Banking

Back to homepageDeficits Matter, but Not the Way You Might Think

By Bob Veres. This originally appeared on Advisor Perspectives. Congress is coming off of a bruising debate over the deficit ceiling – a preview of what we will experience again in a few months. The economy is growing slowly – some

Read MoreCyprus on the Mend?

By Delia Velculescu, IMF Mission Chief for Cyprus Speech given at the Economist Conference, Nicosia, November 25, 2013 Much has already been accomplished in the relatively short time since the approval of the stability program for Cyprus. Let me give three

Read MoreMaha Al-Ghunaim: Enterprising Ladies – Investing in Future Entrepreneurs

Maha Al-Ghunaim is chairperson and managing director of Global Investment House (GIH) – one of the largest such operations in the Gulf Region. She co-founded GIH in 1998 and just ten years later saw her business become the very first

Read MoreSiegmund Warburg: People and Passion First – Profits to Follow

These days, far too often loan applications for the funding of promising business ideas are rejected out of hand by bank computers that spits out a resounding ‘no’. Algorithms lacking intelligence, senses and – indeed – sense, now rule the

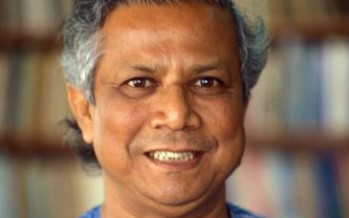

Read MoreMuhammad Yunus: Enabling the Poor to Rise and Prosper

Muhammad Yunus is a soft-spoken gentleman with a South Asian accent. When he speaks, presidents strain to listen. Being one of only seven people to have won the Nobel Peace Prize, Presidential Medal of Freedom, and the Congressional Gold Medal,

Read MoreEuropean Investment Bank: “Vienna Initiative” Keeps Credit Flowing

International financial institutions have joined forces to help calm economic turbulence and avert a collapse in the provision of credit to Central and South East European countries. Now in its second phase, the “Vienna Initiative” by the European Investment Bank,

Read MoreShazia Bashir: Reaching Out with Integrity – Banking on Society

Contrary to popular perception, it is never quite easy for children of successful entrepreneurs to make their own mark in the business they were born into. Few actually achieve this. Shazia Bashir is one of those select few. She belongs

Read MoreAndrew Alli: Helping Unlock a Continent of Opportunity

Africa is still in desperate need of investment. The World Bank estimates that Africa requires $93 billion annually for the upkeep and expansion of its infrastructure. With governments the world over slashing foreign aid budgets, the pressure is growing to

Read MoreAndré Esteves: No Limit to Ambition – Looking to Dominate the World

From intern to owner in barely eight years: If anything, Brazilian banker André Esteves is a financial whirlwind. After grabbing the reigns of Banco Pactual in 1997, becoming one of the bank’s five partners, he engineered its sale to Swiss

Read MoreLady Rice: Wisdom as an Acquired Taste – A Voice of Reason

Lady Susan Rice is the first woman to head a UK clearing bank. Currently, she is managing director of Lloyds Banking Group in Scotland. Born and raised in the United States, Lady Rice now lives in Aberdeen with her husband

Read More