Mamta Murthi: World Bank to Help Poland Resolve the “Robin Hood” Tax Issue

Warsaw, Poland

The World Bank is helping Poland design a new system called the “Robin Hood” tax system. In the first quarter of 2015 a working group composed of representatives of the Ministry of Finance, the World Bank, subnational governments and academia will be launched to share international experience in Poland.

“Reforming the Robin Hood tax is a serious challenge, because Poland has a very complex system of financing subnational governments and calculating horizontal transfers between local government units. Two issues stand out, specifically. The first issue stems from the fact that Robin Hood tax is a forced system – Robin Hood took from the rich to give to the poor. This reduces the incentives of the donor governments to collect revenues, because they lose such a large share,” Mamta Murthi, World Bank Country Director for Central Europe and the Baltic Countries, told PAP.

In her opinion, the other issue related to the Polish Robin Hood tax system is the basis for transfer calculation. “In Poland this is based on revenue from two years before. That means that when the economy turns down you could have a local government making a transfer even though its own revenues are contracting. Such a system is not sustainable,” Murthi said.

As she went on to explain, the World Bank wants to assist Polish authorities in developing a new model of Robin Hood tax by providing expertise and sharing international examples.

To that purpose, a working group will be established in the first quarter of next year. “The Working group will be composed of representatives of the Ministry of Finance, subnational governments, and academics with support from World Bank experts. The details are still being discussed. “We want to make sure that the solutions developed by the group are then consulted by a broad range of stakeholders,” Ewa Korczyc from the World Bank told PAP.

“Reforming the Robin Hood tax is a serious challenge, because Poland has a very complex system of financing subnational governments and calculating horizontal transfers between local government units.”

– Mamta Murthi, World Bank Country Director for Central Europe and the Baltic Countries

The group will continue the work initiated during the international workshop on “Equalization transfers in subnational governments,” organized at the beginning of December by the Ministry of Finance and the World Bank. During the workshop, the systems of horizontal transfers across local government units from various countries were presented.

”Polish Minister of Finance Mateusz Szczurek requested assistance in reforming the Robin Hood tax whilst in the Washington office of the World Bank during the annual meeting held in autumn. We agreed that the first step should be to identify how this problem has been addressed in other countries. Ministry of Finance representatives seemed to be most interested in those countries which equalize not only revenues, but also take expenditures and needs into account,” Ewa Korczyc explained.

Murthi emphasized that this is the initial stage of the work and at this point World Bank representatives are not going to give any recommendations. “Our aim now is to demonstrate some interesting examples. The solutions applied in Scandinavian countries seem to be of particular interest, but there is no single model or silver bullet,” Murthi commented.

”Even if Poland looks at Scandinavia, it will have to look very carefully and adapt that to the local context. One must consider not only technical, but also political aspects. The reason for that is that it is about money that is collected and distributed across local government units so there has to be some consensus to arrive at a sustainable solution for Poland,” she added.

According to World Bank representatives, Poland could start by looking at the Danish, Swiss, German and Canadian models, inter alia.

“In each of those models there are some elements that can be a source of inspiration in reforming the Robin Hood tax. (…) For instance, in the Danish system they take into account revenues as well as expenditure needs. It should be remembered that not every local government with low revenue is automatically a poor local government,” Ewa Korczyc underlined. One should also take into account special needs of big cities, demographics, etc. “When embarking on such reforms, one must first of all prepare a thorough and accurate diagnosis. Right now we are analyzing the Polish system, looking at the interests of all the stakeholders,” she said.

As World Bank representatives point out, “Polish standards are high, and – given a multi-tier system of local authorities – their financing system is also complex and multi-faceted.”

According to the World Bank, this is a two-way communication: Polish experiences can often be put into good use as a source of advice or inspiration for other countries. For example, the Polish experience might help to inform the reforms in Serbia. Source

Mamta Murthi, Country Director for Central Europe and the Baltic Countries

Published by Polish Press Agency (PAP) on December 23, 2014.

You may have an interest in also reading…

Driving Change: Empowering Inclusion and Innovation at Boursa Kuwait

At Boursa Kuwait, inclusion, diversity, and innovation drive the mission to transform Kuwait’s capital markets into a platform for opportunity,

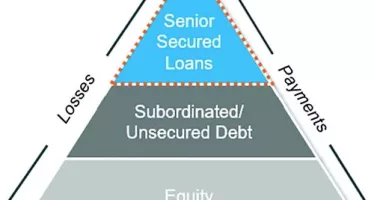

Middle-Market Direct Lending

A Lucrative Alternative Asset Class The US is home to some 200,000 companies dubbed “middle-market” — typically with EBITDA up

Q&A with Ovais Shabab, Head of Financial Services at KPMG: Investing in People, Creating Jobs, Inventing Strategies — it’s a World of Possibilities for KPMG Network

KPMG is a global network of independent member firms offering audit, tax and advisory services, operating in 147 countries. Here,