Unleashing the Economic Potential of the Maghreb – the Role of Foreign Investment

Excerpts of a speech given by Christine Lagarde, Managing Director, International Monetary Fund at a conference in Mauritania in January, 2013

Christine Lagarde

We meet in the wake of the great Arab Awakening, that outbreak of social consciousness in which citizens from all across the region stood up and spoke out for greater dignity, greater opportunity and equity in economic life.

For that, we need the economy of the Maghreb to work for the people of the Maghreb. We need strong and sustained economic growth. Inclusive growth that is generous in sharing its fruits: Growth that produces enough jobs to satisfy the yearnings of the younger generation.

The old economic model was not up to the task. It failed to provide an enabling environment based on fairness and transparency where private enterprises could thrive.

So the Arab Awakening must also lead to a “private sector awakening”—unleashing the productive potential of the Maghreb people and creating an environment that supports innovation, entrepreneurship, creativity, and jobs.

Foreign direct investment is a vital part of this strategy. It can kick start growth and set in train a virtuous circle of higher productivity, enhanced economic diversity, and greater resilience against external turmoil.

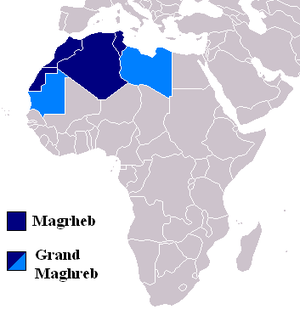

1. Current state of play of foreign investment in the Maghreb

“Basically, the Maghreb has great potential when it comes to attracting investment. But it has not always lived up to that potential.”

For sure, foreign direct investment flows have risen dramatically over the past decade—from $3 billion a year during the early 2000s to $12.3 billion in 2008, the eve of the crisis. But even this peak, at 3 per cent of GDP, was lower than in other emerging regions of Asia, Latin America, and Europe. And that number has gone down to 6.5 billion dollars in 2011, less than 2% of GDP, which is not surprising given the recent period of instability in the region.

At the same time, investment was not diverse. Most foreign direct investment came from Europe—80 per cent for Tunisia and 60 per cent for Morocco, for example. And most of it—about 30 per cent—went to energy and mining.

Clearly, there is some room to do better. The Maghreb is rich in resources and rich in the potential of its people. Just look at some of the advantages enjoyed by the region:

- It enjoys the advantage of location. It sits right next to the largest trade area in the world, the European Union, and is also on the doorstop of the bustling Middle East.

- It enjoys the advantage of a young population. Unlike so many other parts of the world, the Maghreb’s labour force is growing, and will be bountiful for years to come. Your greatest asset is your people.

- It enjoys the advantage of an educated population. The region has made great strides in improving school enrolment. The next step is to improve educational quality to make sure that people have the right skills for the right jobs.

I would add here that the Maghreb should continue to take steps to restore or maintain economic stability, which provides a solid foundation of certainty and predictability for the people who make investment decisions. Staying the course on sound fiscal and monetary policies and guarding against real exchange rate overvaluation is important.

The Maghreb is also taking steps to improve its investment climate and business environment. But this journey is far from complete. The region still has some way to go in removing remaining roadblocks so that the private sector can expand, invest, innovate, and create jobs. It needs to break down all vestiges of privilege and cozy connections and provide a level playing field for all.

The Maghreb is also taking steps to improve its investment climate and business environment. But this journey is far from complete. The region still has some way to go in removing remaining roadblocks so that the private sector can expand, invest, innovate, and create jobs. It needs to break down all vestiges of privilege and cozy connections and provide a level playing field for all.

How can the region make concrete progress in this area? Through regulation that makes economic sense and is impartial; through better quality infrastructure; through fair and predictable tax and customs administration; through a strong, independent, and impartial judiciary; through a financial system that supports productive activity and widespread access to credit.

By making progress in these areas, governments not only attract foreign investment, they earn the confidence of their own people.

2. How greater openness can spur greater investment

Greater openness in the Maghreb can entice more foreign investment into the region: Openness to the world, and all that it can offer; openness to the region, and to the idea of a common destiny; openness to new ways of thinking and acting.

