets is expected in the immediate future. This year began with simultaneous signs of a slowdown in global economic growth and a reorientation toward tightening of monetary policies in advanced economies. In its latest Global Economic

Read MoreCBRE: Multifamily Assets Consolidate Real Estate Investment Growth

Real estate investor appetite for European multifamily properties has been thriving in the past decade. Resilient income-driven performance, sustained by strong occupier market fundamentals and long-term socio-demographic trends, should continue to fuel the rise of this asset class. Last year

Read MoreEvan Harvey, Nasdaq: Language Locks and Building Blocks

Language has been an inhibitor to the progress of sustainable business. Rather than putting a trendy new name on an essentially new business practice, a series of conflicting, complementary, and confusing labels has come into practice. Because this era is

Read MoreEY Argentina: Argentina’s Promotional Tax System for Knowledge-based Companies is Gaining Ground in the Local Market

After more than two years of the enactment of the “knowledge-based” Law, time has come to ask whether this new promotional system have truly improved the capacity of the knowledge-based industries to generate employment, federal economic development, and foreign exchange

Read MoreWorld Bank: Sustained Global Solidarity Needed to Achieve Global COVID-19 Recovery

The pandemic has affected virtually everyone in the world, but its impacts have been hardest on the poor and vulnerable, deepening inequalities and exacerbating underlying challenges. Now more than ever, global solidarity is needed to address the widening gaps between

Read More