Finance

Back to homepageWhy Even the Most Profit Centered Businesses Should Care About ESG Issues

Investors and corporations that do not have an explicit mandate to manage social or environmental issues still have an implicit interest in such issues The strongest way to manage risk is to consider the broadest number of issues material to

Read MoreCartica Management’s Powerful Combination: Investment Acumen, ESG Engagement, and Diverse Leadership

“Many emerging market companies have good ESG practices, but through active engagement we can improve disclosure around these practices to unlock value and ignite a cycle of positive change,” said Emily Alejos, Chief Investment Officer of Cartica Management. Through their

Read MoreJohn Gandolfo, IFC’s Treasurer: Looking Towards Recovery from Covid-19 and a Green, Resilient, Inclusive Future

The Covid-19 crisis has impacted the health and livelihoods of many millions of people across the planet, and it continues to impose an enormous toll on the poor, threatening decades of progress towards raising living standards in the developing world.

Read MoreKPMG Lower Gulf: Banking on ESG Risks in Future

ESG risks have the potential of negatively impacting banks’ assets, earning capacity, and sometimes their reputation, argues Abbas Basrai. Environmental, social and governance (ESG) factors and the emerging risks associated with them are becoming increasingly relevant to organizations, especially banks.

Read MoreRescue by Helicopter Reserves

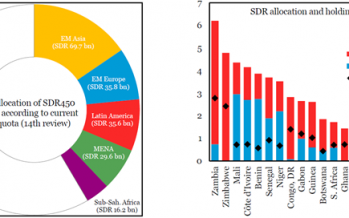

The world woke up on Monday 23 with higher international reserves for all countries. A new allocation of US$650 billion (SDR450 billion) in Special Drawing Rights (SDRs) by the International Monetary Fund (IMF) to its member countries has entered into

Read MoreChina’s Renminbi Needs Convertibility to Internationalise

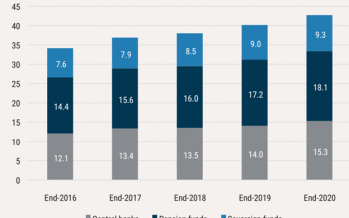

On July 21, the Official Monetary and Financial Institutions Forum (OMFIF) published its eighth annual report on Global Public Investors (GPI). It included a survey the asset allocation plans of reserve managers of central banks, sovereign wealth funds, and public

Read MoreOECD: Business as Usual? Forget About That, and Prepare for Novel and Impactful Variations on a Theme

As we turn our attention towards the imperative of “building forward greener” post-pandemic, there can be no more business as usual. This was Sir Ronald Cohen’s message at the OECD Blended Finance & Impact Week in February. During his keynote

Read MoreOtaviano Canuto: Are We on the Verge of a New Commodity Super-Cycle?

Commodity prices have recovered their 2020 losses and, in most cases, are now above pre-pandemic levels (Figure 1). The pace of Chinese growth since 2020 and the economic recovery that has accompanied vaccine rollouts are driving demand upward, while supply

Read MoreInterview with Grete Faremo, Executive Director of UNOPS: Inclusive Infrastructure Development

In pre-pandemic Oct 2019 (about 20 months ago) you wrote an article for CFI.co magazine that highlighted the importance of infrastructure for communities, sustainable development and across the SDGs. If so, how have the world and your conclusions changed? While

Read MoreEvan Harvey, Nasdaq – SPACs and ESG: Convergence or Collision?

The capital markets love nothing more than a new idea, especially one that promises to reward a little due diligence with a lot of return. The idea of ESG (environmental, social, and governance) has tantalised investors in this way. According

Read More