A Flash in the Pan Fizzles Out: The Downfall of a Brazilian Tycoon

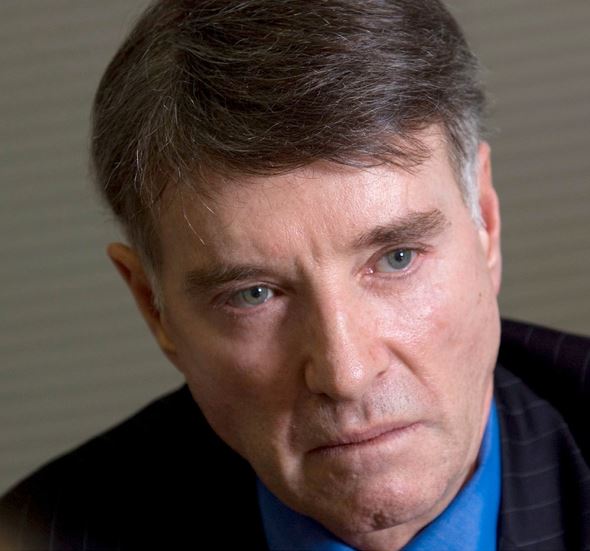

Eike Batista

Playing the markets and getting at the mega-bucks with financial wizardry does not a businessman make: Brazil’s flamboyant Eike Batista – erstwhile owner of the world’s seventh largest fortune – has fallen off his perch in the most spectacular of fashions. Mr Batista’s six commodities and logistics companies have lost a combined $9.7bn so far this year. A drop in the bucket, for sure, when set against the $203bn in losses suffered by the 300 or so publically traded companies in the country.

The downfall of Eike Batista is perhaps best illustrated by the plight of OGX, the former billionaire’s flagship oil company which has lost close to 90% of its value over the past year. OGX was but a bubble, inflated by no less than 55 regulatory filings attesting to largely fictitious oil reserves. The truth had to come out eventually, but before it did Mr Batista took out a dazzling number of put options: 56 million OGX shares to be precise in early June.

He did need a windfall even if was to it arrive on the coattails of his own company’s demise. That impending demise had left Eike Batista with a $1.5bn debt to the Abu Dhabi sovereign wealth fund, the Mubadala Development Corporation. The failing tycoon also owes Brazilian banks a pretty penny: Investment bank BTG would like to see $282m from Batista while the Itau and Bradesco banks are each owed a billion dollars or more.

Mr Batista now rather desperately tries to sell his assets to meet these – and a host of other – obligations. However, his crumbling empire – beset by the twin evils of debt and operational losses – finds few takers. Also, a lawsuit by disgruntled investors has further reduced Mr Batista’s entrepreneurial freedom: An injunction now severely limits his ability to sell assets. The lawsuit, led by Rio de Janeiro lawyer Marcio Lobo accuses Mr Batista of insider trading and “acting in bad faith”.

“Investment bank BTG would like to see $282m from Batista while the Itau and Bradesco banks are each owed a billion dollars or more.”

More befitting an eccentric than a businessman, Mr Batista is a firm believer in the powers of the beyond. Now that Lady Luck stopped smiling, he reportedly has become an assiduous visitor to Rio’s House of Magic, a well-known temple of mysticism. One solace mystics may offer duped investors and creditors is their prediction that Mr Batista will live to be 108. There is some time left to recoup losses.

Meanwhile, Mr Batista’s sorry plight perhaps symbolizes to some extent the broader malaise that has choked Brazil’s economic ascendency and mires the country firmly in the league of the mid-income mediocre. Pundits seldom tire in praising Mr Batista’s purported entrepreneurial genius while, in the same breathe, ascribing his troubles to excessive government meddling and regulation.

The state is to blame. While it is certainly true that Brazilian bureaucracy does not have the best interest of business at heart, it is equally true that plenty companies are able to adapt, manage and even prosper under the circumstances. Much as Mr Batista’s business prowess was grossly overstated (and banked upon), Brazil’s promise as an economic powerhouse is mostly hype.

For now, the country at best may aspire to remain a regional superpower, owing more to its impressive geographical dimension than to any actual progress. The potential is there, and in vast quantities. It is underused and at times being squandered. What Brazil historically lacks is a clear vision on how to develop its potential into lasting prosperity. It should look to Chile for lessons on how to do that.

Mr Batista was merely a flash in the pan. Brazil boasts a great many excellent, world-class entrepreneurs who honed their impressive skills in an adverse regulatory climate and are biting at the bit to get going and build real business empires: Not ones based on flights of fancy and the manipulation, cynical or otherwise, of stock markets. Mr Batista’s downfall may, as such, be a blessing in disguise, drawing attention away from the antics of a joker to perhaps allow more deserving businessmen and –women to come into focus.

You may have an interest in also reading…

A Challenger with its Head and Heart in the Cloud has Dropped Latency to Mere Microseconds

Aquis Exchange, the UK-based creator and facilitator of financial markets, has a track record of innovation and disruption — and

Paolo Sironi, IBM: All Eyes on Financial Services Cyber-Resilience

No industry is fully immune from cybersecurity threats, from water pipelines to healthcare, financial services included. According to experts, regulators

The Limitless Power of Latin America: Renewables to Light Up a Continent

In Latin America, renewable energy can supply up to 22 times the region’s power needs, even taking into consideration future