The Credit Direct Story: Audacity, Innovation, and a Heart for Inclusiveness

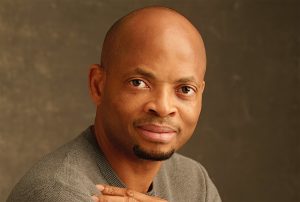

MD & CEO: Akinwande Ademosu

With a culture of simple execution, consistency, dedication and authenticity Credit Direct Ltd has carved a niche for itself in Africa’s largest economy and most populous nation.

Credit Direct pioneered the unsecured lending business in Nigeria, and in the following decade it has continued to embrace its leadership role by setting the pace for non-bank financial services inclusiveness in the country.

The company, with its bold entrance into the Nigerian market, led a movement that has seen exponential growth of consumer and retail lending organisations across several market segments. Twelve years after the advent of Credit Direct as the first mover, operator numbers have grown from just Credit Direct in 2007 to structured operators across Nigeria.

This innovation has created a multi-billion Naira industry that now employs several thousand people. It ranks as one of the most important developments in the Nigerian economy in recent years.

It has had a significant impact on the financial industry for the underbanked and unbanked segments of Nigerian society and on the growth of the country’s middle-class. The business model it introduced has countered lending biases that existed against women in the financial services sector. Now men and women can equally exercise their entrepreneurial skills, contributing to their family living standards and the country’s GDP.

In the short time Credit Direct has been in operation, it has empowered more than 1.5 million Nigerians from all walks of life with a disbursement of well over N150billion ($410m) across the country. The injection of this much-needed, unsecured credit has significantly cushioned the sometimes harsh effects of economic reality. That effort is having a catalysing effect on entrepreneurial activities at small- and medium-scale enterprises, as well as on personal well-being.

Salary earners and small enterprises excluded from funding by traditional financial institutions now have access to credit. Previously they were either neglected or had to borrow at rates ranging between 120 and 500 percent per annum from unstructured loan companies using their personal belongings as collateral. Credit Direct re-wrote this otherwise painful experience and changed Nigeria’s lending space forever.

Credit Direct ran with an idea that many thought would fail. With singular focus, resilience, teamwork, technology, and outstanding leadership, the model is now tried and tested and continues to thrive. The company is more determined than ever to lead technological advancement and expand the horizons of financial service and customer experience.

Credit Direct’s story over the past 12 years has been been led by Akinwande Ademosu, whose stewardship brought about the paradigm shift in the unsecured lending business. Akinwande says: “The understanding that social capital is the key to serve, and lead, successfully, and our pragmatic position in this regard, could be considered our stroke of genius. Our team members are connected and committed to the same purpose.”

Credit Direct has maintained a sterling record of corporate governance, regulatory compliance, effective risk management, innovative technology and profitability that are well above the industry average.

The company has progressively put together the components for sustainable growth, and indicated a resolve to remain the dominant player in its market space.

You may have an interest in also reading…

CFI.co Meets Badaru Adeoti

Badaru is a computer science graduate of Babcock University (one of the first private universities in Nigeria). He worked for/with

Infinity Solar: Vision of Transition that Began with a Revolution

Necessity is the mother of invention, they say, and Infinity Solar started life in 2014 – prompted by the recurrent

Ageas CEO Hans de Cuyper: Ensuring a Sustainable Future for the Insurance Industry

When Belgian Hans De Cuyper joined global insurer Ageas in 2004, it was as director of insurance management for Asia. Based in