Banque Misr Liban: Committed to Excellence in Service Poised for Strong and Sound Future Growth

Mr. Hadi Naffi

A number of factors help Banque Misr Liban to stand out in Lebanon’s relatively crowded and competitive banking sector. It is one of Lebanon’s oldest banks as it was established in 1929 and ranks number 3 on the official historical list of banks in Lebanon. It is 92.44% owned by the Banque Misr Group, which is one of the largest banking groups in the Arab world with total assets exceeding USD 30 billion in 2011 and a network of branches and affiliate banks in the United Arab Emirates, France and Germany, a Rep Office in Turkey, and interests in 135 projects worldwide. The group is presently fully owned by the Central Bank of Egypt, which thus makes BML the only commercial bank in Lebanon backed by the credibility and resources of a central bank. Most important perhaps, BML has been totally reengineered along modern banking lines since 2007 and as a result is poised today to continue its long tradition within the Lebanese banking sector, and has the vision, financial soundness and resources for solid future growth.

At a time when competition, whether in the retail or corporate/commercial business, takes place on the basis of the type and quality of the product or service provided, as well as pricing and client loyalty, BML’s primary vision is to be the preferred bank for its customers and it is working hard to achieve this vision through an emphasis on personalized service that only a smaller bank can provide, and a corporate culture of excellence, team spirit, integrity and professionalism. All this is allied with the application of the latest risk management guidelines, and the highest standard of corporate governance.

The process of reengineering that started in 2007 and set BML on a new path of growth and development has encompassed a complete internal restructuring; the renovation and modernization of all its facilities; an expansion of the branch network; the redevelopment of its human resource base, and the creation of a full complement of services and products that are offered by a modern universal commercial bank. All this was supported by a 140% increase in its paid-up capital in 2010.

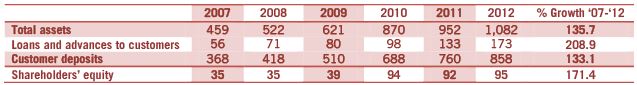

BML Fiscal Highlights

Today, BML’s corporate loans and trade finance services are highly flexible and tailored to meet all institutional requirements. Its evolving retail services and products include all types of deposit accounts; personal loans, consumer loans, housing loans, tuition loans and car loans; plastic cards of all types; insurance programs and products, and other modern services and products. Private banking investment services are provided through a small qualified team to ensure timely information, and fast response and execution.

BML presently has a network of 18 branches, strategically located in the major cities and regions of Lebanon and supported by a network of in-branch and external ATM machines. The expansion of the branch network is an ongoing process dictated by business targets and market considerations.

BML also has plans to expand its activities regionally such as to take full advantage of synergies with the regional and international network of the Banque Misr Group. But these plans have been put on hold since 2011 awaiting a return of stability to the region after the events of the “Arab Spring” that are not yet fully resolved.

Reflecting the success of its development and expansion plan, BML grew rapidly between 2007 and 2012, with assets rising nearly 129% up to the end of November 2012, customer deposits by 128%, and loans and advances to the private sector by a whopping 204% The average annual rate of growth in all three aggregates was faster than the sector and peer bank average. In parallel to that, BML’s shareholders’ equity rose 171% during the same period.

Needless to say, BML’s achievements over the last five years or so are particularly impressive given that the domestic market for banking services is highly competitive, that the rate of market penetration in Lebanon is very high compared with the other Arab countries and emerging economies, and that the 10 largest banks in the country, making up 15% of the total number of banks, control more than 80% of the banking market. i

Needless to say, BML’s achievements over the last five years or so are particularly impressive given that the domestic market for banking services is highly competitive, that the rate of market penetration in Lebanon is very high compared with the other Arab countries and emerging economies, and that the 10 largest banks in the country, making up 15% of the total number of banks, control more than 80% of the banking market. i

You may have an interest in also reading…

World Bank MD and CFO Anshula Kant: Financing Where It Matters Most

Financing Where It Matters Most — People, The Planet, and the Role of Investors Amid overlapping crisis facing the world,

What Really Spurred the Great Recession?

Based on the research of Ravi Jagannathan, Mudit Kapoor and Ernst Schaumburg Globalization and the U.S. dollar are as much

MENA City Lawyers – MCL: Winners in Lebanon

MCL is an innovative, Pan-Arab Law Firm crossing jurisdictional boundaries and challenging Middle Eastern norms by developing the first professional