Within this broad framework, I think there are three specific areas that need attention—greater integration, greater internationalisation and greater diversification:

Greater Integration

This is the reason for the creation of the Arab Maghreb Union and the reason we are here today. Integration must begin with more open foreign direct investment regimes, including in extractive industries. After all, these industries need continuous cutting-edge investment.

The whole region would benefit from becoming more open to itself—by knocking down barriers to trade and opening wide the doors of mutual gain. A Maghreb that allows a free flow of goods and services offers limitless possibilities of a market of over 80 million people.

It was Ibn Khaldun who said that “only tribes animated by a strong esprit de corps are able to live in the desert”. It is time to widen that esprit de corps to encompass the whole region!

Of course, this should go hand-in-hand with efforts to create a common set of trade and investment rules—this will help provide a better investment environment for those who service the Maghreb market and those who locate here to service outside markets.

Greater Internationalisation

My second point is greater internationalisation. By this, I mean that small companies need to think big, national companies need to think international, domestic companies need to think of themselves as part of a wider region.

For when a Maghreb company breaks through and achieves transnational status, this can help with investment all across the region. After all, the local company knows and understands the region well. It can share wealth, knowledge, and experience. Of course, to make this work, we need standard foreign investment rules across the region.

Think of some of the practical advantages that could come with this kind corporate integration. For example, countries with less advanced agro-business sectors—such as Algeria, Libya, or Mauritania—would benefit enormously from the knowledge and know-how that come with investment from Moroccan or Tunisian agro-business companies’ investment.

“I mean that small companies need to think big, national companies need to think international, domestic companies need to think of themselves as part of a wider region.”

This kind of integration and internationalisation could help the region take advantage of favourable geography. Maghreb companies would have an easier time investing in sub-Saharan Africa. The region could even become an important trade and investment hub that bridges sub-Saharan Africa and Europe.

Greater Diversification

The third aspect is diversification—in both sources and sectors of foreign direct investment.

For a start, the Maghreb should branch out and reduce dependence on Europe. I am really intrigued by the possibility of engaging the BRIC countries—Brazil, Russia, India, China—the new economic dynamos on the world stage.

To attract more investment from BRICS, Maghreb countries should of course continue to work on improving the investment climate and on upgrading skills and education. But governments can also be proactive in selling the many benefits of the region. You make your own futures.

Diversification also has another angle—developing new investment niches in new and dynamic sectors. Think beyond natural resources. Think about engineering, software development, computing. It is up to you to seize the initiative and step boldly into a new world of opportunities.

Conclusion

I believe that the “private sector awakening” must be an integral part of the Arab Awakening. A new society needs a new economy. And there is no better way to begin that new economy than through investment, by opening yourself up and tapping into the wisdom and resources of other countries and other regions.

Ultimately, it is about laying the groundwork so that every single person in the region can live up to their true potential. Again, it was Ibn Khaldun who said it best: “the welfare of the people is the best way to strengthen the empire”. We do not have empires any more, but the logic remains the same!

And let me assure you that the IMF will be there to help you along the way. We are deeply engaged with the countries of the Arab Awakening.

We are helping with advice across the region on how to secure stability, protect vulnerable people during the transition, and lay the basis for strong and inclusive growth. We are helping with our loans—we have committed 8½ billion dollars to Jordan, Morocco, and Yemen, and are in discussions with other countries. And we help countries like Tunisia and Libya with capacity building—creating the secure foundations of that new economy.

Through your efforts and your initiative, and with help from outside partnerships, I have no doubt that the Maghreb can succeed. You have laid the groundwork for the future; now you must continue to strive ahead. Do so in a spirit of openness.

You may have an interest in also reading…

The Importance of Promoting Financial Stability and Growth through International Regulatory Coherence

By Nandini Sukumar, Chief Executive Officer, The World Federation of Exchanges One of the World Federation of Exchanges’ (WFE) strategic

Berenberg: Strategic Asset Allocation in a Higher Interest Rate Environment

For the first time in many years, interest rates have risen noticeably in 2022 and 2023, and as a result,

No Sugar Coating for Kenya’s Cane Industry, but KISCOL has an Established Place in Industry

Increased competition and dwindling natural materials challenge some producers, but KISCOL is growing, diversifying, and ‘doing things right’… Kwale International