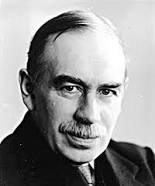

John Maynard Keynes – Keynesianism to the Rescue: It Still Works Wonders

When Steve Forbes rallies against someone, as he often does, the world takes (some) note: Libertarians and conservatives are apt to make noises of approval while all others suspect the object of Mr Forbes’ ire to be a person of interest, if not outright admiration. The man who expertly directed the decline of his family’s vast fortune thoroughly enjoys shouting from rooftops.

When Steve Forbes rallies against someone, as he often does, the world takes (some) note: Libertarians and conservatives are apt to make noises of approval while all others suspect the object of Mr Forbes’ ire to be a person of interest, if not outright admiration. The man who expertly directed the decline of his family’s vast fortune thoroughly enjoys shouting from rooftops.

Mr Forbes latest rant was directed at none other than John Maynard Keynes (1883-1946), the British economist who almost singlehandedly invented and shaped modern macroeconomics. Mr Keynes’ insight was that money controls the production of goods and services. Thus it is not merely a tool for commerce, but in fact reigns supreme.

Mr Forbes regularly calls John Maynard Keynes “a quack” for pointing out that injecting money into a recessionary economy will cause a resumption of growth. The stimuli packages unveiled in both the US and Europe following the financial crisis of 2008, are shining examples of Keynesianism at work.

The forces of monetary orthodoxy severely dislike the thought of governments and their central banks fiddling around with money. They argue that currencies should be kept stable at all times and that the market will eventually find a way out of any quagmire it may have ventured into.

To see how this works, just look at the countries of the euro area. Here stimuli monies were released rather late in the downturn. They were also much more modest in scope and ended up benefitting the banks more than the overall economy. As a result, Europe is taking much longer to crawl out of the crisis. The euro economies are now at risk of becoming stuck in stagflation. Compare this to the UK which had the foresight to appoint an unashamedly Keynesian banker to head the Bank of England. That was a smart move: The British economy is now thundering ahead.

Mr Keynes is hailed as one of the 20th century’s most influential thinkers not least because the analysis he posited were generally proved right after the fact. So it was in 1944 when Mr Keynes led the British delegation of the World Bank commission that was to result in the Bretton Woods System of global monetary management. Though during the negotiations most of his ideas were overruled by the Americans, Keynes’ ideas and suggestions were vindicated by later events.

John Maynard Keynes was also one of the last exponents of the idea that government and its civil service are powers that promote the common good by adhering to common sense. As such, the body of thought that is Mr Keynes’ legacy stands diametrically, and most refreshingly, opposed to the much more cynical game theory of ulterior egocentricity that has guided later macroeconomic thought and brought the world much sorrow.

Mr Keynes ideas are now in dire need of revaluation. The likes of Margaret Thatcher, Ronald Reagan and their many heirs have held sway far too long without producing anything near the results promised.

You may have an interest in also reading…

Nick D’Aloisio: Coding Philosopher

Oxford undergraduate Nick D’Aloisio is no average student. The self-taught programmer became a teenage millionaire in 2012 when he sold

Ukraine Opts for Moscow Leaving EU Empty-Handed

Brussels is baffled, rattled and stunned. The mood in Europe’s capital has turned into one bordering on not-so-quiet diplomatic despair

Child Bride Hero Nujood Ali

Divorce can be a traumatic experience – but for a ten year old? Nujood Ali, now a fifteen year old