Another Inconvenient Truth: Vice Pays

The politically correct and socially sustainable is, though certainly laudable, not particularly profitable. Investors shunning sin stocks manage portfolios that are, on average, significantly less profitable than those possessed by shareholders without similar scruples.

The politically correct and socially sustainable is, though certainly laudable, not particularly profitable. Investors shunning sin stocks manage portfolios that are, on average, significantly less profitable than those possessed by shareholders without similar scruples.

A study released earlier this week by the London Business School (LBS) concludes that the historically already higher-than-average returns offered by industries preying on human frailties have received an additional boost from recent efforts by institutional investors to clean up their portfolios.

According to LBS Professor Emeritus Paul Marsh, one of the study’s authors, the glut of stocks sold for reasons other than those related to corporate performance represent a boon to investors less bothered by ethical considerations: “Shares in well-run companies may now be acquired at a considerable discount.” Some investment funds have tapped this segment and offer a mix of vice stocks as vicious as profitable.

Prof Marsh and fellow researchers Elroy Dimson and Mike Staunton calculated that a single dollar invested in a US tobacco company in 1900 would have turned into well over $243,000 today. In case reinvested dividends are taken into account, that original dollar would now be worth close to $6.3 million. Conversely, had that dollar been used to buy stock in an engineering company, it would have grown to just $2,280.

“Shares in well-run companies may now be acquired at a considerable discount.”

– Paul Marsh, Emeritus Professor of Finance, London Business School

“Bizarrely, this would be evidence that the faith-based investors of the first half of the 20th century, and all sorts of ethical investors in the second half, had an effect,” says Prof Dimson. However, it may not quite have been the effect anticipated. The LBS study, commissioned by Credit Suisse for its Global Investment Returns Yearbook, shows that tobacco has been the most profitable US business segment since 1900. In the UK, the market was led by the alcohol industry with big tobacco trailing closely.

Dividend yields of vice shares are also generally superior. The S&P 500 Tobacco sub-index boasts an average dividend yield of 4.23% as compared a market average of just 1.97%. The gaming industry also offers a dividend yield about twice as high as the overall market.

“Ironically, responsible investors may be partly to blame for the higher returns from sin. If a large enough proportion of investors avoids sin businesses, its share prices will be depressed, thereby offering the prospect of elevated returns to those less troubled by ethical considerations,” says Prof Dimson who also revealed that over the long run, sin stocks from countries ranked low on the transparency index tend to offer superior performance.

While sin stocks usually outperform the overall market, attempts to peddle these shares openly have met with mixed results. One of the few sin stock funds to survive the 2008 market crash, Vice Fund – set up by USA Mutual Advisors in 2002 – recently changed its name to the less brazenly obvious Barrier Fund. Allocating its capital to select companies in the alcohol, tobacco, gaming, and arms industries, Barrier Fund manages a $242m portfolio that, at first glance, seems to offer a rather modest premium over the overall market.

However, when compared to the Vanguard FTSE Social Index fund, set up in 2000 and investing only in sustainably-run corporations, Vice Fund’s performance seems positively stellar. A thousand dollar invested in the Vice/Barrier Fund in 2002 would have turned into $3,364 versus $2,679 for the Vanguard Fund.

Fund managers eschewing investments in ethically reprehensible sectors face an uphill battle. However, there is hope. The LBS study also shows that a “washing machine” approach may deliver the best results. Institutional investors tasked with social responsibility may want to take a stake in less sustainable corporations in order to gain a seat at the table, engage with the company, and work for positive change.

Prof Marsh et al have found that such a strategy oftentimes results in above average returns while ensuring compliance with the trustee concerns. Passively screening out sin stocks, or divesting from vice and violence, is too simple a policy. Instead, socially-responsible investors may want to buy up a few discounted shares from companies deemed distasteful and get to work improving their ways. Changing the world was never going to be a stroll down easy street.

You may have an interest in also reading…

In Conversation with Managing Partner of Worthwhile Capital Partners: Christian Andersson

CFI.co: Would you please say a little about the career steps leading to your present appointment at Worthwhile Capital Partners?

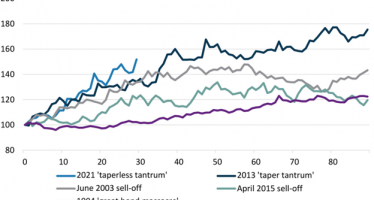

A Possible Tug-of-war Between the Fed and the Markets

The projections for United States GDP released by the Federal Reserve on March 17, pointed to a growth rate of

Barry E. Silbert: Going Out on a Limb, Reinventing Capital Markets

SecondMarket was set up in 2004 and has since expanded into multibillion dollar trading platform with well over 53,000 registered